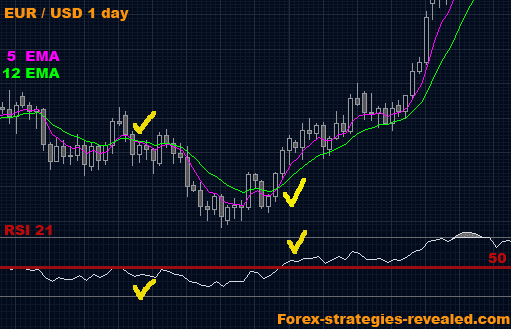

Forex trading strategy #6 ("Key Simplicity")

Submitted by Edward Revy on February 28, 2007 - 15:49.

Yes, one look - one hit. A trader can decide on his/her trading plans by a simple 1 second glance at the chart. It is a very simple Forex trading system that is a pleasure to use for traders with a busy schedule.

Strategy requirements:

Time frame: 1 day

Indicators: 5 EMA, 12 EMA, RSI 21

Currency: ANY

Entry rules: Buy when 5 EMA crosses up and over 12 EMA and RSI is above 50. Sell when 5 EMA crosses down and below 12 EMA and RSI is below 50.

Exit rules: exit when 5 and 12 EMA cross again or when RSI crosses back through 50.

Since it is a daily system the logic behind it can be described as simply following the daily trend. Because EMAs are lagging indicators they actually help us in this case. The signaling EMAs' cross appears after a good pause which is just enough for the new trend (if any) to be established.

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

you will blow your account out if you just follow the rules of this system, whipsaws are deadly, just did a manual backtest over a 3 year period on EUR/USD using a trading simulator which allows you to practice in real time using past data, when it catches a move, it rocks, but will totally kill your account if you took each and every signal

Hi Edward,

Where can i find this?(a user posted on page 3 of this system) "I use EMA crossover signal where i have set up ur EMA set ups which gives me signals with Arrows"? ....i'm kind of new and i don't know if it's a thing that i can do or it's a custom thing/indicator that can be downloaded from around here.

Thanks very much

Waiting for a reply

Hi Edward

what is the optimum entry?

eg if going long wait for the high of the candle to break? with Stop loss at previous day low?

thanks

D

best strategy by edward

thank you

with regards

shaan(india)

This one is good. But if you are trading the daily or some high time frame like that. When you are wrong its gonna hurt. Unless you have a tight stop and if you do.. you will be whipsawed to death. so in my opionion.. the system works but keep a very wide stop in place. just my two cents.

Does your Stop loss rule, as posted on Jan 15th, apply to all time frames? So if you trade 1 hour chart you would use the previous candle's range? And in the event of a confirmed trend/profitable open trade what trailing stop rule would you apply?

thanks

very nice setup and explanation really like how it works very simple and profitable

Hi Alan,

SL = previous day daily range in pips, e.g. High - Low of the previous daily candle.

TP initial target = at least 1.5 times the SL distance.

Manual exit = when 5 and 12 EMA cross back or when RSI crosses 50.

Best regards,

Edward

Hi Edward,

Could you elaborate more on the stop loss and take profit portion as I am not very sure about that.

Regards

Alan

With greetings from Russia. Thanks you Edi for an excellent site. Strategy is good, and the main thing is simple. korya.Tymen,Russia.

Why did I change my strategy?

I have so many other interesting ideas, rules and methods that I simply can't settle with one simple strategy for the rest of my trading career.

I think you'll quickly develop the same feeling once you trade for a while.

Best regards,

Edward

Why have you changed your system is the Key Simplicity not working anymore?

Hi,

I do use Moving averages in my trading, but my system is more complex than this one. I use a mix of strategies and rules from a number of trading systems.

(In this thread I've mentioned those systems: http://forums.forex-strategies-revealed.com/advanced-strategy-the-midnig...)

Kind regards,

Edward

Hi Edward are you still using the Key Simplicity?

Hi,

I would love to one day be able to help with coding experts. But today I'm not yet have enough knowledge on this subject. I'm very sorry for not being able to help you with that. Try asking people at forex-tsd.com:

http://www.forex-tsd.com/questions/270-ask.html

Kind regards,

Edward

Post new comment