Advanced system #3 (Neat entry: RSI + Full Stochastic)

Submitted by Edward Revy on May 13, 2007 - 15:40.

Current strategy has won the hearts of many Forex traders. And why not when it has a great winning potential.

Strategy requirements/setup:

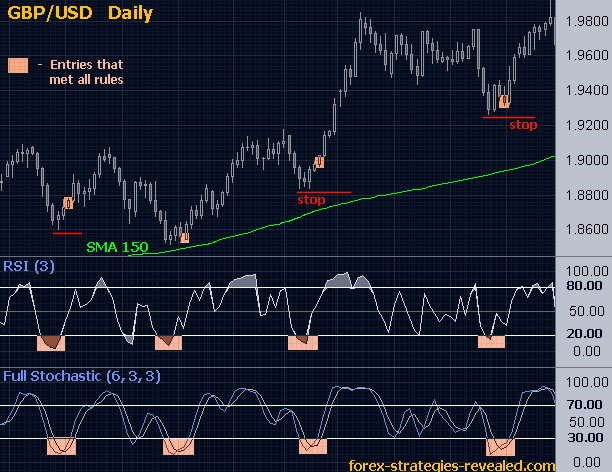

Time frame: daily

Currency pair: any

Trading setup: SMA 150,

RSI (3) with horizontal lines at 80 and 20,

Full Stochastic (6, 3, 3) with horizontal lines at 70 and 30.

Trading rules:

Entry for uptrend: when the price is above 150 SMA look for RSI to plunge below 20. Then look at Stochastic - once the Stochastic lines crossover occur and it is (must be) below 30 - enter Long with a new price bar.

If at least one of the conditions is not met - stay out.

Opposite for downtrend: when the price is below 150 SMA wait for the RSI to go above 80. Then if shortly after you see a Stochastic lines crossover above 70 - enter Short.

Protective stop is placed at the moment of entry and is adjusted to the most recent swing high/low.

Profits are going to be taken next way:

Option 1 - using Stochastic - with the first Stochastic lines cross above 70 (for uptrend) / below 30 (for downtrend).

Option 2 - using a trailing stop - for an uptrend a trailing stop is activated for the first time when Stochastic reaches 70. A trailing stop is placed below the previous bar's lowest price and is moved with each new price bar.

This strategy allows to accurately pin-point good entries with sound money management - risks/protective stops are very tight and potential profits are high.

Current trading strategy can be improved when it comes to defining the best exits. For example, once in trade traders may also try applying Fibonacci studying to the most recent swings. This way they can predict short-term retracements and make sure they will not be pulled out of the trade early and will continue pursuing profit targets at Fibonacci extension levels.

Profitable Forex trading to everyone!

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

We'd like to thank you everyone for your feedback, support and questions!

Comments for this strategy are now closed. To continue discussion, please use our Forex Forum, where you can create a new discussion topic.

Please follow the topic at:

http://forums.forex-strategies-revealed.com/advanced-system-neat-entry-t...

It would be nice to close this thread and let the other, in the newer forum, be more active. Two places to comment this great strategy can be confusing and the newer forum works in a better way.

http://forums.forex-strategies-revealed.com/advanced-system-neat-entry-t...

________________

Haydel

Chris,

As you can see in the GBP/USD Daily charts, price is above SMA150, so there we have the buy filter.

Then, the 28th, RSI was below 20, that gave the first signal.

Then, the 29th, Full Stochastic crossed below 30, giving the final signal to BUY at the close of that bar. As Edward mentioned before, at that point it doesn't matter if RSI is above 20, the signal was there just one day before, I have a limit of three days between those signals to consider them valid, this was only one day apart so I consider it a very good signal.

The price reached to more than 140 pips on the 31st starting from the buying price at the closing the 29th bar where the BUY signal fired.

I would like to Upload the chart but for some reason I can't.

Regards,

________________

Haydel

Doesn't the 2nd rule require the RSI to drop below 20 (for a buy signal)?

This has not happened yet.......

Chris

Hi Haydel,

at the moment the uploading is not working, and it's a bit frustrating. So all images should be either sent to my email or uploaded to free file sharing sites...

Reagrds,

Edward

For some reason I can’t Upload images to this forum to be able to show you my GBP/USD chart. I click on the "Upload a file or image" link below and all I see is a white space.

Anyway, according to the rules of this strategy, there is a clear LONG opportunity on GBP/USD right now.

Happy Trading.

____________

Haydel

It's then going to be a false entry, nothing to do about it, except that there is a one not so commonly known, but yet very useful and interesting rule: when Stochastic stays for a long time in an oversold/overbought zone, the following move/wave is expected to be very shallow.

Regards,

Edward

Good system. I have a question though. There are times when both rsi and stochastics will remain in the overbought or oversold areas for extended periods of time. Stochastics crossover may take place but its a 'fake' one if i may say. What do you do in such a scenario. Thanks. Please post more strategies, this is one of the best i've seen on the site.

Hi Larry,

It's a valid setup.

RSI needs to visit an overbought zone (above 80) only once, after that you consider it "done" and move on to Stochastic. At that time RSI may revisit above 80 (or fall short close to 80), but that doesn't matter, as we had the first signal from RSI already and it stays effective.

Kind regards,

Edward

Hello

Good little system.

One question. If looking for a short trade and the rsi goes above 80 then comes back down again then back up but not all the way past 80 and the stochastic makes its cross down, is this an entry? Or does the rsi have to go above 80 and come down in a straight line?

It's a bit hard to explain. See EUR/CHF 8-3-2011

Cheers

Larry

Hi SB,

9 EMA simply helps to pin-point a better entry. It's very useful, but should be treated only as an additional Entry helper so to speak.

Once you're in a trade, you focus on the original system rules, and put aside 9 EMA method until next time when you need a help with a new entry.

Kind regards,

Edward

Post new comment