Advanced technique #11 (True and False Trend Line Breakouts)

Submitted by Edward Revy on December 15, 2008 - 12:23.

When price breaks through a trend line, how can we tell whether it is a true or a false break?

Well, we can't tell or predict until we see it later on. But, we can analyze what price has been doing prior to this breakout in order to form our own opinion and bias, and either pay attention to the breakout or disregard it.

We can always go back and look at waves pattern, or simply, whether price was making Lower Lows (LL), Lower Highs(LH), Higher Highs (HH) etc..?

Let's look at the next two screen shots:

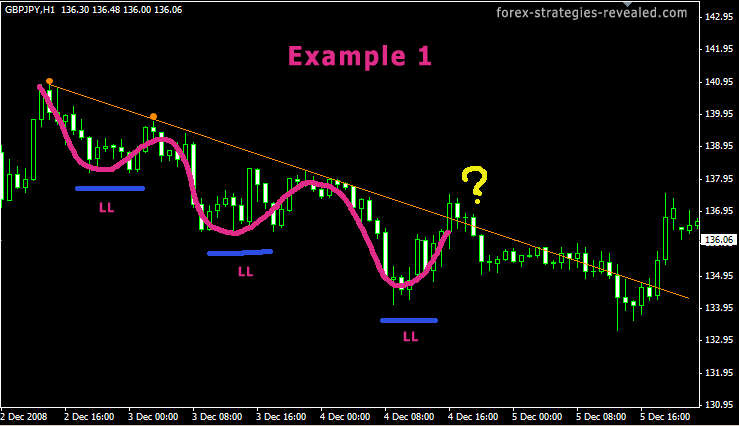

The market was in a downtrend. We drew a trend line connecting first two tops.

(A tutorial on how to draw trend lines can be found at http://www.forextrendline.com/)

Price was obeying the line, but then at some point (where I put a yellow question mark), price breaks the trend line and closes above it.

How can we know at that moment whether we could trust this breakout or not?

The simplest and popular method is to wait till price returns back to test the strength of the broken trend line again. Then, if it holds, traders would say that a breakout is confirmed and enter either somewhere near the test point or when price advances through the earlier established breakout mark.

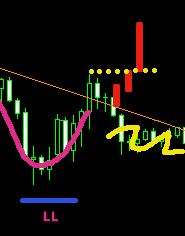

Here is a quick example (I drew the red candles myself to illustrate the point):

After the break of a trend line price returns, tests the line again, finds support and, as a result, goes up. Yellow dotted line indicates the point of entry with a Buy order.

BUT, this kind of re-tests don't happen all the time. Sometimes price would just break the line and advance further without looking back. What to do then?

This is why I like to look back at older data to learn what happened prior to the breakout.

What can we see on the first example (first screen shot above)?

Price was consistently making Lower Lows. But, most importantly, prior to breaking a trend line, price made another Lower Low, telling us that Sellers were still strong and were able to push the price down.

Based on this, we can say that this particular breakout that we were questioning cannot be "trusted". (I use the word "trusted", because whether the breakout was valid or not we will only learn later).

Now, let's look at the next example below:

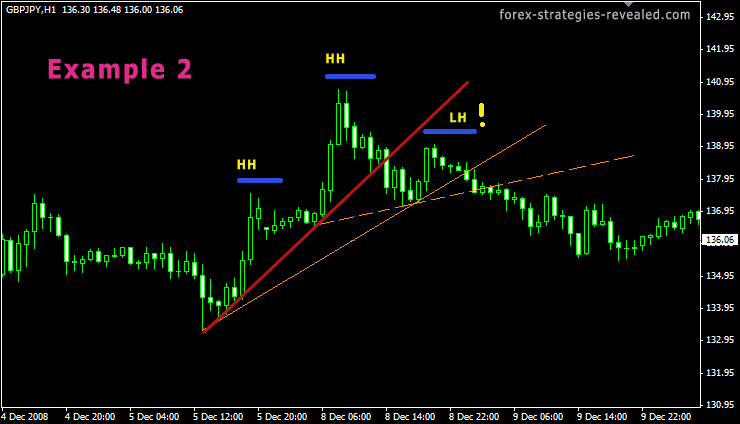

Let's start form the beginning: price is making Higher Highs and we draw our red trend line.

At some point later the red trend line gets broken. Can we trust it? The answer is "no, we can't", because we still can see a higher high, which means that buyers were still able to push the price higher.

Few candles later price is bottoming out, attempts another up-move, but fails and puts a Lower High this time.

That's nothing else but a trigger that bulls are weakening and either one of the trend lines (solid or dashed in brown) which you'll be able to identify will become the point of truth: if it gets broken - the price is very likely to move lower.

That's it. A simple method, which might help you to judge about most likely outcomes of the trend line breakouts.

Remember, that in the uptrend you need to take into consideration only Swing Highs, in the down trend and for downtrend trend lines - only Swing Lows.

I hope you enjoyed this trend line breakout presentation.

Happy trading!

Edward Revy

and my best Forex Strategies Team

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

nice method...i understand that but what we do after the trendline breakout after higher high and higher low..???

regard,

edwin..

Hello.

Using your analysis above, Which timeframe is best for day trading. Would

trendlines be best drawn on the Daily, H4 or H1 for identifying the breakout?

Thank you.

EP

yes sir ur correct iam doing trading on this method and i got good returns when i studied ur concept i got one of my mistake solution thank u very much sir my heartiest blessings to u giving free knowledge

Hi armafx,

Thank you for your feedback as well as simple and useful tips.

Happy trading!

Edward

Hi Edward, this is one of the best learning site i've found. Would like to add some small tips on trading breakouts.

Based on Example 1 above, the breaking candle is the signal candle whether or not true breakout will happen, if anyone wants to ride the bus earlier, not wait for the pullback, just enter buy stop 10 pips above the high of the breaking candle, most important is wait for the breaking candle to complete than can enter the PO.

Why complete candle is important? if the breaking candle is a reversal pin bar at the trendline, would anyone dare to challenge the bears..?

armafx

Clear and simple, just awesome....

Thanks with many regards,

Puguh Kurniawan

I have a comment about the TL break. When we have a wedge like we did in GBP a little while ago, as far as SL, I make it on line with the apex of the wedge (as seen with the fibo number for easy reference).

I was within a few pts of getting hit on this one, but usually it works good, as very often there is a retrace after the break, as in a bear/bull trap, and then the break continues.

Also, most times the go with the general trend, so be careful with a counter trend trade like the EUR was a little while ago.

Keep up the good work Edward and crew!

Grant

Hi, Jatin

Trading trend line breakouts would be easy if all the time we had just one trend line breakout pattern, but we don't.

Below are just few possible outcomes of a trend line breakout.

Let's review our options:

Taking entries on the trend line break (green dot) is great, when price is determined to go higher (case #1 and #6), in fact, in case #6 that's the only opportunity to enter.

A bit scary, though, if it happen to be case #4, where we could, actually, instead of a normal break, witness just a spike - price would poke the line, triggering our Buy order and return back below the line...

But, what about remaining scenarios? By entering on the initial trend line break we could also be taken for a long ride up and down without any result; that's because it is not yet known whether the trend line itself is an important level of support/resistance. When will we know it? Only when a trend line is re-tested.

If a trend line holds on a re-test, it confirms that there are forces behind it. But are they strong?

Same thing, we don't know yet, still the obvious benefit of entering on a trend line re-test (blue dot) is that we could risk very little to find out the truth — our stop will be placed just below the trend line, or even better, if we switch to a smaller time frame, we could identify a candle that clearly bounced off of the line and then put a stop just below that candle. So, entering on the re-test of a trend line, especially when, according to your market studies, the breakout was expected and should trigger a new trend, is a good choice.

And, finally, our third option is to wait till the driving forces behind the new breakout are proved to be strong — we enter on the break of the first swing which came after the breakout (yellow dot). This is the most conservative approach, which allows to avoid majority of false breakouts, plus you won't need to wait long for the results to come, as opposed to "green dot entry".

Hope this helps to select your preferred type of trend line breakout entries.

This is just a trading technique, so to speak, for stops and profits you'd be using your regular/other Forex strategy.

Happy trading!

Edward

Great stuff!

thank you, Ed!

Lew

Sure, the strategies can be printed out for your own reference or shared with friends.

They cannot be, however, re-published anywhere without special permission.

Regards,

Edward

Thank you, Lino

I'm sure Skype chatting is a great idea, but , unfortunately, I won't be able to join in because of my tight schedule..

But I always be here to answer every question you may have.

Kind regards,

Edward

Thanks Edward for the this wonderful strategies. By the way, are we allow to print these strategies out for our own reference and study? Need to ask you for permission first. Thanks.

Sorry Edward, my skype name is Lino De Sousa, Im from South Africa.

Hi Edward,

My name is Lino, Iv been following three of your systems, the trendline break out system, trend line trading strategy and reading up on true and false T/L breakouts.

I was doing very well untill greed got the better of me and i over leveraged which quickly stole a big slice of my capital, my big head doing!

What i would like to suggest is, may i post my skype name on here, in that way when we trade we can learn from each other while live trading, sometimes if a trade setup is not really there we tend to want to trade anyway, with others reading this awesome site we can help each other by making sure we sticking to the rules on here.

Just a thought, worked well for me once before, i met guys from a forex chat room, i refered them to here, they read the strategy and we hooked up on skype, we stuck to the rules and make some awesome trades.

Im going to write my skype name here, if you decide to post this comment anybody is welcome to add me, lets help each other when it really counts!

Regards Lino.

Thank you, Jatin

I'll make a new illustration to it by Wednesday.

Post new comment