Advanced system #19 (IKH-HA Strategy)

Submitted by User on August 18, 2011 - 10:40.

Submitted by Gary Sharp

FXPT - SharpForex

IKH-HA STRATEGY

This strategy is based on Ichimoku Kinko Hyo chart trading method, and combined with the ichi360 Monitor and Heiken Ashi candlestick chart method.

Anyone not familiar with Ichimoku Kinko Hyo can visit http://www.kumotrader.com/ichimoku_wiki/index.php?title=Main_Page for a comprehensive introduction.

The ichi360 Monitor can be downloaded at http://www.ichi360.com/?p=1594 free of charge. Other indicators listed below are part of the MT4 package.

If you are not able to spend the whole day at the screen, and want to be able to set-and-forget, the IKH_HA Strategy provides a good solution PROVIDED you also employ the use of a trailing stop.

Timeframe: 4 hour

Currency Pair: Any pair

Risk Factor: 2% of account balance

Stop Loss: Use Kijun Sen +/- ATR/6 buffer for trailing stop

INDICATORS:

Ichimoku Kinko Hyo 9,26,52

Heiken Ashi

Multi Timeframe Indicator - ichi360 Monitor (Download: ichi360_Monitor_V2.zip)

ATR 14

MONEY MANAGEMENT:

Lotsize is determined by money management with risk limited to no more than 2% of account balance per trade. This is achieved by (1) calculating 2% of the account balance, (2) calculating the dollar value between the current price and the Kijun Sen – ATR/6 for a long position or Kijun Sen + ATR/6 for a short position, and (3) dividing 2% of the account balance by the dollar value in (2) above. The result is the number of lots that can be traded without exceeding the 2% risk factor if the stop-loss is hit. The “ATR/6” component adds a buffer to the stop-loss to allow for noise.

CURRENCY PAIR SHORT LISTING:

Once each day, or every 4-hours if you prefer, check the ichi360 Monitor for each currency pair to select suitable currency pairs for short listing. This is a step that MUST be performed before a currency pair can be considered for trading, and helps eliminate bad trades. The ichi360 Monitor MUST be 80% positive (13 or more up arrows) or 80% negative (13 or more down arrows) for a currency pair to be added to the short list.

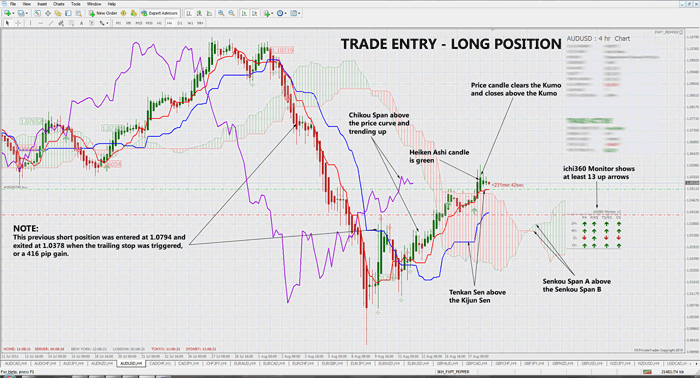

TRADE ENTRY – LONG POSITION:

· Price candle MUST completely clear top of the Kumo and close above the Kumo;

· Tenkan Sen cross up above Kijun Sen;

· Chikou Span MUST be above the price curve and trending upwards;

· Senkou Span A cross up above Senkou Span B; and

· Heiken Ashi candle MUST be green.

TRADE ENTRY – SHORT POSITION:

· Price candle MUST completely clear bottom of the Kumo and close below the Kumo;

· Tenkan Sen cross down below Kijun Sen;

· Chikou Span MUST be below the price curve and trending downwards;

· Senkou Span A cross down below Senkou Span B; and

· Heiken Ashi candle MUST be red.

EXIT STRATEGY:

This is essentially a trend-trading strategy so whilst we want to cut losses short, we also want to allow profitable trades to run to their maximum potential. Exit is achieved in one of two ways:

· Trailing stop trigger, or

· Tenkan Sen / Kijun Sen cross in the opposite direction of the trade.

The following screen shot shows all the criteria that must be met in order to enter a long position. It also shows the results of a previous short trade that resulted in a 416 pip gain.

Ichimoku Kinko Hyo can appear to be complex and intimidating to those not familiar with this highly reliable charting system, but in reality it is an incredibly easy method to master. Once you become familiar with this method you may wonder how you managed trade without.

Cheers,

Gary Sharp

FXPT - SharpForex

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hi Gary,

fantastic simple strategy! Congrats mate. I just love it! One question regarding the Ich 360Monitor: with 80% up or downtrend I only get 9 arrows max. Something wrong with it? Hopefully not.

Thnks, all the best, Kimo

To get the Ich360MonitorV2 to display nicely on MT4, do the following once you have pasted it into your Experts > Indicators Folder and restarted your MT4 platform.

Maximise a chart.

Insert Ich360monitor indicator with the following inputs:

TextOffSetfromRight = 25

TextOffsetfromTop = 400

Job Done.

If that is not sitting nicely on your chart, just play around with the Offset numbers.

Do I need to use ichi360? How much would it affect the results if I were not to use it. Also, is there any other standard/mt4 indicators or anything I can do that would replace the ichi360 indicator?

thanks

Hi Great one

Can you help me please , do you meant ATR/6 is ATR with period 6 or it is ATR (14) / 6 (divided by 6) thanks!

just, opened some positions 'user', will update you soon

just wondering how profitable everyone has found this to be?

Can you help me please , do you meant ATR/6 is ATR with period 6 or it is ATR (14) / 6 (divided by 6) thanks!

User, I like Ichi as well.

Yes, you tend to NOT trade as much as you're now a more patient & disciplined trader than most...awaiting ONLY the very best setups. Traders today trade like its a game, gamble and have poor RR management...most traders fail and their personal lives suck as a result. No wife, no kids, no dog, no fun (lol). Once you figure out cloud trading, you'll regain control, have far less screen time AND actually get your life back into balance. I can attest to the fact that Asian traders, predominantly the origin of Ichimoku Kinko Kyo, are patient, disciplined and typically very technical in trading. Additionally MANY, MANY Asian banks use Ichi exclusively as they know that ONLY the biggest waves provide the smoothest and tastiest rides to profit. Hang Ten bro ;)

~ Mongo

is it possible to get the multi tf indicator in different timeframes? i would ideally like it to analyse 15min 30min 1 hr and 4 hr rather than the current 4 timeframes... thanks very much!

Re display of ichi360. It wasnt displaying, then I discovered, because of the default position of the indicator I have to maximise the chart window in order to see it. Hope this helps some people

I would not suggest you trade below 4 hrs because it becomes very inacurate.

can i trade the IKH-HA strategy with other TF such 5mins,15mins or 30mins?

Wow, User, you are all over the place !

Ichimoku

X-Scalper

Scalping 1 min. EU

Are you twins or triplites ?

Stuart

and Slingshot.

can you tell me more about your method ....

Other than a few longer-term trades, no significant trading activity past week to date, sorry! My wife was recently diagnosed with Breast Cancer and the past week or so has involved many trips between home and the hospital...more surgery next Wednesday, and she takes priority. Expecting a good outcome, although Chemo will be a challenge.

I do have some small open trades in Silver, Gold, EURAUD, EURCAD, EURJPY, EURUSD, USDCHF, and NZDUSD controlled by my Money Management EA, and these are up around 30% to date. Will update soon.

Post new comment