Complex trading system #5 (Fibonacci trading)

Submitted by Edward Revy on June 30, 2007 - 13:27.

Traders were asking to post some strategies that will work on smaller time frames.

Here is one very nice trading system that can be worth your attention.

When a trader chooses to use small time frames (like 10 min, 15 min, 30 min even 1 hour) risks to be wrong are always higher than with larger time frames.

Therefore, it is very important to have a really good Forex trading system that can advise on entries with high chances to win and what's more important it should be able to tell exactly where to exit without need to constantly monitor the price.

Note also, the more traders look at charts, the more they tend to have controversial feelings about the success of a current open trade...

With all this long introduction, it is only left to mention that this strategy will require from traders basic knowledge of use of Fibonacci tool.

What is Fibonacci tool and how to use it? Simply Google "forex fibonacci" phrase and you'll find a lot of information about it.

...This is probably the only reason we classified this trading system as Complex one, not every trader is comfortable with using Fibonacci studies in Forex.

Trading setup:

Time frame: any over 5 min and less than 3-4 hour.

Currency pairs: any.

Indicators: 5 WMA

Rules:

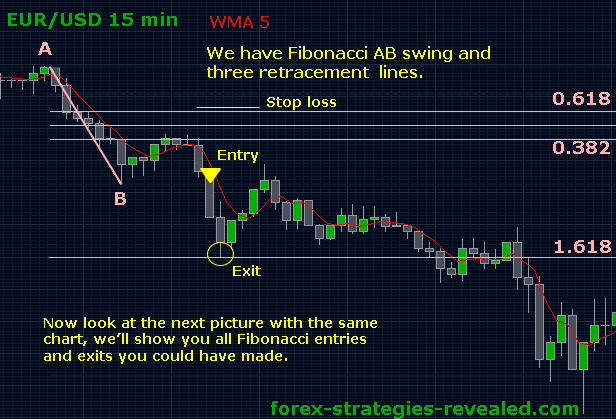

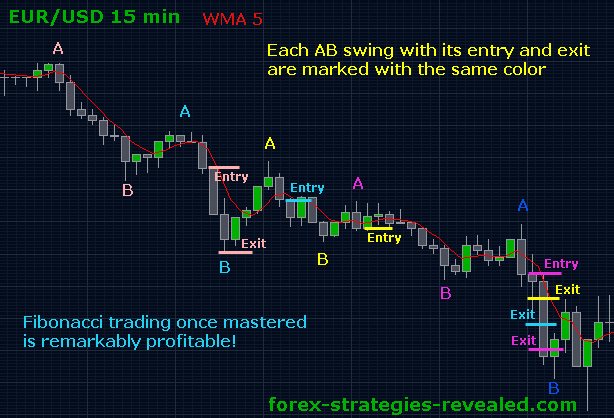

Look at the price waves. Find the most recent swing high and the most recent swing low = so called Fibonacci A swing and B swing.

Pull Fibonacci from A to B.

To know which direction to pull (up or down) simply look at the trend; if it is unclear, find appropriate AB swings and set Fibonacci in both directions.

Once set, wait and watch the retracement from AB swing to unfold.

During the retracement there are three conditions to be met in order to consider trading:

1. The price must touch 5 WMA.

2. The price must at least touch 0.382 Fibonacci retracement level.

3. The 0.618 Fibonacci retracement level must not fail. Here it means the price should not close below (uptrend) / above (downtrend) 0.618 retracement line. It can touch or poke it, but the level must withstand the "attack".

When all three criteria are met, enter once the candle is clearly closed above 5 WMA for Long entry, below - for Short.

Stop order is placed always 4-5 pips above (downtrend) / below (uptrend) the 0.618 Fibonacci retracement level.

Profit target is set to 1.618 Fibonacci expansion level derived from point A.

Master your Fibonacci trading!

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hola Edward

una pregunta, del primer punto A y B, se recorre el Fibonacci al siguiente punto A y B y asi sucesivamente?

saludos!

I can help anyone for any tedious tasks you may need done (back-testing etc). If you will pay for my time I will do the work. I need to build my trading money back up and if you can help me with that I can help you with almost anything in the market. Contact me via my email subject "Backtest" mustafoinc at gmail dot com.

I don't understand how find entry point?

I was wondering if we could use this strategy in 1 Min Chart.??? have anybody had tested it????

Also what if use Martigales along with this strategy?? I know it could be dangerous but we can set orders on every Fibo level with low volumes???? The worse scenario would be like the market does not respect to all level and break all of them which I think it happens rarely ???

I am looking forward to read your opinions ....

Regards

Hossein

Now I have my own broker account, I need now is to get a good trader, serious, honest and disciplined with good profit, good reports, if anyone knows anything, I need help, thanks

can i use zigzag to fine my AB ?

I've added, and now mostly use 70.7, 78.6, 127.0, and 141.0 percent retracements. Set these up and you'll see what I mean. The 78.6 is extremely useful when it comes to reversals.

looks better

Hi Edward. Do you have any other suggestions about this system on confirming an entry other than price close on other side of 5 SMA?

The original Fibonacci indicator in MT4 is the best one.

Unless you want fibonacci lines to be drawn constantly and automatically, then see the previous page with a solution for Fibonacci Retracements - FiboRetracement3.mq4.

Best regards,

Edward

there is a fibonacci indicator in meta trader 4 is this the best one, does it work or is there another download that is better, please let me know.

Definitely, you can.

It's a healthy choice to try out indicators that you like and which could help you make a better decision.

Regards,

Edward

hello.can i add some other indicator for this strategy like stoch 8,3,3?

Try these:

swing_zz.mq4 - it'll help to find tops and bottoms for Fibs.

or FiboRetracement3.mq4 - it'll draw Fibs for you.

Thomas.

thank you Thomas...

Post new comment