Forex trading strategy #14 (ADX Power)

Submitted by User on June 10, 2009 - 12:46.

Hi everyone,

Just another simple to follow strategy for you guys, hope you find it useful.

==================================================

ADX POWER

==================================================

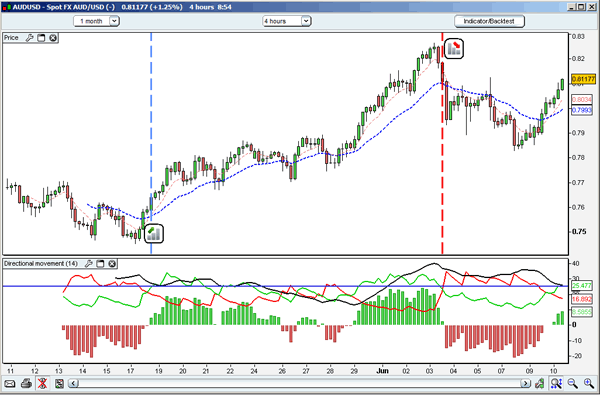

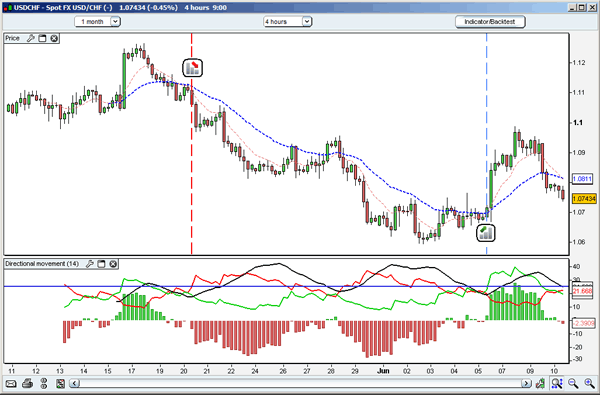

- Timeframe: I use it on 4 hours, feel free to use it on smaller timeframes as well

- Currency Pair: Any

- Indicators: EMA9 and EMA26 and DMI (Directional Movement Indicator with ADX)

- DMI Settings: Draw a horizental line at 25 to watch for the crossovers of DI+ or DI-

- ADX Settings: Ignore signals where ADX is lower 20

GO LONG WHEN:

- EMA9 has crossed over EMA26

- DI+ >= 25

- ADX >= 20

- ADX is in between DI+ and DI-

EXIT LONG WHEN:

- EMA26 has crossed EMA9 AND

- DI- is higher than DI+

GO SHORT WHEN:

- EMA26 has crossed EMA9

- DI- >= 25

- ADX >= 20

- ADX is in between DI- and DI+

EXIT SHORT WHEN:

- EMA9 has crossed EMA26 AND

- DI+ is higher than DI-

WHAT TO IGNORE:

- While in Long Position: DI+ and DI- Cross-overs while the EMA9 is still on top of EMA26

- While in Short Position: DI+ and DI- Cross-overs while the EMA26 is still on top of EMA9

- While searching for Trading Opportunities: The EMAs has crossed over but the DI+ or DI- (depending on whether you're looking for Long or Short positions) are still under 25. Also, wait till the ADX has reached 20 before entering into Trade

- Price breaking the Lower EMA (EMA26 in case of Long Positions) line while the EMA9 is still on top of EMA26

Good luck and happy trading,

Nariman Ghanghro

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

hi Edward Revy thanks for teaching us how to use some indicators... and exposing us to trading systems.... I have few questions

1)best time to use trading system? most say trade when lets say you trading eur/usd ... you must trade when NYSE open and London...but my problem with that is during those time there is a lot of news released.

2)This one is about this trading system...i don't get that part that says in ADX must between D+ and D- ... because in the picture i see ADX over D-/D+

sizwe

Hi! Sometimes I saw the exit points are almost as the same level as the entry points, although the profit could be made, the price simply came back... How to choose more early the correct exit points??

so far this is the best performing basic strategy I ever backtested. Thanks a lot Nariman for sharing!

In the example-1 AUDUSD H4 chart, the short position does not qualify for a sell position

because of this rule " ADX is in between DI- and DI+ "

can you please elaborate, why you opened that short position

P

hi, do I put applied price to CLOSE or OPEN ?

green DI+

red DI-

blue ADX line

Hi Edward,

Thanks a million for the site. I am a beginner to forex. Your site is a godsend. So many tips and so much information.

Sorry to be sounding dumb. In the ADX window there are three lines - Red, Green and Blue. Which is what?

Thanks for helping.

Nanda.

Hi Nariman,

I like your system a lot. I have a question about your charts.

On page 1 you have 2 charts - both with the Directional Movement Histogram Indicator. Where can I get this indicator? (It makes reading the charts easier and quicker.)

Thanks for the posting.

Paul

We must enter when EMA's just crossed or we can enter even on later times after the EMA's had crossed and the other requirements are OK as the DI>=25 and ADX>=20 and ADX is in between DI + and - ?

The crossing happens very rare so I don't see the point using this method if what I've asked is not available....

i love this (lee)

Hi Rob,

Why MACD when it's about ADX.

Did I miss something?

Regards,

Edward

Edward it looks as if MACD figures in this system. Iam just checking as you made no references to this.

Rob

May be that's why the rule suggests that ADX should be between DI- and DI+. there will be fewer false signals when ADX rises 1 point above 20.

The use of the ADX must be done anyhow of its initial position? So if is 21 and pointing down we can still start the trade? Maybe in a few minutes it will be under 20 so the pattern as was shown will not be clear...

what if ADX is above 20 but not between DI+ and DI-? can we take that trades too?

Post new comment