Complex trading system #3 (MACD Divergence)

Submitted by Edward Revy on April 19, 2007 - 16:55.

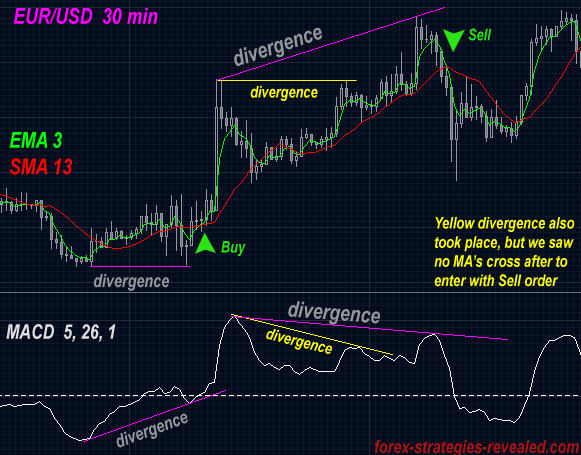

Currency: EUR/USD (preferred) or any other.

Time frame: 30 min.

Indicators: MACD (5, 26, 1) – draw 0 line,

Full Stochastic (14, 3, 3)

EMA 3

SMA 13

Trading rules: watch for divergence between the price on the chart and MACD or between price on the chart and Stochastic.

Once divergence spotted, wait for EMA 3 and SMA 13 to cross and enter the trade in the direction of EMA 3.

Set stop loss at 26 pips.

Take half of the profit at 20 pips; let the rest to run further with trailing stop in place.

Divergence on Stochastic can be found the same way as on MACD. The reason for using both MACD and Stochastic is that one of the indicators can show divergence while the other will not at given period of time.

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hello Guys

Im trading with this strategy but using the Slow Stochastic (14,5, 5 ) EMA 3 SMA 13

What you guys are discussing above is all very good but you do need to add some conditional rules before entering the trade to reduce failed divergences.

I make sure that if Im seeing a divergence developing on a 1H chart and its supporting the trend direction on the daily chart, then I watch the 15min chart also for the same divergence to happen at the same time as the 1H developing divergence. 1H + 15min divergence is ABSOLUTELY AWESOME!!!!!

Maybe add this conditional rule to this strategy and you will see some nice powerful candles follow.

Matthew

Hi All,

Could you please recommend the best available automatically indicators for:

* showing regular/hidden Divergence.

* foreseeing how long any particular divergence will last.

Thank you in advance.

Regards

Thanks Edward for submitting this strategy. Have you used it recently? If you have, could you provide some numbers describing the success of this strategy?

Thanks a lot!

http://www.investopedia.com/terms/a/andrewspitchfork.asp

hello. what is pitchforks?

Diveregence along with pitchforks togeather is a great system. Look to get in at the birth of the move.

Divergence can develop for a prolonged period of time: the longer it lasts, the more impatient the market becomes, and thus reversals can be sharp. But sometimes the market reacts to the very first occurrence/sign of divergence.

As a trader, you can't foresee how long any particular divergence will last/develop. But you can use additional indicators/analysis to improve your timing on that.

Regards,

Edward

hi edward,

if there is divergence, than how long the effect of this divergence?

Divergence suggests trend reversal, thus you should be looking to enter a counter-trend position: in an uptrend - look to Sell, in a downtrend - look to Buy.

thankyou so much for making this website.i got the idea of divergence but i dont know about entering the position after divergence...is it in the same side or in reverse.how will we determine that

I use MACD (12, 26, 1) for 4h and daily. Stoch 14 and Moving averages - up to you, depends what pair you trade. Even if you adjust Moving averages here and there a few points, it won't be bad.

Are the settings the same for the MACD,stoch. & emas on the daily TF?

Thanks,

Charles

Hello Edward, I did a "back test" and I have to say, your system is great. Thank you.

Fanda

A candle should close, then we enter.

Best regards,

Edward

edward in this strategy do you wait for the candle to close or imediatly as we see the crossover we enter?

Post new comment