Advanced system #4-a (London GBPJPY breakout)

Submitted by Edward Revy on March 2, 2009 - 16:24.

Submitted by Stuart Williamson

This strategy is based on the London Market.

Currency Pair: GBPJPY

Timeframe: 1 hour

Strategy:

Before London opens, at 08:00 GMT, mark the High and Low of the last 4 hours - from 04:00 until 07:59 GMT. Set your Buy and Sell orders 10 pips away from those highs and lows.

I set my TP to 100 pips, excluding spread, and have a trailing Stop Loss, and take which ever comes first? My trailing stop is set at the previous hours high, and follows every hour.

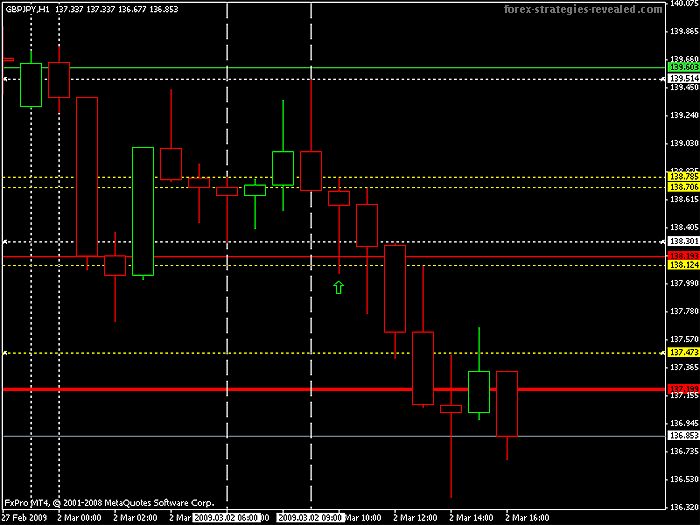

On the image:

The white lines are the highs and lows

The Yellow lines are the trailing Stop Loss

The green is my buy order

The red line is my sell order, which was triggered

The thick red line is my TP of 100 pips which was hit.

All depending on your money management, this can work due to the pairs large moves.

Any additional tips will be greatly appreciated.

Happy Trading,

Stuart Williamson,

Belgium

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

I was interested to learn this strategy, perhaps there is a breakout strategy technik about london?

HI Edward, what do you think if i use this method, but refine the TP and SL to 30pips each for EURUSD. Am thinking that i could leverage on the huge movement at london open to make a quick kill. Since the SL is relative some, I could be trading more lots instead of trying to get the 100pips? I'm quite new to forex, what do you think?

Regards,

Gary

Hi Dave,

The first is ideally an OCO order, if your trading platform supports it, otherwise, you'll need to cancel the opposite order manually as soon as one of them is triggered.

The trailing stop in this case is manual, because you want to move the stop behind the last hourly candle, while the length of each new candle will be different, thus a fixed step (distance in pips) for the trailing stop won't do the trick.

Best regards,

Edward

hey stuart or edward.

another great strategy from stuart!!....ok..i am new ..and so still working thru some basics.......i wonder..1) do you put in a oco...or have it cancel the other side automatically...or do you watch the trade and cancel it yourself???and also

2)i have not worked with trailing stops yet.......do you do that manually as well...or is it set with an automatic trailing stop??

thanks again

dave in virginia

Great stuff, Pantilis!

Thanks a lot for sharing your feedback and modification rules.

That's the kind of feedback we need to keep this strategies improving.

Cheers,

Thomas

Hi everybody,

I made some adjustments to your system. I use 5 min chart with Accelerator/Decelerator and Awesome oscillator.I also use MACD(20,50,5) to see the overall trend,and EMA50 which is a great support and resistance in the 5 min chart. Usually from 7:30 to 8:30 and from 12:30 to 13:30, the GBPJPY pair has the 2 major breakouts from 80 to 220 pips and some times more. When the market movement is going down watch for a big candlestick below the 50 EMA. Then the downtrend has start for sure. The uptrend is slower and needs more time. The downtrend is more fast. I use the 5 min chart because you loose a lot of pips with the 30 min chart. Even after a downtrend the market is moving up, a lot of times the price candlesticks don't brake the 50 EMA so the downtrend will continue. Always check for a downtrend breakout the MACD to be below 0, or above 0 for an uptrend.

You may check my system and let me know your opinion.

Best Regards,

Pantelis

Hi,

first of all, thanks a lot for the feedback. It means a lot to me and my team.

It makes sense to start an hour earlier to trade with Frankfurt opening. Definitely should be tried.

I would refer 150 pips to the average daily range here (for GBPJPY). It is a round number, but very reasonable and based on the historical volatility of the pair.

If the average daily range is less than 150 pips, it wouldn't be right to hope to capture 100 pips on the breakout, somewhere around 70 pips is possible, while going for more will simply not reach the target.

Best regards,

Edward

Hi everyone - this is my first post, so I'll try to keep my questions concise!

Re the times for breakout - with Frankfurt opening at 7am GMT (and a good number of moves driven from this), would it perhaps be more effective to study the 3AM to 7AM bars in order to capture the early breakout?

Re the comments on Daily Range: 150 pips seems like quite a round number, are there backtest results to support this? Is this looking at average daily range, or previous days range?

Finally, I must offer my sincere thanks to Edward for this site. It's amazing! I spent thousands with a 'professional' training company to learn about 3 strategies (that are almost useless in this ranging market) and learned more on here for free than I learned on the course!

the strategy only works if the daily range is more than 150pips. Below that, it will whipsaw hard. November and Dec seems the daily range is below 150pips. Use it again once the range picks up

We should adjust the hours.

As Edward says, breakout strategies use to lose their effectiveness over the time, and while the methodology leaves, the hours need adjustments.

Thomas

Hi,

I agree that the strategy is no longer reliable and the losses can be huge if the trade goes against you.

Hello,

This strategy doesn't seem to be working any more. I back tested recent weeks and most of the trades have failed. Do you still use this strategy?

thanks

Sam

Hi Edward

This strategy should hold good for any currency is'nt it? i am very new to forex and i am still testing this strategy . You got a great well done

Aryan

Hi Aryan,

yes, I would try it on other pairs too.

Regards,

Edward

Post new comment