Developing a system #18 (Pin reversal bar)

Submitted by User on September 28, 2009 - 06:22.

Hi people

Im Nick and i am pretty new to trading and have only been trading demo accounts so far and have found this site very helpful so thanks Edward and team.

I would like to share an idea for a system and get some feed back and hopefully people will forward test it if they think it is worth while.

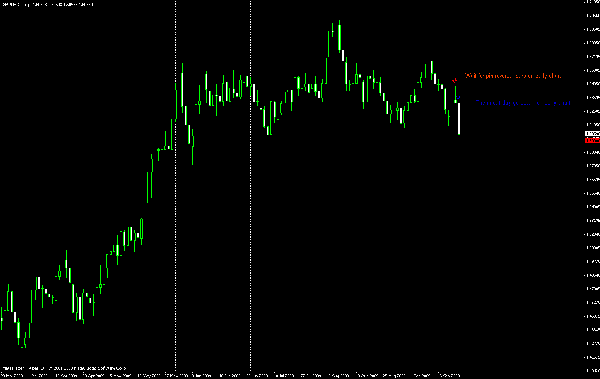

basically the idea is you trade the break out off the hourly bar witch closes at 7am on a day after where an pin reversal bar has occurred on a daily chart ,this idea came about because i was trying to find a better risk/reward than placing the stop loss at top off pin bar

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hey guys,

I too trade Pin Bars but only on the daily timeframe. I find its more reliable than the smaller time frames, as the daily charts contain less noise. Here is a link to some very useful documents that I used when I learnt about them. Hope people find them useful.

http://www.forexfactory.com/showthread.php?t=6721

Downloads:

Pin-bar-introduction.pdf

Pin-bar-advanced.pdf

I only trade daily bars and have been consistently profitable for about a year. My entries are 10 pips above/below the high/low of the pin bar, depending on the direction the price action is likely to go. Stop loss also goes 10 pips above or below the high/low. I might trail stops depending on what happens the day my orders trigger. I also tend to look for additional things when trading pins. These include confluence of Fib levels and moving averages, to stack the odds in my favour. For example, on Thursday 14 May (last week)there was a good Pin bar on the USDCAD daily chart. Friday 14th May I closed with a decent profit.

I hope these links help those who are learning about Pin Bars.

Regards

Nil

www.forexlayman.com

Hi there,

I trade pin bar on two ways:

1 - Break out

2 - Reversal.

1 - I play the break out always when pin is formed against the trend and with the trend. If divergence is found, much better. Watch for support/resistance position. Never sell against a support level/never buy against resistance level. If pin bar is too close just let it go.

2 - After most pin bars formation (specially on 4H) prices retrace, some can go as far as 61% reversal on the tail. I would take an entry if prices reach 50% of the whole previous bar (pin bar) with my stops 2-5 pips above/bellow bar tail. This way I will minimize my lost if it is a fake pin bar. Most of the times they are not.

The above is much better on 4H, Daily, Weekly. Play 5 min, 15min pin bars with divergence.

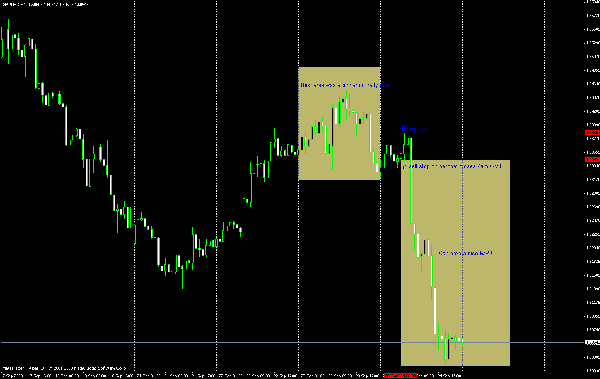

I want to make a comment on the above picture and add my two cents.

Submitted by Edward Revy on October 15, 2009 - 21:13

I think and IMHO the first formation "IS THE BEST OF THE BEST" 2 pin bars are better than 1 and much better if the second bar tail falls lower than the first one. If you read these two bars properly they are telling you that buying pressure on the second bar are very exhausted. They tried to go up again for a second time but failed. I would play 2 consecutive pin bars all the time. You just imagine that 2 pin bars are not very common, why because when the first one is formed there is already weakness on the previous trend so when you see 2 pin bars you will hit the jackpot.(All this is assuming that the bar is completed.

The other 2 examples are not bad at all but if you are referring to the entry points I think the entry would be too late. Why to wait for prices to go that low??

On the question "how do we know if it is time to protect our position or let it run" I would say that pin bars are the best price action formations with a great, fabulous, incredible Risk/Reward numbers. Just don't be greedy and close half position when 1:1.5, move you stops 5-10 pips covering your entry point and trail bar by bar because really no one knows when the market is reversing again. There will be plenty of pin bars for every one today, tomorrow and for the rest of the market existence.

Thanks for this great website

Ernesto

It is 7 am GMT according to the screen shot.

Regards,

Edward

What do you mean by 7 am? Is it GMT or EST?

Hi Kris and Edward thanks for your replys

yes you assume right only place order in one direction after pin bar

i have found personally the 7am bar break works best on GBP/USD as on other pairs you seem to get stopped out with a false break and should probably wiat for brake off pin bar low / high with mabey stops governed by asian range i would like to know if any one has any ideas for optimum entry time on other pairs

as for exits i agree must let trade run till end of day if i have a small proffit say 20-40 pips if my stop has'nt been hit i will close trade .if we have a large move its worth waiting as to see what happens next day as price will quiet offten carry on for 2-3 days before a major retraction but i allways look for areas of support/resistance and major round numbers as we approach these it could be time to exit regardless

Hi Nick,

I like the simplicity of the idea.

I would assume we'll be looking to take trades only in one direction based on the appearance of the pin reversal bar. E.g. on your first screenshot, it would be only a Sell order after the highlighted pin bar.

As far as I'm concerned, no additional filters/indicators requires so far.

The question is, how do we know if it is time to protect our position or let it run.

Here is what I've been thinking initially:

After the entry, we keep a trade open for the whole day. By the end of the day (assuming that our Stop loss was not hit) we can evaluate further risks of being in the trade and see whether the reversal is actually showing some promising signs for tomorrow.

If the following day could not clear the pin bar's height, or does it very unconvincingly (e.g. clearing the candle body + shadows by just 10-20 pips or less), we should consider some actions to protect our position, since as far as we can see there is little promise ahead. Thus moving a stop loss to breakeven might be an option.

If the following day we have a good progress, then we can leave a trade open without significant concerns, because everything [price] is going according to the plan.

If the following day we have a candle that clears both: the pin bar and its previous bar, that is a strong sign that we have might just caught a true top/bottom and there should be some good reward ahead.

Best regards,

Edward

You get in at the low of pin bar, or if it does not get hit, you take 7am breakout ;) works well any currency pair...And what is your exit strategy?

Happy trading

Kris from Estonia

Post new comment