Complex trading system #11 (Trading MACD consolidation)

Submitted by User on December 17, 2007 - 13:58.

Current Forex strategy was submitted by Egudu - our valued contributor.

-------------------------------------------------------

I am egudu, and here's another strategy.

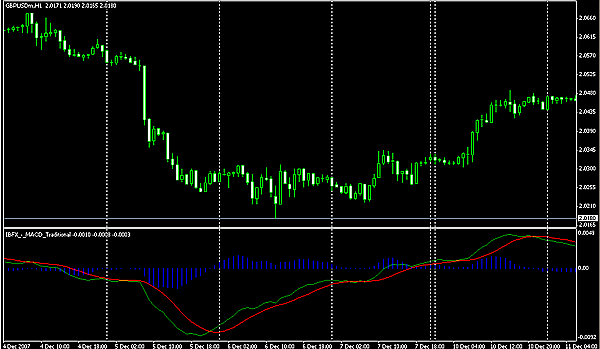

It's trading the MACD consolidation.

Time frame: 1hr

currency: any

indicator: MACD(12,26,9)

Entry: place a buy stop and a sell stop 5pips during the MACD consolidation with a stop loss of 10pips from entry and a profit target of 30-50pips.

Please note that, the MACD must be very close, in fact it should almost become a straight line only then should you enter the positions. l hope to give a picture shot of it soon, but u can check the chart of GBP on the 7th, 10th, 14th of Dec 2007 on the hourly chart.

Egudu, thank you once again, and we hope to hear from our users about their tests and trading performance with this strategy.

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hi,I will like to paste my own technique .I call it d NNOREX Method.it works well.my email is [email protected]

Hi Luis,

sorry for the late reply.

Good_macd is used the same way as regular MACD.

Where do you stuck: at installation point or with interpreting MACD signals on the chart?

Regards,

Edward

Good morning everyone

Edward / Egudu, by any chance, do you know about a manual or something like this, of how use the Good_Macd.

Thanks in advance

Luis

has anyone tested this strategy? mind to share the result of your testing?

in MT4 you make a right click on the chart and in the menu 'Common' check the 'Show Volume', if that's what you mean.

Richard

How do you get volume on currency pairs?

TP is 30-50 pips from the entry.

SL is outside the previous price swing high/low.

Thomas

Where the Stop Loss & Take Profit we put ?

Hi John,

Good question. Yes we should.

During MACD and price consolidation we often observe low Volume. But, when Volume picks up during consolidation periods it is a strong indication that market participants become very interested in that currency pair again and so a breakout is due almost immediately.

Additionally, with Volume we can determine a validity of a breakout itself. If a breakout occurs on low or decreasing volume, it most likely be a false move. Valid breakouts are always supported by rising Volume.

Regards,

Edward

When the MACD consolidates, should we be concerned about high/low volume as well?

John

Yes, these are OCO orders.

I have to understand: this is an OCO placed in the consolidation phase ? Or if there is no possibility for OCO traders must manuel itselfs delete the order not going into the direction made at first ?

Hi Jatin,

If you look at MACD on the screen shot above, you'll be able to identify blue histogram of MACD. This histogram oscillates around MACD 0 level, expanding and compressing as price action unfolds.

MACD consolidation is observed when MACD histogram bars become really short and compress tightly around MACD 0 level. At those moments the price on the charts will have a very narrow trading range. Traders' task is to identify that trading range and mark its high and low boundaries (either visually or by drawing trend lines) and then place pending trading orders (Buy stop and Sell stop) 5 pips away on each side of the trading range.

Buy stop is a pending order placed above current price and will be executed only if price reaches the value set in the order.

Sell stop is also a pending order placed below current price and will be executed only if price drops to the value indicated in the order.

Should you have any further questions, you are very welcome to ask.

Regards,

Edward

hi, i am new in forex i read this simple strategy but did not understand the sentence 'place a buy stop and a sell stop 5pips during the MACD consolidation'? please can u describe it deeply.i am a newbai here so if i asked a baby question than i apologise it.

thanx, jatin

Hallo Edward,

Thank You very much for your help,

I,ve found all indicators.

I'll sent you my result about (simple trading strategy#11, #16)

Regards

Darius

Post new comment