Advanced system #5 (Trend Lines Breakout System)

Submitted by Edward Revy on June 3, 2007 - 15:20.

Breakout systems like this are always in great demand. It is quick, easy and with a proper use has a true winning rate of over 90%.

Currency pair: GBP/USD, EUR/USD - tested. Other pairs may also be used.

Time frame: 1 hour.

Indicators: none.

Trading setup:

For this Forex system to work properly a trader needs to know the basics of identifying swings high and low, rules of drawing trend lines, plus be able to use Pivot Points.

These are very simple things we believe every trader should know.

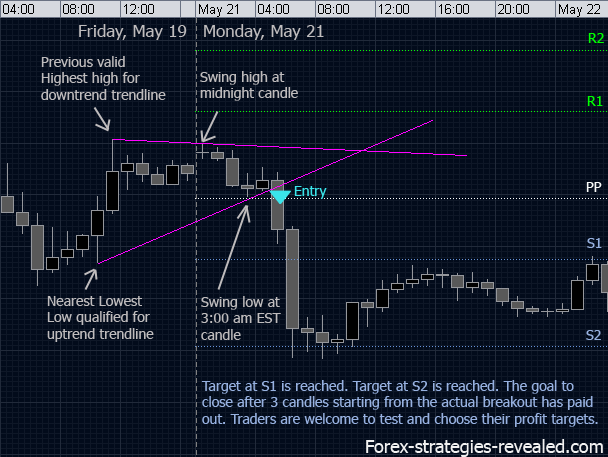

Our working range includes 5 candles: from midnight to 4:00 am EST (including the 4:00 am candle).

Optionally: draw a midnight vertical line for a visual aid.

Within those 5 candles look for a valid swing high and swing low of the price.

Now, draw a downtrend trend line connecting your swing High to the most recent swing High of the previous day. (Make sure the last one is also a valid High to draw a downtrend trend line through).

Do the same for the swing Low: connect it to the most recent swing low of the previous days, make sure you are pulling the right trend line using the rules of drawing Uptrend trend lines this time.

If a trader sees, for example, no swings High in the 5-candle range, that means there will be no downtrend trend lines this morning. Same for a swing Low.

The Entry is done on the break of either one of the trend lines and is immediate without waiting for a current candle to close. A protective stop is placed just above/bellow the candle that broke through the trend line.

Profit target:

Usually the whole action is unfolded within the next three candles (count in the candle that had violated the trend line but only if it closed on the other side of the trend line).

So, after the actual breakout we have 3 hours or 3 candles to trade, after that we will exit with whatever profit is made.

Main rule: Using Pivot points + timing

Our profit target is going to be the nearest level of support or resistance according to Pivot point levels.

If, however, after only one candle (or 1 hour) this target is reached, it suggests a very strong market, thus we would stay in a trade longer and set our goal for the next support/resistance level. We would also choose the second Pivot point level of support/resistance as our profit goal if the first Pivot level appears to be too close to our entry point.

We have three candles to trade after the breakout in total, that's why we can trade calm and allow our goal to shift to the next Pivot Point level.

It is an absolute traders' discretion of whether to set the target at the nearest Pivot point support/resistance level and leave the trade once the target is hit, or using the timing factor exit after the two/maximum three consecutive candles.

Tip: running two orders can save lots of nerves. First target - the nearest Pivot point support/resistance level. Second - on the close of the third candle.

Another simplified option would be with fixed targets and timing:

For example, EUR/USD target = 20 pips minus spread, GBP/USD = 40 pips minus spread. These are only suggestions, and for other currency pairs = testing will tell...

Hold position open for the next three candles.

If the target is not reached within those three candle, close all trading positions anyway.

That's it. Simple and very effective.

Happy Forex trading!

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

I'd like to thank you everyone for your feedback, support and questions!

Comments for this strategy are now closed. To continue discussion, please use our Forex Forum, where you can create a new discussion topic.

Please follow the topic at:

http://forums.forex-strategies-revealed.com/advanced-system-trend-lines-...

Hi Keith,

thank you for your feedback, and yes, I continue to use this trading stategy successfully.

I think I know where there is a mistake in your example.

When you found a valid swing High on Tuesday, you don't need for another swing high to be necessarily on Monday, instead you have to scroll back as far as you want before you can identify a valid swing to connect with your Tuesday High.

Same for every other day: we are looking for a valid swing high in the 5 candle range, after that we scroll back seeking for a previous most recent swing high, which will be found regardless the time, day and proximity to our current day.

Best regards,

Edward

Hi Edward,

Firstly, I really appreciate what you did for everyone here. You shared simple yet valuable strategies some of which could be commercial. This strategy is amazing.

Just one question about VALID swing High/Low:

Assume that I had a VALID swing High/Low on Monday (I don't care last week).Today is Tuesday and there's NO VALID swing High/Low after 5 candles, so I cannot draw trend lines -> no trade on Tuesday.Is it right?

Next, on Wednesday, if I have Valid swing High/Low I still don't have trend lines because there's no Valid swing High/Low on Tuesday and I have to wait to see if there's valid swing High/Low on Thursday. If so I connect swing High/Low on Wednesday and swing High/Low on Thursday to make trend lines. If not, no trading on Thursday hence no trading on Friday either. Is it correct?

Hope you get what I am saying :)

Best Regards,

Keith

P.S : Do you still use this method?

Hi Grace,

Please send me a screen shot using our contact for below and we'll compare the timing.

Regards,

Edward

Hi Edward,

I am using ChoiceFx. It seems like the midnight bar is 01:00 am bar.

Could you compare it with yours and kindly highlight the 5 bars you are using?

I am in Est zone.

Thanks

Grace

Hi Grace,

Trend line are in angle most of the time, but I find it easy anyway to find a price level suitable for entries. Treat it as art, where +-3 pips won't matter much, your perception of the best entry price is important, after 2-3 days of practicing I'm sure you'll be comfortable with placing new entry orders.

It is true that I don't know when a trend line will be broken: several hours may pass without a breakout, and my entry order may be obsolete and not as accurate as before. I have a simple rule: if I happen to be around charts to re-adjust the entry order, I happily do so, if not, I leave things as is.

Best regards,

Edward

Hi Edward,

You said "Once both trend lines are in place I set limit orders which would be triggered if price goes through any of the trend line. At that point I stop monitoring the charts." Where do you set limit order when the trendlines are in a angle and we don't know when they will be broken at which hour?

Thanks

Grace

No, it doesn't.

Regards,

Edward

Hi Edward,

Thanks for this wonderful strategy. I just wanted to confirm something. Lets say we have 3 candles - A, B, C. A and B have the same low, C has a higher low. Does that make B a valid swing low for this strategy?

Many thanks

Hi Chris,

your application as well as timing is correct. I've got the same results +-few pips on choppy days. I'm sticking to the rules anyway. However, not without trying to improve the odds. At the moment my latest experiments involved additional timing + a Moving average. I don't have stats to share, neither for the new tests nor for the original strategy simply because my account includes trades from several other strategies besides this one. But, I'd like to share the idea I've been working on.

Here it goes:

- we draw trend lines using 5 candle range after midnight AND now also 3 hours before the midnight if there is a valid swing to use.

- if we ended up using a swing before the midnight, we only draw a trend line which would allow us to trade a breakout in the direction of a main trend.

- a main trend is suggested by 200 EMA: price above 200 EMA - uptrend, below - downtrend.

I'm still seeing some losses, but a fresh idea makes me exited to further work with this method.

Best regards,

Edward

I have also attached a similar screenshot but this time from the eurusd pair, hopefully this will help show anything im doing wrong.

Day1 - Small profit

Day2 - unsure, market very choppy, probably a small loss?

Day3 - no break

Day4 - again hard to tell but probably a loss on the sell then recovered on the buy?

Day5 - very small profit if closing after 3 bars, good profit if left for a while

Day6 - small profit if closing after 3 bars

Again and pointers about where I might be going wrong if indeed I am are very much appreciated.

Regards,

Chris

Thanks for the response Edward, I have uploaded this screen shot to show the last few days trading so you can see how I drew my lines in. These are the results I would come up with based on these lines.

Day1 - 2 losses, as the market broke the lower trendline then retraced above the higher trendline, signalling the 2nd trade which also retraced.

Day2 - questionable if trendline would have been drawn in as show as its totally flat, but if so its a loss.

Day3 - I just realised that I have draw the line in wrong and it should be diagonally upwards to the candle 4 candles previous, but if taken to the correct point it looks like possibly a small win as the 3rd candle finishes below the line.

Day4 - No trade.

Day5 - Possibly a small loss if stop was moved below the large green candle that broke out of the trendline, possibly a win if leaving it to run.

Day6 - A loss on the long breakout with that loss being recovered on the short breakout therefor a breakeven day.

I have double checked that I am going from the correct candle which im pretty sure I am due to time differences, but it could possibly be something to do with that. If not then if there is something blindingly obvious that I am doing wrong please do let me know! If you could inform me what results you achieved over this time that would help greatly.

Also just for confirmation am I right in saying you dont trade monday mornings with this method?

Regards,

Chris.

Hi Chris,

Mid October caused some troubles, but overall we came out with positive results.

I think you shouldn't be worried.

If you have any concerns about the right application of strategy steps, please do not hesitate to upload screen shots, and we'll look at it together.

Best regards,

Edward

I have been paper trading this method for a month now and I'm very impressed. The only thing I have found with my testing is that for this last month the GBPUSD has performed very well and the EURUSD has really struggled. Has anyone else found this because if not I must be doing something wrong! I'm wondering if anyone has tried out any other currency pairs with success as well?

Regards,

Chris.

Thank you, Darren

I don't see why not trade it slightly different if it also works :)

Happy trading!

Best regards,

Edward

Post new comment