Advanced system #1-a (Midnight setup addition: Trading Breakouts of the Breakouts)

Submitted by Edward Revy on February 22, 2008 - 10:47.

Current trading method was developed as an addition to original Midnight Setup strategy, but can also be traded alone or in combination with any other Forex strategy.

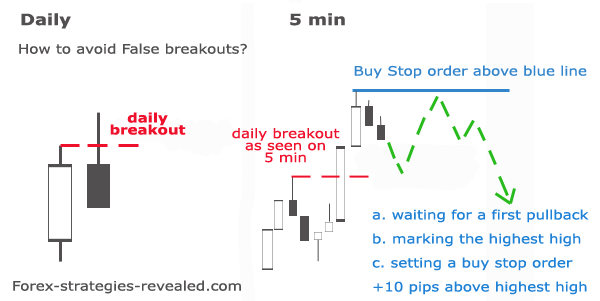

The idea is to filter out some big portion of false breakouts in our case above/below daily candles.

Setup: daily charts and 5 min charts, no indicators.

Entry rules:

Using rules from Midnight Setup strategy we get ready to enter on the break of the daily candle's high or low.

However, this time instead of placing Buy/Sell stop orders above/below daily candle, we aren't placing any, but rather waiting for actual breakout to occur. Would be a good idea to set an alert signal on a trading platform that will call us when the first breakout is in place.

Immediately after a breakout above/below daily candle on daily charts we go to 5 min charts, where we wait for the price to finish its first advance and start retracing back.

Here comes the idea of Trading Breakouts of the Breakouts:

On 5 min chart we mark the very first extreme level set by the price (highest high or lowest low depending on the breakout direction) and place Buy Stop or Sell Stop orders +10 pips above/below that extreme. This way our order will be triggered only if the price confirms its directional intentions... Otherwise, it was a false breakout.

Quite often after the breakout on Daily charts, 5 min charts first extreme point reveals the real nature of the breakout. Price may never reach that extreme again, or it can come and make double top/bottom pattern and back up. Not all but many losing trades can be avoided by Trading Breakouts of the Breakouts.

Along with advantages, there are some not very critical disadvantages of this method:

First of all, we are going to enter a bit later after the initial daily breakout and thus will definitely miss some pips from the starting breakout point.

Second, if the breakout is extremely powerful, our 5 min retracement may never come or come way too late. Chances for that are quite small, usually there is always something to spot on 5 min charts, but exceptions may occur.

Third, you can't set it once in the morning and forget about it for the rest of the day. You need to be there to spot the first 5 min retracement and set appropriate orders.

Happy trading!

Truly yours,

Edward Revy

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hi Viorel,

it looks similar to grid trading. I believe it could work as long as you stick to the rules. Automating it would be the best option, unfortunately, I dont' have enough skills to write EAs.

Best regards,

Edward

Hi Edward,

We know Price will move either one or both direction from the open price (GMT ) every day with minimum 30 pips, in my opinion I think here is the profit.

This is my ideea: open 2 trades: buystop + 10 pips from open price and sellstop -10 from open price, volume lot 0.01, TP and SL 20 pips.

NOW IF ONE ORDER GETS TRIGGERD WE SAY THE BUY ORDER.. WE immediately CHANGE THE OPPOSITE ORDER AT THE LOW FROM 0.01 to 0.02 )...... and we do that until theprofit is reached.

Can somebody code that?

Thanks,

Viorel

Hi M.F. Zahid,

Thank you for your feedback! It's a lot to read on the site, but that's how the learning process works. The more you study & practice the more you know.

to have a quick start, take a look at the posit where I talked about favorite strategies: http://forums.forex-strategies-revealed.com/advanced-strategy-the-midnig...

Speaking about % monthly target, it's very individual; and even excluding all variables, it'll still depend on the market behavior every month: e.g. if there are no profits to make, because the market is flat, you won't be able to reach your monthly goals. Let's say next: if you're able to keep above 10% each month, you're doing well.

Kind regards,

Edward

Hi Edward,

Your website is amazing to learn forex. Please advice, in your opinion what are the best strategies to test beacause if we try all one by one it takes lot of time. I want to trade live as early as possible with very selected methods which experinced traders like you are using and making money to live life.

In addition please also advice that what should be the average % target of return one should keep while keeping a tight money management and minimum and safest risk? 5%, 10% or More per month? It will help to decide about the lot size and other calculations.

Awaiting your professional and kind comments.

Very Kind Regards,

M.F. Zahid

Hi John,

Pivot points do well in suggesting price direction in the morning.

Kind regards,

Edward

Hi Edward,

We know Price will move either one or both direction from the open price (GMT ), in your opinion which is the most reliable method to predict the most potential direction of price movement from GMT open price.

Whish you a profitable day

John

Many Thanks Edward for your helpful response!!!

Really appreciated.

Best regards

Lan

Hi Lan,

MACD indicator on MT4 shows a histogram + a signal line.

For two line MACD, there is a custom indicator: Good_Macd.mq4.

Download it and add to your platform using steps outlined on this page:

How to add indicators to MT4.

Best regards,

Edward

Hi Edward,

Many Thanks for ur time and consistent efforts to educate others.

My question is actually about MACD..(perhaps isnt the best place to ask, but unsure where else to ask)

Using MT4 platform, whenever I insert MACD, all i see is the signal line and the histograms.

But on ur MACD (on the EkpereHAMA screenshot) and those of other tutors, I actually see two lines and the histograms !!

I guess Im doing something or even drawing MACD incorrectly????

Pls see attchd image file.

How can I draw the MACD lines correctly, and more importantly interprete MACD correctly??

Many thanks for any useful tips.

Brgds

Lan

(Forex Newbie)

Very nice site!

Hi Victor,

The concept of entering on breakouts of the breakouts, has no common patterns for placing stops. So, for me, a stop loss would be something of your own: based on charts patterns, indicators, fixed numbers etc.

Regards,

Edward

Hi, I am just wondering how should we set up the stop loss for this strategy

Thanks,

Victor

Hi Edward

Really appreciate your comments.

Thank you

Regards

Jimmy

Hi Jimmy,

Yes, that would be a valid entry.

It doesn't have to retrace to yesterday's low or high. A pullback of any size is accepted. The only requirement is: it has to be the first pullback.

I haven't created any rules for entering after wide pullbacks though.

Regards,

Edward

Hi Edward

In fact i should asked you this question first. What do you mean by retracement? Does it have to retrace back to the yesterday's low or high? What if the retracement, the gap between lowest low or highest high is huge for example 40+ pips. Is it a valid entree?

Thanks a million in advance.

Regards

Jimmy

Post new comment