Advanced system #2 (Fibonacci Trading)

Submitted by Edward Revy on May 6, 2007 - 04:39.

The fact that Fibonacci numbers have found their way to Forex trading is hard to deny.

Moreover, trading currencies with Fibonacci tool for many traders have become the bread and butter of their whole trading career.

So, shall we look at the one of such good Forex trading systems today?

Trading setup and tools we need:

Time frame: 3 hour (or 4 hour).

Currency pairs: any.

Indicators:

Fibonacci tool - our main tool

EMA 100 – green (visual guidance)

SMA 150 – red (visual guidance)

RSI (14) on a daily chart

Read entire post >>>

Hello Edwards and many thanks answering all these comments.

Can you tell me how much profitable is this strategy for you?

Thanks

Hi Bob,

thank you for your feedback as well as the good comment.

I must agree with your suggestion about using ZigZag and Fractals. Makes a lot of sense, because not only it is easier to select swings for Fibs, but also you'll be "trading on the same page" if I can say so, e.g. using the same reference points as many other traders do.

My favorite strategies are advanced #3, #5; 9 EMA method #1; I like the idea and application of advanced method #10 & #14; also simple #5 and #8... Possibly I forgot to mention other strategies, there are lots of good ideas almost in every method, plus they add up quickly, it gets challenging to rate them all.

Best regards,

Edward

Edward,

I forgot to ask you which of the many strategies are your favorites, and which are the most profitable.

Thanks again,

Bob

Hi Edward,

I am literally blown away by the magnitude of the really good strategies that you have brought to the forex community. Kudos! A really noble achievement...

What do you think about the use of fractal and zig-zag indicators to determine surrent price waves? These indicators have specific criteria to establish their respective positions. My point is that this would present a more uniform set of criteria for determining the wave, rather than my own indiscriminate method of determining what I think a new wave is. And yes I realize the ZZ can repaint, but price could do that to me anyway with my wave selection, as well.

Many thanks,

Bob in Wisconsin

Got it Ed, thank you very much.

Nique

Hi Nique,

by that I meant that while we stayed in a trade (Entry Long) there were 4 cases when we had to re-set Fibonacci (and we did), because, according to our rules, quote: "once another wave greater than 100 pips occur, set a new Fibonacci on the new wave".

We did that because we need to have a fresh set of Fibonacci lines each time there is a new wave over 100 pips is span, because:

a) it allows us to adjust a Stop loss.

b) it provides a new "must channel" area, which we also have to monitor in case we need to exit (should a full candle trades and closes outside 0.250 on our first screenshot on the first page)

Hope it makes sense :)

Regards,

Edward

Hi Edward,

What does it mean "since entry we had to reset Fibonacci 4 times" written on the chart?

Thank you

Nique

Fibonacci tool is not "downloadable". It is a must have tool for any Forex trading platform. Which one do yo use?

Try asking your broker to help you find this tool on your trading platform.

hey all..

can i know from where to download

Fibonacci tool

THANKxX

Hi Barry,

Fibonacci may take time to master for a beginner. Just keep on going in case you can't understand something in the beginning; you'll learn it with time.

For now, take a look at this source, which explains Fibonacci basics: Forex Fibonacci ebook

Regards,

Edward

Hi Ed

I am really struggling understanding fibanacci, how do you create these retacements with the fibanacci tool..i am a newbie so please pardon my ignorance...everthing sounds so technical . maybe expained in laymans language

Barry

Hi Snowhyte,

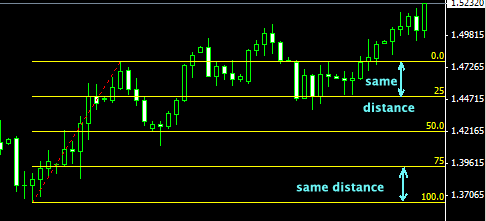

We pull fibs from swing high to swing low or vise versa. It doesn't actually matter in which direction to pull, since 25% and 75% fib lines are located equal distance from each side of the swing.

When price closes inside 25 and 75 channel, it is a retracement move, which is expected. When price breaks outside 25/75 channel, it may indeed travel not too log on the first run, but, what we want to see here is a long term trend, that's why I prefer looking at 3 or 4 hour charts and higher.

Regards,

Edward

Hello Edward,

I have been scanning this strategy for some time and I hope you can spare some moments to clear my doubts.

When we pull the Fibo lines i.e. swing up for uptrend and swing down for down trend. Is this correct?

I am testing this strategy on 1hr TF. Also notice that if we wait for the price to close completely inside 75 or 25 territory, sometimes the trnd is already ending? Don't you think so?

Thanks /Snowhyte

Hi Michael,

This strategy works 24/7.

I'd recommend EURUSD, USDJPY and GBPUSD.

Fibonacci tool on any trading platform has the levels, you've just named. You'll need to add 75 and 25 level manually. Do do that:

- add Fibonacci retracement to the chart first;

- right click on the indicator until you see "Fibo properties" menu. (If you can't call this menu, then right click on the chart and choose "Object List" -> from the list choose "Fibo" -> Edit -> where you'll add 75 and 25vfibo levels.)

Regards,

Edward

Thanks Edward.

I normally scalp with good success. I don't use these indicators for scalping. I am now looking to add long term strategy to my arsenal, hence my interest.

3 Questions:

You are referring to the 25/75 level but by default on Metatrader when I apply Fibonacci retracement. I only have 0, 23.6, 38.2, 50.0, 61,8 and 100. Should I be tweaking the properties in the indicator, and if so, what tweaks should I add?

Do you recommend any specific pair more then others ?

Is this trading strategy one that can be used 24 hours a day or are there certain times where I should not be trading?

Thanks in advance for your help.

Michael

Post new comment