Advanced system #18 (Trend lines + WMA swing strategy)

Submitted by User on December 12, 2010 - 18:17.

Submitted by Hessel

Currency: EUR/USD

Time Frame: 3 hours

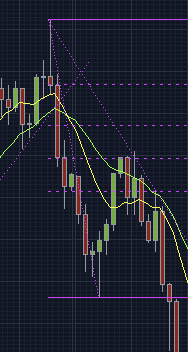

This (swing) strategy uses trend lines in combination with WMA 21 and WMA 11.

A good knowledge on how to draw trend lines is required for this system to work successfully.

I think this strategy is best explained by some pictures:

As you see, I connect lows, bottoms in a uptrend and highs, resistances in a downtrend. I prefer trend lines that connect at least 3 lows/highs.

When a trend line is broken, a change in trend is likely to occur. But we only enter the market when the WMA's cross on almost (may take a few candles) the same time as price breaks the trend line.

Patience is very important when using this strategy, waiting for the WMA's to cross prevents traders from trading a false breakout.

When you opened a position, it may occur that price action moves the other way. Don't worry, this is just a pullback, and it will make a lower high or a higher low!

If you don't feel comfortable with this, you can enter the market during this pullback using Fibonacci Retracement. When a trend line is broken, price often moves aggressively in the opposite direction, so a retrace to the 23,6 or 38,2 Fibonacci Retracement would provide a very reliable entry (trend has changed, WMA's crossed, retracement made a higher low or lower high!).

Once again, a picture to make it more clear:

When you're short, exit the market when price makes a higher low, breaks trend line or WMA's cross.

When you're long, exit the market when price makes a lower high, breaks trend line or WMA's cross.

Can't really help you with providing a useful stop loss. I watch the market every 3 hours and simply don't use stop losses. The last high or low would be a good stop loss, but this could easily be 80 pips away!

You could use RSI 18 or 20 to determine when to exit the market too. Help would be welcome here!

Remember, patience is important, wait for the trend line to be broken AND the WMA's to cross. Or, when you want to take less risk, wait for a pullback to 23,6 of 38,2 Fibo Retracement and then enter the market. I like this strategy very much because you don't have to monitor your computer whole day long. I just check my charts once in 3 or 6 hours. This strategy is excellent for swing traders.

Good luck!

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hello Edward.

you say you do not use stop loss. why not?

Seems the best combinations range from 31-38 for small MA and 36-44 for large MA for both buy and sell signals. ATM, I'm using 36 and 37 on a 30 min with 35 and 42 on 1 hour for confirmation. So so far have had 20% return in 2 days. Re-calculating every day for best combination as the data does not go back further than about a month for the 1 hour and 30 min charts.

- Frogztar

Hi Guys,

I ran a backtest for MA's on a 3 hour chart using data from 26 June to today. Variables I tested were from the ranges 1-100 for the small, 1-300 for the large. This was buying only on the EURUSD. The most effective combination for the 3 hour is 34 for the small MA, 42 for the large MA. This yields a result of 80% winning trades, average 72.7098 pips per trade, max est. drawdown (for the acct size, stops and entry sizes I chose) was 270. Return on capital was 290% for about a month using buy signals only and risking 10% per trade.

I will backtest using sell orders too, risking 2% per trade and a 1 hour chart.

Will post results as soon as they are computed (can take a while) - Hope these help.

Let me know if you think any other strategy is worth backtesting.

- Frogztar

Thank you Winny,

I do apologize for the delay. Sometimes it takes me a few days to answer, but when it gets terribly busy I might not be available for a while, yet I keep track of every single comment on the site.

Yes, those strategies still work. They are built on principles that won't become obsolete with time.

I don't think there are any strategies (these or any other besides those) that would be considered as a "hot trend".

Traders choose different methods to trade. Sometimes, however, if we talk about commercial EA Forex systems, they can take over the trading audience if properly presented and if they, of course, show any profit potentials. Then this can create a "hot trend".

The advertisement should be treated as advertisement. I don't trade with automated signals or third party signals, and I haven't used their services to provide a feedback.

Kind regards,

Edward

Thanks Edward.. i was looking everyday and hoping you would answer.. actually today i lost hope but still i had look ..and thank god you answered.. i have seen these strategy before and i am working on them on a demo to get to know them better.. Are these strategy still working? I mean cant you make an update on what you would say is hot at the moment?

Again thanks for the answer.. and you changed my trading for ever and i want to thank you for that .. Edward..may god bless you and your family....

Edward one more thing the company's making advisement on your website would you say that they are waterproof because they look a little bit fishy to me .. or are they just making advertisement and you haven't checked them out..?

Sincerely

Winny

Hi Winny,

I think the best answer to your first question will be found on this page, where I mentioned several favorite strategies, which you can also start trading with:

http://forums.forex-strategies-revealed.com/advanced-strategy-the-midnig...

Best regards,

Edward

allright edward.. i am sorry but i thought nobody is here to answer anymore.. i know what you mean ...

hope you will answer me soon...

I also wrote you to your email....

SIncerly

Winny.. i will give a scalping straregy soon to you . hope you will like it

Winny,

I'll be able to get to your comments shortly. I'm answering as many as I can per day.

But when I can't, it may take up to 2 weeks to receive a reply... it's too much work these days besides Forex trading, sorry. Thank you for your understanding!

Kind regards,

Edward

is this forum still in use? or why is nobody answering me .. helooooo edward or anybody from the team ??

winny

Iam not Edward , but youre asking for something which no system will give you out of the box , no system can promise you antyhing except losses. There is no shortcut to get constant profits,no seminar, no "trendmaster 3000" indicator, no Guru. What you need is screentime,screentime,screentime. Also you need to learn how the markets and specially the market makers work , most of the brokers, specially those who only operate in spot markets are pure bucketshops, they dont realy trade at any market its just a videogame, no matter what they promise avoid them at all cost.

Dont trade start trading countertrend strats, at least as long as you arent fully sure what youre doing, better look for a trend , or better descibed a wave which takes out latest LL or HH in the opposite direction , then wait for retracemnet , then for the pullback in trenddirection , trade that pullback. Sorry my english is bad and i cant realy well describe this but you can see that on the pics of this strategy several times.

Place the stop at the latest swing , take half profit at half SL(thats for the case its a falsy) , rest break even and adjust SL every swing , TF doesnt matter it works on all TF´s and every instrument you can put on the chart .

Its surely not a holy grail you will have losses and it needs a lot screentime to spot good setups, but its the only thing which i have ever seen working(for retail traders) at someone who is living of trading.

Edward could you please answer my questions ? please x 100000000000000000

Dear Edward.. i wonder if you could answer my question which i mentioned above??

Sincerly

Winny

Dear Edward,

I am trading since 1/2 years.. and i made only losses so far.. I must admit that i got fooled by so called ibs and forex schools who were just teaching crap to rip us off.

I think your website is great and i know you have heard this now a hundred times.. but i have read now almost every strategy..and i am a bit confused which one to choose!

I am not looking for big profits maybe something in between 5% to 10%.. but 5% would satisfy me completely in a month.. with a money management not to risk more than 1% in a trade. I am interested a lot in daily strategies but also 4 hour strategies...can you tell me which strategies you would advise for the daily trading most of which one you use yourself.. and which strategies you would choose for trading inter day.. and also for scalping.. how you would mix strategies to ac heave a 5% profit per month..

Thanks again for the great site . may the spirits bless you brother!

Winny

Do you have an email where i can contact you ? mine is [email protected]

HOpe to hear from you soon

Mhh i dont know, either it gives a falls break out even with filtering through the wma cross, or your in the trade to late,not that i qouldnt have any winning trades but its roughly BE after a month of demo trading. I tested it on EUR/USD 3h only

its a goog trading system

Post new comment