Advanced system #1 (Midnight setup)

Submitted by Edward Revy on April 29, 2007 - 08:11.

Ready to dedicate your midnight hour to Forex trading? This strategy can be your winner.

Trading strategy setup:

Currency pair: GBP/USD or any other.

Time frame: 1 day.

Indicators: None.

Trading Rules:

This system is based on the fact that most of the time you won't find same size candles for 2 consecutive days on a daily chart. What does this mean for us – only one thing: the price is moving steady either up or down with almost no price "noise" which is always present on smaller time frames.

Entry:

At 00:00 (your local time) or rather: according to the time set on your trading platform, with newly formed daily candle find highest and lowest price of the day for the previous daily bar.

If the price bar (including shadows) is less than 90 pips long we will not open new trades the next day. (This is our requirement for GBP/USD pair, it can be changed/adjusted for other currency pairs).

If the previous day bar turns out to be an Inside bar,

be cautious about entries the following day. While an Inside bar candle implies a good breakout opportunity the following day, it can also be a dual whipsaw breakout - a break in both directions - the most unwanted scenario for our trading system.

If we've chosen to trade the next day, set a Buy Stop order at the top of the previous day candle — the highest price +5 pips, and Sell stop order at the bottom -5 pips.

Put your stop loss order for a Long entry at the lowest price of the previous day -3 pips.

Put your stop for the Short order at the top of the highest price of the previous day +3 pips.

These additional pips for entries and stops can also be adjusted once you learn the behavior of a chosen currency pair over the time.

Exit:

Now, when one of the orders is filled – stay in the trade for the whole day. At midnight with the new daily candle open, adjust your orders and stops according with the previous daily candle following the same routine; keep trading position open until you get +100 pips, then you may close current position to reward yourself. Rewarding is a very powerful tool, use it.

An alternative money management approach would suggest to enter with two trading positions, where the first one will be closed once we are +100 pips in profit, while the second one will be left to run till we get stopped out, thus allowing us to collect everything the market is willing to offer.

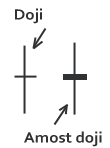

Close you current open positions (with either profit or loss) if a daily candle becomes a Doji candle or is almost a Doji. What we mean by "almost" is that for the true Doji you need open price = close price, while "almost Doji" can have some distance between open and close (but no more than 10 pips).

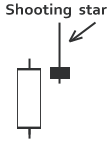

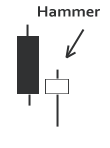

Also close your open trades if you've met a Shooting Star candlestick in an uptrend or a Hammer candlestick in a downtrend.

|

|

|

Below is an example (no screen shot) to illustrate how we navigate in time:

On May 1st at 00:05am, we opened a daily chart and it was a downtrend.

We set our orders (both Buy and Sell) according to the previous candle (April 30th). The same day our Sell order gets filled. The day has passed and the price made some further progress down. At 00:05am, May 2nd with a new daily candle appearing we change our stop loss for a current Short position according to the high of the previous bar (from May 1st), from that point we can either continue to stay in the trade or lock in profits. Also we reset our Buy order which is now going to be just above the highest high of the May 2nd candle.

This system also gives an opportunity to be constantly in a trade and at the same time it requires very little observation and takes only 5 minutes a day to set all positions and forget about Forex till the next midnight. You will see losing trades with this system from time to time – it is a part of any trading, but the overall result will be very positive.

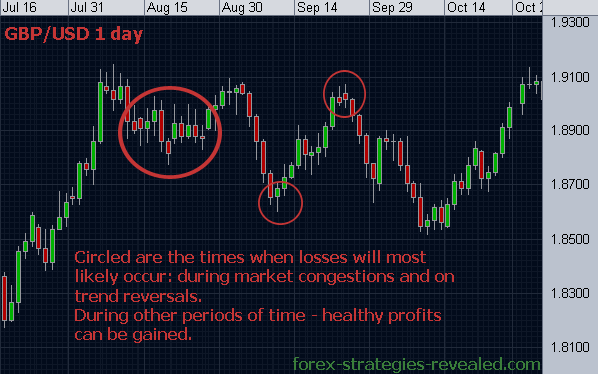

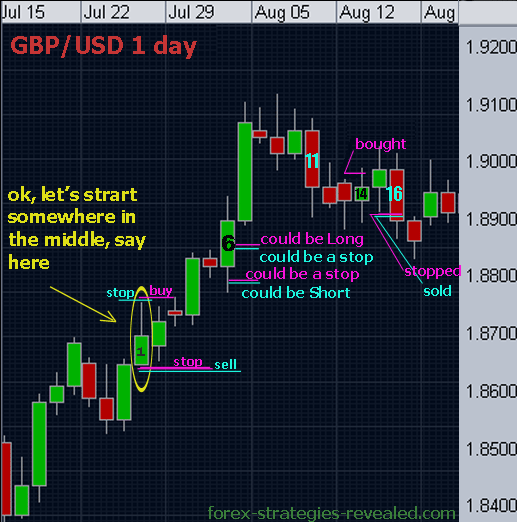

Let’s look at the screen shot now and examine our trading in greater details:

Next is a detailed candle-by-candle explanation of the trading on the chart above.

We will number candles starting form 1, so number 1 is a circled candle.

1st candle (high – low = over 90 pips) which allows entries the next day. We set entry orders.

2nd candle – the price didn't get above or below the 1st candle, no orders filled. Midnight: the 2nd candle is over 90 pips long, we're going to reset orders according to the 2nd candle’s high and low. The second candle is also an Inside bar, so if we decide to trade, we should keep in mind that our risks at this stage will be higher.

3rd – our buy order is filled. Midnight: day ended negatively, but didn't trigger the stop loss, we keep our position open and adjust stop loss below the low of the 3rd candle and minus additional 3 pips. The 3rd candle is also less that 90 pips long and we wouldn’t trade the next day except that for now we have already one position running.

4th – went in profit and we rewarded ourselves closing position at the end of the day with just over 100 pips (you can actually set your target lower than that, or use 2 entry orders as suggested above).

Choosing a profit target for the day becomes easier when you know a daily range average for a particular currency pair.

For example,

GBP/USD daily range average is 180-200 pips

EUR/USD daily range average is 110-120 pips

USD/JPY daily range average is 80-90 pips

USD/CHF daily range average is 120-130 pips

Taking about a half of it can determine your daily profit targets.

Update: from now on to get data about Daily range average over the past month (20 days, excluding Saturdays and Sundays, you can use the following custom indicator for MT4: Daily_Range_Calculator.mq4) Attention: with 5 decimal platforms you have to disregard the 5th digit. On 4 decimal platform no adjustments needed.

5th – no trading as the price didn’t exceed previous candle boundaries. Midnight: candle #5 is less than 90 pips + it is an Inside bar, thus we are not setting any orders for the next day.

6th – we didn’t trade it and for a good reason – price managed to get below and above the previous candle’s high and low, which would have hit our stops, in worst case - twice. By the end of the day we reevaluate the charts and it is a good time to set new trades.

7th - entered Long, our stop loss was below the low of candle #6, this trade is a reward again – more than 150 pips, so we lock it in. At midnight we set new orders again.

We will have systems that will be able to easily allow trades running their positions further relatively safe, but for this one it is important to lock your profits at least partially – the reason is that we move our stop order every day.

8th – no trading opportunities. Midnight: candle #8 is less than 90 pips + an Inside bar (IB) again, means we are not going to trade the next day.

9th - no trading and we were very right about it. Midnight: #9 candle is long enough for us to set targets for the next day.

10th – no orders triggered. Midnight: #10 candle is long enough, but is again an Inside bar, it is risky to trade, looking at previous days traders are now obviously indecisive about the trend. Decide per your own risk appetite.

11th – no trading, but if we did, the day would have ended with a small profit.

12th – no orders triggered. An IB again.

13th – no trading. At midnight set new pending orders.

14th - Bought, but closed negative for the day, although the candle was bullish. We stay in a trade.

15th – we are almost at break even, but nothing to earn, we stay in a trade, stop loss below the latest daily candle.

16th – we got stopped out (not a problem, you shouldn't be worried about such negative days), a short position is filled soon after on the same day. One day later it'll become profitable and so on...

Happy trading!

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

I'd like to thank you everyone for your feedback, support and questions!

Comments for this strategy are now closed. To continue the discussion, please use our Forex Forum, where you can create a new discussion topic.

Please follow the topic at:

http://forums.forex-strategies-revealed.com/advanced-strategy-the-midnig...

Thank you for your feedbcak, guys!

I'm aware of the risks, but please don't forget that we're dealing with daily candlesticks and here we cannot use those comfortable 20-30 pips stops, it just wouldn't work.

One more rule regarding stops: if in a trend we meet a really tall candlestick - the market exploded in one direction - is it highly recommended the next day to put your stop loss to 50% of the length of this tall candle rather than keeping a stop far behind. If you had two orders running or can do partial closing of positions, take some profits out and let the rest run.

Best regards,

Edward

It is a game of risks, although myself I don't like this much.

If we risk little = set tight stops = we get no expected rewards, just a small loss after a small loss. If we risk more = we risk to lose more. What is your pick?

I'm trading with Edward's rules so far so good, but it is still on paper.

Altt

Firstly, Great Site, excellent information.

I have been playing round with this strategy on demo account, have found that if the take profit is set at 50 points for Gbp/usd, and 35 for Eur/usd you will profit nearly every day, this is without monitoring the open trades at all, if you had time and trailed the profit or set the Take Profit a bit bigger there would be more points made. This level of profit gets hit alot anyway ( 50 & 35 ). Some days there will be no trades as the price doesnt move outside the previous days candle. Also I have been using 10 points outside the daily candles to set the entry orders, found this is a bit better for not getting hit unless a genuine move is underway (it was 5 points in the original rules) In the last 10 days on Gbp/usd I have seen successful 300 points, and 150 on Eur/usd.

Found the 100 TP level a bit much for this strategy, and get stopped out more.

The problem is the stop loss is very wide being at the high / low of the previous days candle as stated in the original rules. If it came to hitting the stop you would lose 150-200 points, maybe more depending on the size of previous daily candle. Big loss. Havent been stopped out yet, came close on Eur/usd, but came back into profit, 35 pips the following day. So the risk / reward ratio is not good... Well, thats it, anyone have any comments...etc.

Dodgy

Hi Edward,

My name is Paul

I modified this sytem a little bit and below are the rules:

- I sell on breaks, but the SL is 20 pips behind the Pivot level.

- I reload the position on everyday after and lower the stop to the priviuos day 20 pips above Pivot.

- I only trade if the price closed above daily pivot (BUY), below daily pivot (SELL)

This rules will eliminate the bad trades and limit the loses.

Hi edward, awesome strategy. i have been looking at this strategy for a while now and i think i have found a different way of doing things but still using your ideas. could you please look at my idea and let me know what you think.

.instead of looking at 12am to 12am look at 8 am to 8am

.at 8am put the buy and sell orders at the high and low of that day [12am to 8am

.if you are in profit by 12am put a stop loss in place so you are safe while sleeping. havnt decided where to put stop loss yet.either at previous pivot point or from the highest or lowest point from 6pm onwards.

.once you wake up at 8am move your stop loss [from 12am]to the highest or lowest point from 12am to 8am

love to know what you think

matt [kattming(at)hotmail.com]

For those who do not feel comfortable for using an EA. Here is an indicator which shows the buy/sell stop price, stop loss and take profit.

midnight_gu_1.mq4

midnight_gu.ex4

"This strategy is ignoring the most important trading rule. Run your profits and cut your losses. This is cutting the profits instead of running. This strategy is completely based on Trend so it should cash in the complete trend as much as possible. The take profit should not be used and just move the stop loss to the previous day low. That would give better results."

You will find what you said is not correct if you do some backtest. Trailing stop loss is usually not as good as a hard stop loss, unless the trend is extremely strong with very little noise.

dogberry

I have been testing this over the last one month and it had decent success. The worst thing I observed is some trades are ending up in losses even they were in around 50-70 profit. I think we should move the stop loss to break once the trade goes to some minimum profit target. Moving to break even with very little profit will kill everything. It should be around 70-100 pips, move the stop loss and run your profit.

This strategy is ignoring the most important trading rule. Run your profits and cut your losses. This is cutting the profits instead of running. This strategy is completely based on Trend so it should cash in the complete trend as much as possible. The take profit should not be used and just move the stop loss to the previous day low. That would give better results.

Thank you, Edwin

I saved this some time ago:

Currencies Average daily range

Take about 1/2 of the range to get a value of minimum pips required.

Keep in mind that some volatile months will differ from other quiet months, so it will always be an approximate value. I came up with 90 pips for GBPUSD after an extended period of tests, so, after you take 1/2 of the daily average range, look back at historical data and adjust the value if needed.

Regards,

Edward

hi Edward

Thanks for the brilliant strategy. But understand that this strategy can also be used for other pairs. Can you advise how can we determine the minimum daily pips of other pairs before we can setup the trade?

Edwin

Thank you, dogberry2009

Regards,

Edward

Hi, Edward,

I have posted my EA here. I am pretty busy at moment. I will read your post more carefully and answer your questions maybe one or two weeks time later.

However, I can say that, after more testing, I found that your parameter is still the best (100 pips instead of 300 pips taking profit, after one order is closed no new orders should be opened until the coming midnight). If you find the EA is useful, please sponsor me some money. Many thanks!

dogberry2009

//+------------------------------------------------------------------------+

//|Although I believe this EA is working, I cannot guarantee it's bug-free|

//|So please do not use it on your real money. Test |

//|it on a demo account for at least 2 months. Please report any bugs to |

//|dogberry2009(at)live.co.uk. If you find this EA is useful, please donate |

//|some money via my paypal account at dogberry2009(at)live.co.uk so that I |

//|can develop the rest EAs on this site. Thanks! |

//| |

//| How to use it. Make sure this EA is enabled between 00:00am and 01:00am|

//| at your MetaTrader's time. For example, for Alpari UK, it's 11:00pm UK |

//| time. The EA will open 2 orders for you, one is sell, the other buy. |

//| After the orders are |

//| opened, you can either disable the EA or let it run. However, If you |

//| enable EAs' manual confirm and let the EA run, the EA will ask you to |

//| modify the Stop Lose of your orders constantly, which is annoying. |

//| This is because the Variable Spread of your broker. |

//+------------------------------------------------------------------------+

midnight_setup_gu_1.mq4

Post new comment