Advanced system #2 (Fibonacci Trading)

Submitted by Edward Revy on May 6, 2007 - 04:39.

The fact that Fibonacci numbers have found their way to Forex trading is hard to deny.

Moreover, trading currencies with Fibonacci tool for many traders have become the bread and butter of their whole trading career.

So, shall we look at the one of such good Forex trading systems today?

Trading setup and tools we need:

Time frame: 3 hour (or 4 hour).

Currency pairs: any.

Indicators:

Fibonacci tool - our main tool

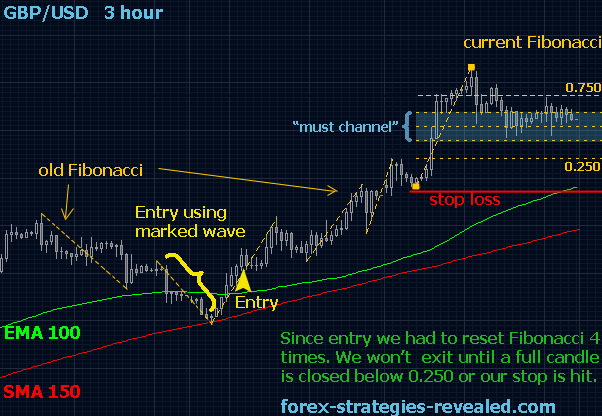

EMA 100 – green (visual guidance)

SMA 150 – red (visual guidance)

RSI (14) on a daily chart

We will be working with next Fibonacci retracement levels: 0.382, 0.618, 0.250 and 0.750.

Default stop loss – roughly 100 pips and then adjusted according to the most recent swing high/low.

Profit target – no target is set as we will let the profits run.

Trading Rules:

Find the closest to the current price wave with a distance from High to Low over 100 pips.

Apply Fibonacci on it no matter if the wave is going up or down, only size matters.

Some terms we are going to use here:

The corridor between 0.382 Fibonacci retracement level and 0.618 retracement on the chart – will be called a “must channel”.

Fibonacci retracement levels will be numbered always from bottom to top, no matter whether it is an up or a down wave. E.g. at the bottom we will always have 0.250, then next 0.382, 0.618 and finally on top – 0.750 Fibonacci retracement level.

Entry rules:

Always enter only according with both:

1. EMA and SMA trend suggestion (e.g. green on top – uptrend, red on top - downtrend)

2. RSI suggestion (e.g. reading below 50 – only sell orders, above – only buy orders).

Now, after applying Fibonacci on a wave bigger than 100 pips we wait for the price to go inside a “must channel” area (at least to make 1 pip into the channel). Only then next rules will be valid:

- If a full candle (including shadows) is closed below 0.250 Fibonacci retracement, we go short. If we are currently long – it is time to close long position – it is an exit rule as well.

- If a full candle (including shadows) is closed above 0.750 Fibonacci retracement, we go long. If till this time we had short positions open – we close them – and again it is an exit rule as well.

Important: once another wave greater than 100 pips occur, set a new Fibonacci on the new wave. Retracement levels will change and so we will now follow new retracements.

(Optional: for visual aid traders may mark old Fibonacci wave to see the general pattern of consecutive waves on the chart).

That’s it. Stay in trade, resetting Fibonacci with each new wave and moving a stop loss according to the last swings high or low (in simple words, a stop loss will be always just below the Fibonacci 0% line) until it is time to close the position according to our rules.

This strategy prevents a lot of “bad” entries, eliminates early exits and allows staying in trade for a long period of time helping to take everything a current move can offer.

Traders may close all good winning positions on Friday evening if they prefer not to hold them over a weekend.

To your trading success!

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hi chris..

Im also a newbie in this trading. 3 moths ago, i started with demo and after a month "playing and studying" with demo, i jumped into the real account. Now its already 2 months with real account and thanks God i managed to double my investment. However, since 3 months ago im still looking for strategy that convincing, easy to understand, work and suit best for me. Ive been studiying this strategy and i think i have found one. I think im understand and gonna try this.. coz the best thing as for this strategy is.. lets your profit run.. thanks to mr edward.. really appreciate yur sharing...

Ok chris.. answering to yur question.. i'll try my best.. from my understanding.. yes chris.. we have to wait.. it is as for further confirmation that the trend is really reversing.. this is to filter and avoid any false signal or breakout.. below .25 and above .75 here are the signals telling us to enter or exit.. and for yur question , it means time to exit and secure yur profit coz its 'maybe' a trend reversal is forming... not for entry..better safe than sorry right?.. ;-)

Sorry for my poor english.. regards, azlan

Well it seems Edward is no longer following this thread, so maybe someone else can answer my question. My question is, if we are, say, long and a candle closes below 23.6 which will close our long trade and then a full candle is below 23.6 do we automatically go short or do we wait for the emas to cross lower and rsi to go below 50. Thanks, Chris.

Is Edward still active on this thread???

Hello Edward,

many brokers often have a gap at the beginning of the week, my question in regard to the fibo on the 4hr chart, if the end of the previous week was the high & there's a gap the next lower, (or vice versa with a move up) should the fibo be drawn form current week candle after the gap? Sorry if this is a bit unclear, I can't send a jpg to illustrate via this post. Otherwise I'm keen to give this strategy a go!

Regards Lindsay

Just to further my question regarding upswings and how you tell where the extremes of the currency movement is - If you look at the graph in Edwards' first example, there are dotted lines marking waves. The first one labelled Old Fibonacci has quite a sideways movement (ie the candles don't go straight down in a line. The arrow marking the entry point is on an up wave, but immediatley after the entry point the candles dip downwards before continuing up - how big does this dip have to be before it is no longer part of that up wave? There are 4 up waves on Edwards' image after the marked wave that signals an entry. Why are these split up into 4 separates waves, and not one big wave? I can't find anything to explain how to determine where the wave starts and ends (as I am doing this manually initially the answer use the software isn't helpful)

Thanks,

Linda

I don't have metatrader platform - trying to do it manually. I can see some lines drawn, but trying to work out what the extremes are of a currency movement. Sometimes when it is moving downwards there are slight sideways movements or up swings, then it keeps moving down. Sometimes these are included as part of the same wave and sometimes not. I am trying to understand when it should be regarded as an up wave, and when it is regarded as still part of the down wave. If I could post some pictures it would make it clearer what I am asking. But for example, if there is general downwards mevement, witha small upwards swing in it, would that upwards swing be ignored if it was only 10 pips, or is that counted as an upwards movement, or would the change have to be 20 pips or 5 pips - at what point does it become an upwards movement rather than just a speedbump on the way down? (same question for the opposite direction)

price must go into this "must channel" to validate the retracement.

Hi, regarding the selection of points to be a wave - how do you determine the top and bottom of a wave - I have looked at a lot of the examples, and some are easy to pick (ie fairly straight line with a clear change in direction), but sometimes there are a lot of smaller up and down movements within what has been defined as a wave. Are there rules for what the top or bottom of a wave is (eg if next 4 candles are lower then you were at the top of a wave?).

Can you please tell me what is the purpose of the "must" channel?

Easiest way to put it: you see on his picture there are some lines drawn. You can call that a "wave". If you have MetaTrader platform click middle button or scroll and draw a line, it will calculate the size of your line in pips.

Hi, Kindly explain to me what you mean by a wave greater than 100 pips.

Sam, Ghana

Hi Edward

I'm new to this forum, system and sort of a newbie to trading, I've not read the whole forum here just 11 pages or so but I need to ask how does the 100 pip swing figure fare up in a 5 decimal price range? In the original screen shot with 4 decimal fine but do we now move our pip ratio in accordance with this price change I.e 1000 pips for our swing, 100 pips is nothing on even the GBP/USD on a 4 hour chart ?

Many thanks

Mark

to user:

what other confirmation would you consider to validate a breakout of a resistance line? 3%, open above, close above?

I don't get it. Doesn't it defeat the whole purpose of fibs? Go short when the whole candle is below 0.260 and long when above 0.750. That's madness, it doesn't give you confirmation that resistance has been broken at all! Don't you mean other way around?

Hi Edward,

Can the same EMA, SMA & RSI with fibonacci be used with weekly chart.

if not, please suggest the weightage?

regards,

akash

Post new comment