Complex trading strategy #24 (Forex Strategy Based on Large Stop-Losses)

Submitted by Edward Revy on October 18, 2013 - 13:47.

Submitted by Adam Green

1. Main Concepts

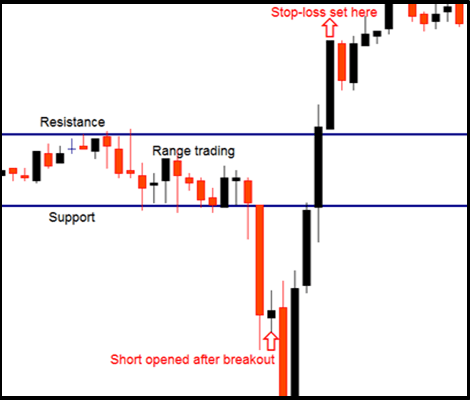

Beginners must attain sufficient trading expertise and skill in order to be capable of selecting excellent stop-losses and profit targets for all the trades that they execute. These are crucial actions to perfect primarily because Forex has such an erratic and unpredictable character that it can quickly stop-out positions safeguarded by only small stop-losses, e.g.50 pips or less. The subsequent chart demonstrates such a trading situation.

On the above chart, price advanced within a constricted trading range, as displayed towards its left-hand side, before it eventually plunged to the downside. A new short position was subsequently activated safeguarded by a stop-loss located about 50 pips above the previous resistance level. Unluckily, a sizeable bullish price spike caused this trade to exit at a loss.

Investors are also well-advised to formulate trading strategies that have beneficial win-to-loss and reward-to-risk ratios. However, the skills required to achieve these objectives require significant time to learn. As such, do newbies have any possible shortcuts accessible to them? Yes, they do because a trading strategy has been specifically created to overcome these complications.

2. A Large Stop-loss Strategy in Action

Despite the fact that this strategy appears weird at first sight as its key principles seem to contradict most of the advised guidelines for trading Forex successfully, many professionals have still accomplished impressive results using it. The fundamental principle is that you trade utilizing a very large stop, in the order of 500 pips, while plundering profits of about 50 pips per position.You could even assessthis strategy to be a macro variation of scalping ones. This is because the key idea behind scalping strategies is to enter and exit positions very rapidly with the intent of reducing your risk exposure while plundering tiny profits of 5 to 10 pips each time. In relation to large stop-loss strategies, you must appreciate that a large stop-loss of 500 pips will be extremely hard for price to knock-out. This principle consequently offers a foundation for newbies to trade proficiently since they will no longer have to develop the expertise to constantly safeguard their active positions by utilizing small stop-losses.However, the reward-to-risk ratio of 1 to 10 for this kind of trading strategy is appallingly bad. Nevertheless, the key point is that the energy needed by price to stop-out a 500 pip stop is substantially greater than that of a 50 pip one. So, the theory is to attain an excellent win-to-loss ratio that will subsequently counteract the poor reward-to-risk one. For instance, if you are able to capture 11 wins of 50 pips versus 1 loss of 500 pips, then you would register a gain of 50 pips.

3. CounteringInherent Problems

Although these concepts seem to be impressive, this strategy must be implemented carefully and accurately. This is because your trades could become stranded in ‘no-mans-land’. Price could then remain trapped within such zones for extended periods of time e.g. months. If such events did occur, you would then be deprived ofthe ability to record profits for considerable amounts of time.

To resolve this issue, you should utilize an excellent money management policy. In this instance, you should only wager between 0.1% and 0.2% of your overall trading capital per trade. By doing so, you will generate maximum security for your collateral. Additionally, you will gain the benefit of letting a limited number of trades become marooned while waiting for them to recapture a profitable status. Also by endangering just a small amount of your account balance per position, you will be able to open numerous trades concurrently. The subsequent chart demonstrates these concepts.

The bottom–left of above diagram illustrates that a short trade was execute following a breakout. A large stop-loss was activated by locating it above the blue line. Sadly, price subsequently underwent a major reversal soon after this position was activated suspending it in a state of limbo before it eventually recaptured a profitable status some months later. However, you can confirm that the usage of a large stop-loss prevented this trade from being exited at a loss.

The great advantage of this trading strategy is that it allows novices room to make mistakes which they would not enjoy if they constantly used smaller stop-losses. Some beginners ask why they cannot risk a bigger percentage of their budget e.g. 10%. They think that they should be able to do this because they are using such a large stop-loss.

However, this is definitely not a good idea if you realize that 10 successive losses risking 10% per trade would consume more than 66% of your original budget. In contrast, if you risked only 2% per position than 10 consecutive losses would lose only about 17% of your equity. The second case provides much better protection for your account balance.

4. Additional Guidelines

A large stop-loss strategy allows newbies to experiment in small increments of risk rather than jumping into trading situations without fully understanding them. The following concepts should also be utilized to support this strategy whenever possible.

1. Always try and trade with the trend, if possible.

2. Utilize techniques to help distinguish fakeouts from the true breakouts.

3. Move your stop- losses to breakeven after a reasonable profit has been recorded, e.g. 25 pips.

4. Aim for small profits of about 50 pips.

5. Avoid trading a large stop-loss strategy when major economic news is due for posting. This is because the resultant increases in volatility can cause erratic price movements.

You should not attempt to attain very large monthly profits using a large stop-loss strategy. Instead, you should seek smaller returns while learning about Forex in the process.

This large stop-loss strategy was provided s by Adam Green, editor at Investoo.com. Visit his site for FX and spread betting day-trading strategies, tutorials and guides.

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Post new comment