Advanced system #5 (Trend Lines Breakout System)

Submitted by Edward Revy on June 3, 2007 - 15:20.

Breakout systems like this are always in great demand. It is quick, easy and with a proper use has a true winning rate of over 90%.

Currency pair: GBP/USD, EUR/USD - tested. Other pairs may also be used.

Time frame: 1 hour.

Indicators: none.

Trading setup:

For this Forex system to work properly a trader needs to know the basics of identifying swings high and low, rules of drawing trend lines, plus be able to use Pivot Points.

Read entire post >>>

Hi Krishna,

News releases come everyday, however not all of them make significant impact on the market.

If a trader knows that Really important news are about to be released (like Non-Farm Payroll on the first Friday each month) and he doesn't want to be in a trade at that time, he can play safe and stay out. Otherwise, I don't see a problem in trading during the news; news could also be on our side.

Kind regards,

Edward

Hello Edward

My doubt is, if the price action of a news release breaks the trend line can we enter into the trade accordingly. I am asking this to find out if we should consider the candle stick which breaks the trend line immediately after a news release. During news releases we find a lot of crazy price movements. How do we deal with such situation? Do we enter trade because it broke the trend line or do we just wait and not trade for that particular day or do we enter trade only if it breaks the other trend line.

Thank You.

Krishna

Hello Edward

I need to thank you for looking into this strategy to help us out. This is what I am actually doing. I am setting 2 orders. First one is a buy order set 5 pip above the expected trend line break out and second one is a sell order which gets activated once the stop loss of the first order is hit. Each order is set with 60 pip take profit and 30 pip stop loss.

What I also find is that usually or in most cases the distance between the high and low of the midnight candle is about 20- 30 pips. So our other order which gets kicked off once the stop loss of the first order is hit, is invariably placed after the break of the other trend line.

Also we need to note that after the break of any trend line the price moves in our direction to get those 60 pips(sometimes it moves a lot more) or we get stopped out. Once we get stopped out, our other order gets activated and that order 95 out of 100 times would hit our 60 pip target.

I some how feel the set and forget orders work much better compared to orders which we need to monitor. And yes we need to move our stop loss or exit trades after the close of the 3 am candle because we usually have a lot of news releases during that time.

Thank you. Really appreciate your help.

Hi Krishna,

It is indeed an interesting observation. It looks that majority of entries made on the break of a midnight candle's trend line could deliver positive results; and when a trade is closed for a loss, an opposite trade can be opened on the break of another trend line, which will cover previous losses. Congratulations on your great discovery!

I'd like to add some comments on possible filters here.

I haven't tested it live yet, just while looking back at past days charts I've noticed that if the length of a midnight candle (body + shadows) is less than the length of the previous candle - 23:00 EST, then we would have a greater chance of a false breakout.

It is because when we start drawing trend lines, we will most likely have one connected to that 23:00 candle, which will ultimately make an angle of a trend line too sharp.

Then also it looks to me it would be a good idea to protect profits on the close of 3 am EST candle by moving a stop to break even or above/below (downtrend/uptrend) 3 am candle.

Exits on the close of 4 am candle could be planned.

The idea needs further testing, but overall it is very intriguing discovery!

Thanks a lot for this great contribution!

Regards,

Edward.

Hi Edward

I have made a scintillating observation today. Just take only the 00:00 est candle and follow the same set of rules. Like drawing a trend line from its high to the recent swing high and from its low to the recent swing low. I found out that every time we entered into a trade after the trend line break, we made profit. Kindly take time to check that out. As you are an experienced trader you might find some draw backs. If you find any please let me know.

Thank You.

Krishna

Thank you so very much, Edward!

Now it clicked! Oh my, you've nailed it now!

Yes, the problem is that I thought I had to draw the trendlines precisely at the fifth bar.

Well then, this sure is a great system - now I can see why so many people are profiting from it.

Thank you again!

Hi Krishna,

In such cases I prefer to wait and let the trade run.

Losses with this system aren't too big and don't hurt trading accounts too much.

Well, if a loss is less than 10 pips, then it could be easily accepted.

But, usually, if we've been in the market for 3 hours and so far had negative performance, there is quite often no reason to exit immediately as our Stop loss order is usually just few pips away from being hit. So, why accept losses now and save few remaining pips if we could risk those pips to find out whether we were eventually right or wrong.

Kind regards,

Edward.

Hi Edward

As per the rules we exit after 3 candle sticks close. Do we exit even if we are in a loss but not stopped out yet or do we just let the trade run till our stop loss or take profit is hit?

Thank you.

Krishna

Hi again,

Now I see where the problem is...

That's the chart with trend lines on it.

We look at 5 candles range. Right.

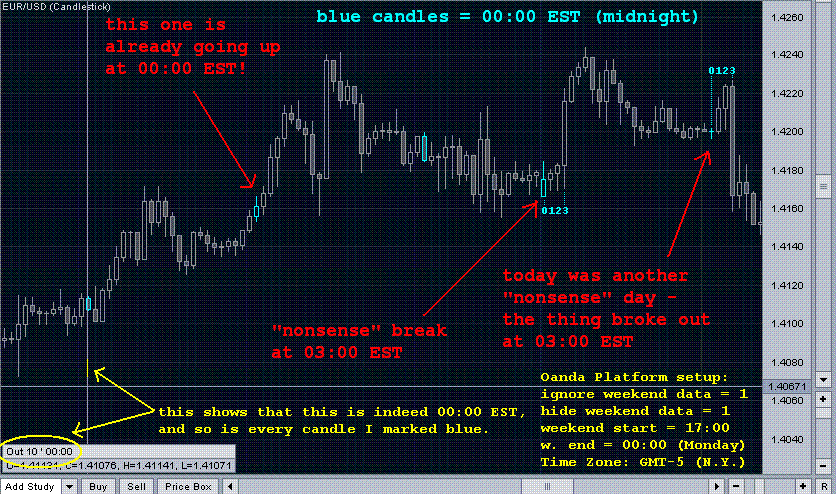

Once we saw THE FIRST swing high withing this range, that's it! We draw a trend line and ALREADY ready to enter on the break of that trend line. E.g. no more need to wait till all 5 morning candles are in place. Same for swing low. Thus, the breakouts at 3:00 am on the picture that you've described as "nonsense" are in fact valid trades. I hope now we've nailed the problem :).

Best regards,

Edward.

Thank you for your prompt reply, but I think something is still wrong.

To me those are all losing days. As I wrote in the picture, those 06:00 marks aren't actually 06:00, it's just 06:00 in MetaTrader's crazy clock. I've done the maths and those 06:00 correspond to midnight EST. And I can verify that when I configure my Oanda charts to EST Time Zone and I can see that those marks are indeed all midnights EST.

So now you see why I'm completely puzzled?

I'm attaching a more clarifying chart, this time Oanda's, so that you can see the time issue I'm talking about. I'd appreciate if you could comment on that, and verify that (or if) indeed I've got the right times.

Notice that I've got my Oanda charts setup just like yours, as I noted in the bottom left corner of the picture. Can you tell me what's wrong? Now you see why I'm having so much trouble understanding all these people winnings! :)

Hi,

Your charts are fine as well as timing. Starting from 00:00 EST (which as I understood is 6:00 am your local time), you should count 5 candles forward (not backwards) and look for swings high/low withing that 5 candle range.

Should you have any difficulties with Forex market hours, please have a look at: Forex market hours and tell me if there is anything else I can help you with.

Last several days weren't the best ones, that's may be why you were struggling to see any profitable trades. I've drawn trend lines on your original picture, the same way I drew them on my charts, where I've got:

Oct 10 - win

Oct 11 - nothing

Oct 12 - loss

Oct 15 - win

Hope this helps. Happy trading!

P.S. Thanks for the screen shot. Now we can also show traders that "empty days" and losses with this system are a part of everyday Forex trading routine.

Best regards,

Edward

Hey Edward,

Here's my chart of the last 4 00:00 I can see. You see what I'm saying to you, the next 4 bars after the 00:00 bars marked in red in the attached picture are too violent and completely consume any profits I could take (and even if they didn't, I'd have no way to draw trendlines!) Please compare my chart to your charts so that I know if I'm making any mistakes regarding the time.

Here's my chart picture:

Hi Edward,

I've been trying hard to understand this strategy, and I think I do, but the problem is that I can't seem to find _any_ day having the 5 first bars calm enough to apply your strategy. Going back in my charts, it seems the action begins at 1:00 (and that's EST - although I'm not inside EST, I did the maths). I even registered at Oanda FXgame to see if I could find the May 21 day shown in your example, to see if I've got the times correctly, but their platform doesn't go back that much. Could you give another fresher example, preferably one that doesn't span through a weekend, showing the exact 5 bars beginning at midnight and drawing the trendlines? I've gone back through EURUSD and GBPUSD and can't find a single day where I could even begin to think about drawing anything - the action happens right in the second bar.

Also, if you could tell me how does that 00:00 EST align with market open hours (e.g. are you saying that the first of those 5 bars we have to monitor is the one that happens 2 hours prior to the London open?), then maybe I could understand it better, but I still would need a fresher example to compare with my charts. Oh, by the way, I can go way back in my MetaTrader4 but I still couldn't find a May 21 day that looks like yours (in both eurusd and gbpusd), that's why I'm kind of awed by the people saying it works really well and that they rarely collect losses.

Thanks for the swing high and low explanation, that really helped me. And thanks for this wonderful website of yours. You certainly help lots of people and I imagine you make a living trading forex, for which I praise you.

We use two most recent swings high/low we can find on the chart (the first should be found within our 5 candles range, the second - doesn't matter how far away it is (e.g. how many days back), the only requirement for it is to be the most recent and valid to draw up/down trend line from).

I've made some pictures for you. Hope this helps.

Regards,

Edward.

Hi Edward

Can you stress on how to identify swing highs and lows. If we find swing high the previous day, can we draw a trend line to it. OR should we look at few days back. If yes how many days. I drew trend line to the previous days high a few times and got stopped out. I guess that is not the way to draw. Kindly help. Thank you.

Post new comment