How many of us will succeed in Forex?

Submitted by Edward Revy on March 22, 2008 - 19:40.

Many of us have probably heard the statement that 95% of beginners lose in Forex and remaining 5% become successful.

A common trading journey in Forex starts with demo account and develops into live account with further positive or negative outcome.

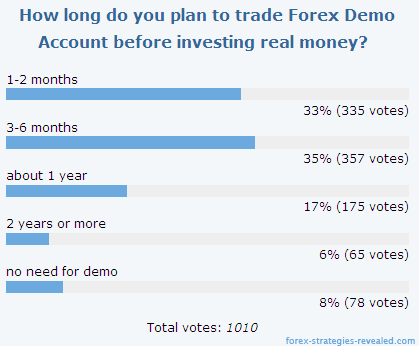

We have made own simple research that was aimed to find out how long on average traders plan to demo trade Forex before going live. We offered traders to vote on our Poll. Here are the results:

Although it would be wrong to state that these are exactly the results that prove the theory of "95% to 5%", the data came out to be quite interesting.

Traders who planned to invest real money after 1-6 months of demo trading formed 68% of all voters. There were 17% who were giving it about 1 year and 6% who said they will demo trade for 2 years or more.

Our research cannot provide an insight whether all those traders will change their minds about going live in Forex after stated period of time, but we may presume that many of them will more or less stick to their plans.

You have probably already made your mind about the option you’d vote for in our poll above.

Let’s see how many of us will succeed in Forex?

If you have chosen to open a live Forex account after 1-2 and up to 6 months of demo trading, your chances to successfully manage your live account are quite slim. Exceptions happen, but we speak about majority of Forex traders.

The reason why we made such verdict is because no matter how much you study Forex every day, 6 months is too little to gain all necessary experience and digest enormous amount of information about Forex trading, plus be able to test it long enough in order to confidently invest money relying on knowledge gained and start trading successfully.

Traders that were willing to dedicate about 1 year to demo trading had most likely been already demoing Forex for some time and gained some initial experience, that allowed to analyze the time needed for proper learning and research more realistically. These traders have initially higher chances to manage live accounts properly, but would need much more time to be able to achieve stable performance. Their risks of sooner or later losing it all are still high; therefore, unless they consider at least another year of practice and studying we may add them to our initial 68% group of risk. Total would be 85% now.

Again, why we are so strict bout the verdict? In any field professionalism is never achieved in no time. Students study for 5-6 years in universities to obtain a profession, a sport champion has to work on his body and skills for years before receiving his first gold medal.

Learning Forex in one year won’t make most of us financially independent.

The category "no need for demo" lists both: traders who voted for immediate opening of real account in Forex and learning while trading live, and traders who already had real accounts. This category was made to help maintaining quality of votes on other voting options.

And finally we have the remaining 6% of traders who planned to demo trade and practice for 2 years or more before going live. This small group has the highest potential to make it right and achieve its financial goals in Forex. We can only add here a well known wisdom: "Success in anything you do lies in hard work, continuous learning and passion for tasks set and choices made".

What is our advice after all?

If you happen to be in the 85% group, simply plan for further studying and testing and later open a live account with more serious approach.

If you belong to remaining 6% of traders, move on and stick to your plan.

What practical value does this research have for an average Forex trader?

With some exceptions (which we all wish to be a part of, but let’s be realistic), there will be no quick profits in Forex and no financial miracles.

Demo trading is a great and free way to test your Forex trading skills and practice as long as it is needed. Being serious about investing real money, means being serious about learning how to manage them in artificially created conditions.

But, let’s don’t forget about live trading!

Live trading is even much better way to learn about real challenges in Forex. Many Forex traders confirm that after trading with real money they had to revise their views about Forex trading.

It is highly advised to open a real trading account to get a taste of real Forex. Caution! Don’t rush in to earn money with your first live account, approach things wisely.

If your trading skills aren’t truly outstanding so that you can confidently manage large funds, do not invest a lot in your first live account. Consider you new live account as live-test account. Test your live skills by managing a small balance and trading the smallest lots possible(!): up to 1000-2000 units, so that your balance won’t be affected much even if your first trading attempts result mostly in losses. Find a broker that allows to open a mini account and trade with small lots.

And finally, our scheme to success in Forex:

Demo trading – live-test trading – live trading

Between each stage at least 1 year of trading experience.

To your trading success!

Edward Revy and my best Forex strategies Team

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hi, I'm from Malaysia. I started with demo first around 4-6 month. I don't know how many demos acc i'd burnt already, but the feelings is different when you're trading live acc. My first acc also blown because i had only small amount of money to invest and still doing trial and error. Then i put some more money but trade with the smallest lot per trade. I want to learn and never give up hopes.

I'm only using 1H,4H,Daily & Weekly TF.As for strategy only coupless like Fibo Ext, MACD and RSI.Still testing other tools but so far after 2 years i think this method is the most fit with my style.For me i learned the hard ways like others but i will never give up because I know what I'm doing.If you want to involve in Fx you must give 100% commitment like it's your own business.

So far I'm doing well, for me getting 4-15 dollars a day is good enough coz I'm only trade with small lot ( 0.01-0.10), depends on which trade Fx or commodity.I know someone will laugh coz its a small amount but like I said, I'm new and still consider myself a freshie and Fx is a long journey plus my acc amount is not big, <1000 USD.Losing some trade and winning some trade if a learning session. Like Edward said , dont be greedy and have money management, learn as much as you can coz learning is golden.

Thanks Edward for this marvelous site.

I started trading 5 years back. I opened first live account thinking of earning big without demoing the method I used for live trading. Deposited huge amount in live account. Made few big wins. I was unable to give time to my family. One day disaster struck. I lost 10-15k in one trade. My immediate reaction was to withdraw all the amount and close the live fx account. I think I made a wise decision at that time. After 5 years of demo trading/ opening live account with very few amount and testing few methods, I think finally I know what fx is after all. Respect the market. Any one who is new to trading keeps on hopping from one method to another to find that perfect method. This is the point where new ones get frustrated. Life is precious and maintain balance in time you give for work/family/fx.

In my opinion paper trading is nothing like the real deal, I would paper trade just to get familiar with your trading program and broker, after that go live and start trading with small amount of money.

I took 2 years to understand how to use indicator properly, read the market movement, read the trend and trade on demo acc. now on year's 3 i know exactly when i can open position and when i must close it. the risk to lose money become very small now so, it's true we will need atleast min. 2 years to trade on demo acc.

Thank you for the great article. I took the short cut to LIVE trading and got burnt!

I have now been learning and doing Demo for 6 months and I planning to go testing for the next year to 2 years. However I am worried, what if the retail forex market blows up and I don't get a chance to trade LIVE and make a living from trading in the next few years?

Do you think the retail forex market will still be around in the next 10 to 20 years?

I will greatly appreciate your answer.

Thank You

M

I read your posting and was jealuos

hi Sam From Kenya.

Very simple advices, do not rush it! do not enter the market without a solid strategy, do not think that you are getting rich overnight, work hard do all research you can.

Long story short, I have been around forex for abouth 4 years, and i have tested a lot of strategies. For the last 2 years I have been developing a strategy on my own, demoing and testing and backtesting it over and over again, and every time I do I find things that need to be improved. Now after all that time of very hard work i'm just starting to see positive results, but there is at least half a year more ahead of testing.

Nice post about Success in Forex it would be helpful for traders

Sam from Kenya

I have just learnt about forex in the past week, I still am totally green am using demo accounts and have lost $600 in one day, but this is mainly due to my inexperience and lack of strategies.

How long should I demo? I also want to enter into real forex trading to earn income in the future, based on research what is the average income experienced retail traders make in a month?

aud by ya sell

As an Economist I say to you : NOBODY has the magic trading system and economics is more Psychology than a Science. If someone has a strategy that on the long term gives 100% probability that 100% of the users would be profitable, He/she deserves the Nobelprize of Economics.

Seminars are advisors just suck and are a waste of money and time. It's always the same story : GREED will bring you down :)

thankkkkkkkkkkssssssssssssss

Pls, i'm a novice in dis whole forex of a thing, but i wanna go into it...there's a lot of forex tradin program usually last for three days like more of seminar and which i bliev it ain't enough to go into it. Is dere anyway u could b of help in helpin me out to have a real educationist dat could tutor me

There's more to trading than just understanding the charts, indicators and strategies, but even those elements will take more than one year to learn. It probably takes a year just to sift through all of the info to start working out what actually suits you as an individual, then another year to focus on the specific techniques of how you have decided to trade. If you get through all of that without a hitch, then you've got your dreaded emotions and psychology to contend with. Another year to work out how to deal with them so that your emotions don't impact your trading and you've become a well rounded trader in three years.

If you manage that, you're at the top of the game and you've done really well. I know some people will do it quicker and that's great for them, but they are the exception. I've been at it for four years, but only got serious 12 months ago. Once I decided to get serious and put some proper hours in, I started to get some success and am now profitable. I predict another 3 years of hard work before I will be able to consider myself good enough to become a professional trader.

Leigh

Post new comment