Forex Strategies & Systems collection revealed!

Active Forex trading and constant research enabled us to collect different strategies and techniques in our trading arsenal.

Today our Team is glad to present a new fair Forex trading strategies website where traders can quickly and free explore different Forex strategies and learn trading techniques!

Why do we share our knowledge?

We are traders like others and we like what we do.

There are no secrets about Forex trading, only experience and dedication.

Besides, on the Internet there are countless sellers who offer their strategies and systems for traders ready to pay... we would be surprised if you haven't met one yet! Free or paid — the choice is for traders to make. Our choice is a free collection. We are also going to update our collection each time we discover a new good Forex strategy!

We welcome You today to explore Forex trading strategies and systems with us and hope You find some useful information for yourself that will eventually improve your trading!

Ready to share your ideas with other traders? Post your trading strategy at our forum — join us in our mission to help Forex traders become better traders!

What to DO when your trading system STOPS working..?

Submitted by Edward Revy on December 24, 2021 - 18:29.

Every now and then there will be a situation when once well performing system starts to fail...

What to Do?

Option 1: Painful and costly - is to keep trading & watch the system die

Option 2: Adopt a rescue approach

The Rescue Approach to a Failing System

How do you pinpoint the time when things go WRONG?

Clue 1: Your past 30 days performance and profits decline

Clue 2: And/Or your past 15 trades left more to be desired

Note, in both cases, the system hasn't failed completely (didn't die), but it stopped performing as expected.

Forex Trading Strategy #56 (DWL3 system, AKA DT2)

Submitted by User on March 10, 2021 - 13:08.

Submitted by James Leone

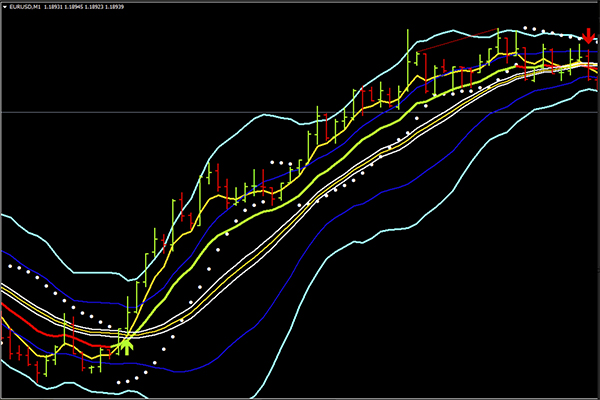

Indicators:

PSAR (0.02,0.2,0.02 Colour White size 2)

Bollinger Bands, 21 period 2 Std Dev (Mid line set to invisible) Upper and lower Aqua

Bollinger Bands, 21 period 1 Std Dev (Mid line set to invisible) Upper and lower Blue

Bollinger Bands, 21 period 0.1 Std Dev Mid Line Green (Up)/Red (Down) Upper and lower White

EMA 8, Yellow or Gold

EMA 13, Green Uptrend and Red Downtrend)

MACD 12 26 9 (MACD colour coded)

Timescale:

Any time frame, any faster moving major markets on lower time frames. Any on Higher time frames.

Entry X 2

There are 2 types of entry signal. 1 with PSAR outside outer bands, 2 with PSAR inside the bands (anywhere inside).

1. PSAR flips from above/below to opposite and is outside the outer Band (above upper for SELL, below Lower for BUY). This is our heads-up message. Then we observe the 2 EMAs, must cross (8 above 13 for buy and 8 below 13, for sell). Price MUST be above (BUY) or below (SELL) the centre DWL/DBL bands. Confirmed entry with emergency stop at the relevant PSAR.

2. PSAR flips from above/below to opposite and is inside the Band (above PRICE for SELL, below PRICE for BUY). This is our heads-up message. Again, we observe the 2 EMAs, must cross and be in the right mode (red/red SELL and green/green BUY) Price MUST be above (BUY) or below (SELL) the centre DWL/DBL bands, AND inside the BUY or SELL channel. Confirmed entry with emergency stop at the relevant PSAR.

Types of Trading Styles: Explained

Forex strategies often have recommendations that have the following statement:

"Suitable for Day trading" or "Best for "Swing Trading".

But what does that actually mean?

| Trading Style | Time Frame | Trade Duration |

|---|---|---|

| Day Trading | Short-term | Trade lasts less than 1 day, never kept overnight |

| Swing Trading | Medium-term | Trade lasts for several days, up to a few weeks |

| Position Trading | Long-term | Trade lasts from several weeks to years |

| Scalping | Short-term | Trade lasts around 1 minute, but less that 5 minutes |

Scalping - possibly best trading style for beginners...

While experts say, that long-term trend trading approach is your best strategy. It might not work for beginner Forex traders.

And here is why:

Reason #1 Lack of practice on larger time frames

Beginner Forex traders need lots of practice, they're eager to try out new methods/techniques they've been learning about each day.

Daily charts won't let you apply this knowledge in timely manner. It'll take weeks and months to have a proper setup formed in order to trade it.

Hourly charts would be faster, but in many cases, still too slow to offer quick application/testing and verification of knowledge acquired by beginner traders.

Reason #2 Urge to trade

Beginner traders want to trade, need to trade, and will eventually find every excuse to trade whether there is any good market opportunities or not.

The only way to satisfy this need, is to trade on smaller time frames. Simply allow yourself to trade, any time (but better, of course, during active market hours), any day (except weekends) as long as you can physically handle it, until fully content.

Stop Hunting?.. No.

Submitted by Edward Revy on January 7, 2019 - 14:35.

Here is a good example we just encountered: a losing trade, which looks very much like dreaded "Stop Hunting"... Oh-oh..

Let's take a look:

EURUSD 5 min chart. We're up for a quick trade.

Price congests inside a neat flag pattern. We'd like to enter the market on the breakout. Sell Stop order is set below the flag formation (we're bearish today).

Forex Money Management Calculator

Our Money Management Calculator will answer your questions:

- How much money can I risk at any moment?

- What should my stop loss distance be?

- What's my optimal trading lot size?

- How many pips can the market move against me before I get a margin call?

Answer these questions and set clear expectations about your trading.

Now that's what we call Smart trading!

TOP 10 Best ECN Forex Brokers 2023

Market Makers ideal for:

- Ideal for seasoned traders (access to liquidity, best execution, pro- trading conditions)

- Ideal for all strategies, in addition to certain types of strategies (scalping, news trading)

- NOT ideal at all for beginners (high deposits, high risks of losses due to luck of trading experience)

TOP 10 Best Market Makers 2023 | Forex Brokers

Market Makers ideal for:

- Ideal for beginner traders (low deposit, high leverage, mini/micro lots, fair start with great beginner education and support)

- Ideal for certain trading strategies (that don't survive otherwise in extremely volatile markets)

- NOT ideal at all for scalping (as scalping is often either prohibited or quite closely monitored)

Our TOP 10 Market Maker Forex Brokers

Carefully selected:

looking back at 10+ years of experience,

looking back at 10+ years of experience,

regulation,

regulation,

reputation,

reputation,

popularity,

popularity,

transparency

transparency

and most suitable fair conditions for beginner traders.

and most suitable fair conditions for beginner traders.

Rest assured, these are the true top picks.

Advanced strategy #21 (5 Min Morning Pivot Strategy)

Submitted by Edward Revy on December 31, 2018 - 00:28.

Currency pairs: Any

Charts: 5 min and 1 hour

After midnight (on Christmas night... just joking :)... any day after midnight, find the first opening candle on your 5 min chart.

Now draw a horizontal line through it's middle. This line will now act as an Advanced 5 Min Morning Pivot!

Let's see how we did the math:

High: 1.13051

Low: 1.2967

5 min Morning Pivot: (High - Low)/2 + Low = 1.3009

Arena - "If you can picture it, you can build it"

Arena is the software for those who have a good understanding of investing and how to build a strategy, but don't want to code or use programs that give you code that must be tested, re-coded and then tested again. We have all been there, you have worked in finance for years now and you have brilliant ideas of putting a strategy together but you are going to either pay a programmer an arm and a leg to code one strategy for you or your going to build it in something that is slow and clunky. It writes out the code for you; you copy and paste it into MT4, it doesn't hit the target in just the right place you go back and adjust etc, etc, etc.

How To Double The Account In 1 Day?

Submitted by User on September 13, 2015 - 23:04.

Author: Hassam

Forex trading can be fun if you can master the skill of risk management. In my opinion, the most important thing in any trade is risk management. If you risk 30 pips per trade and make 100 pips on average, even if you have a 50% winrate you will be making 350 pips in 10 trades ( 50% winrate means in 10 trades you win 5 trades and you lose 5 trades on average. Winning 5 trades means making 500 pips and losing 5 trades means you lose 150 pips so you make a total of 350 pips).

There is a no 100% winning trade setup. Every trade setup has a probability of failure. When you enter into a trade, you are taking the risk. With a small risk you ensure that if the trade setup fails you will not lose much. The trick lies in entering small and testing the waters. When the trade moves in your favor and you become pretty sure that you have caught a good move, you should open more positions. This will ensure that you multiply your profits manifolds. The important question is how we do it. I use candlesticks a lot in my trading. H4 candle and H1 candle are very important and they can give you very important clues where the price is going and where you should place the stop loss. I don’t bother about M5, M15 but use M30 candles as well as H1 and H4 candles in making my entry and exit decisions. I only open a trade at the close of M30, H1 or H4 candle.

All indicators are lagging and unreliable. The most reliable indicator as said above is price action. In the screenshots you will see Stochastic and MACD oscillator. I use them only 30% of the time while the use candlesticks 70% of the time. Moving averages work as strong support and resistance levels. I use moving averages as support and resistance levels.

How I saved over a million in one year of live trading

About the author:

Martin Pearce, professional forex trader and member of FX Trading Revolution team. He shows the truth about forex and brokers. To contact him, fill in the contact form at the FXTradingRevolution.com website.

How I saved over a million in one year of live trading

Undoubtedly, every trader has already been thinking about how to make their first million by trading on FOREX. They tried a dozen various systems, strategies or indicators that are guaranteed to work, and yet the success dreamt of hasn't arrived yet. Have you really tried everything? Now I would like to show you a bit of a different perspective on how to save your first million with live trading.

This is the tenth year I've been investing in capital markets. Together with my business partners we work as portfolio managers for institutional clients. During our time on the FOREX market we've realized that success in manual trading depends on:

1) The traders abilities - how he can adapt, sense an opportunity for potential profit, and accept trading loss situations;

2) On the broker through whom he realized transactions.

Not even mentioning the importance of choosing a top class broker in normal automatic or even high-frequency trading.

Let me first clarify what costs every realized deal entails in reality. In the following illustrative example from real trading you will see how significant the difference in total costs could be with various brokers.

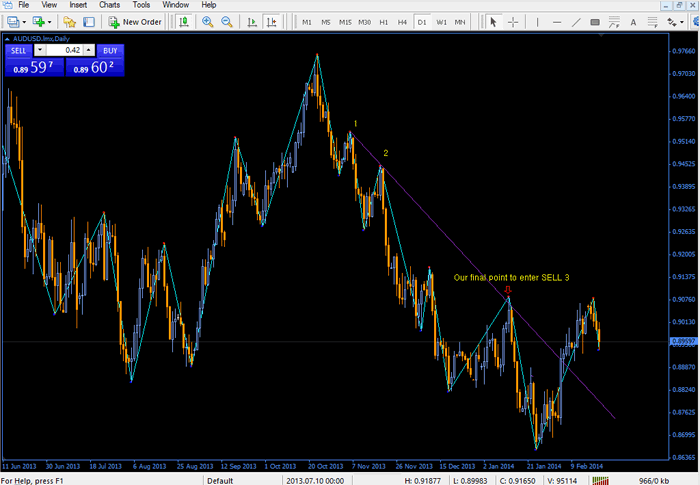

Advanced strategy #10-a (Complementary to strategy with Trendlines)

Submitted by User on March 4, 2014 - 00:35.

Submitted by Andrei Florian

Ok, here we go.

Myron said (here) we draw the trendline by HH (Higher Highs) and HL (Higher Lows) for uptrend and LH (Lower Highs) and LL (Lower Lows) for downtrend. We need a minimum of 2 LH swings for downtrend and a minimum of 2 HL swings for uptrend. We need be a trend follower and ALWAYS go with the trend. These are the words of Myron when the trendline strategy was presented, not mine. So, when the third time the price intersect our line we are looking for buy if we have uptrend line and for sell if we have downtrend line.

For example, on AUD/USD Daily we got a huge and clearly downtrend

Trailing Stop EAs for MT4

Submitted by Edward Revy on January 21, 2011 - 13:12.

I've decided to gather the resources about Trailing Stop EAs available today.

Most of indicators and EAs is a courtesy of Forex-TSD.com - one of the most advanced forums about Forex trading, where you can find almost anything!

But even then, it's sometimes difficult to find indicators/EAs you need quickly.

So, I've decided to make a series of pages with indicators and Expert Advisors (EAs) that, in my opinion, are the most useful.

Follow me, enjoy trading!

Detecting and Trading Range-bound Markets

Submitted by Edward Revy on December 17, 2009 - 13:05.

|

We’ll go over various methods of detecting and trading during range-bound markets.

Join in to discover new ideas, indicators and tools to gain additional control over range-bound trading. |

The fact is, during well trending markets majority of Forex traders trade profitably and comfortably, but once a trend is over all kinds of problems arise: trend-following systems no longer work, frequency of false entry signals increases bringing additional losses which eat up earlier accumulated profits.

Taking into consideration that Forex market spends up to 50% time in non-trending, sideways state, the knowledge of how to deal with range-bound markets becomes vital.

Forex Money Management & Exit Strategies

Submitted by Edward Revy on July 16, 2009 - 17:20.

We believe it is time to open a new Topic dedicated to Money Management.

Here we'll be posting trading systems and methods that help to control losses, evaluate and limit risks, improve win : loss ratio, in other words, everything related to money management in Forex.

We hope that this subject will create a new interest to money management in currency trading, and eventually help you improve a winning ratio of your favorite trading system.

How many of us will succeed in Forex?

Submitted by Edward Revy on March 22, 2008 - 19:40.

Many of us have probably heard the statement that 95% of beginners lose in Forex and remaining 5% become successful.

A common trading journey in Forex starts with demo account and develops into live account with further positive or negative outcome.

We have made own simple research that was aimed to find out how long on average traders plan to demo trade Forex before going live.

Forex Brokers that Allow Scalping: Research and Results

Submitted by User on June 5, 2007 - 13:56.

The topic of Forex Brokers allowing scalping is always actual and sensitive.

The list of UNLIMITED Scalping Forex Brokers contains most detailed information about best Forex brokers for scalping.

I was looking for answers in various forums, tried searching with keywords in search engines, tried reading policies and FAQs on the websites of different Forex brokers for scalping...

It seemed like I had only guesses, but nothing solid to rely on.

And then I came up with a simple solution - sending customer support inquiries to the different Forex brokers...

My question to all of them was the same:

“Do you allow scalping? By scalping I mean holding a position for less than 1 minute.”

That’s it.

Today, I’d like to share with you what my research has revealed.

So, brokers allowing or not allowing scalping...

Guidelines to creating own Forex trading system

Submitted by Edward Revy on January 27, 2007 - 18:49.

There are several things we want to achieve when creating Forex trading system:

1. Find entry points as early as possible.

2. Find exit points securing maximum gains.

3. Avoid fake entry and exit signals.