Exit strategy #6 (Tight stop timing with CCI)

Submitted by Edward Revy on September 29, 2009 - 16:56.

Today's challenge: how to exit a trade in time without leaving much on the table.

Today's system: reveals how to use CCI indicator to know where to pull the trigger and launch aggressive price chasing.

The idea is actually pretty simple, like all good ideas: we need to figure out when price gets "carried away" in a rapidly developing momentum and from that point we'll be looking to aggressively protect our gains while giving the market a chance to progress till it runs out of steam and inevitably reverses.

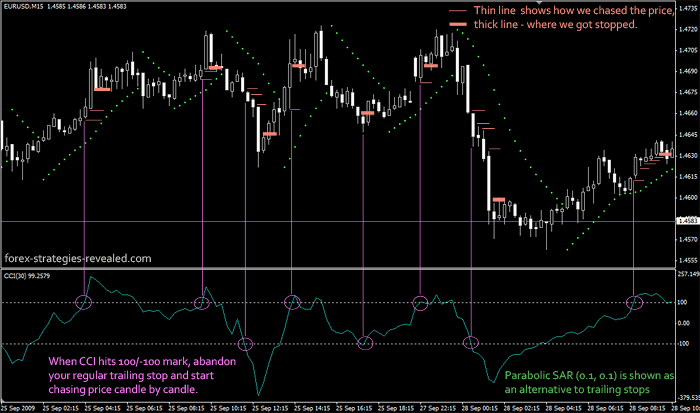

To illustrate the strategy I've chosen 15 min EURUSD and 30 CCI.

For other pairs and other time frames, you can figure out the settings quite easily with a few minutes observation; there is no golden rule, just your perception of the market. I encourage you to experiment! If you find a good combination, share it with other trader here.

Back to the point now:

On the screen shot below let's first take a look at Parabolic SAR (0.1, 0.1). In this example it represents a regular trailing stop trading: a trader simply places a trailing stop behind each new SAR dot, until finally the stop is hit.

Now we move to CCI.

We are interested in CCI when it goes above 100 (overbought) and below -100 (oversold). Before that we happily trail our stop with whatever indicator we have, in our example it is a Parabolic SAR.

So, after opening a trading position we are trailing our stop with SAR indicator, but then later there is a signal from CCI -> CCI hits 100/-100 mark. We react to it by abandoning our old trailing stop method/indicator and instead introducing a candle by candle trailing as illustrated on the screen shot above. Circled in purple are the moments when we switch from trailing stops by SAR to trailing stops by candlesticks (e.g. behind each newly closed candlestick). We do so candle by candle till we get stopped out.

That's it. We get stopped. There will be a new trade, another stop trailing until CCI signals that its time to limit risks and protect profits if any.

This exit strategy prevents emotional trading, stop guessing and other fears related to protecting profits while letting a trade run. It shows how to control the situation when market accelerates and/or prepares to reverse.

Happy trading!

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hi

Has anyone used this exit strategy on 4hr timeframe? Or What are the best CCI settings to use on 4hr?

Thanks

MZ

I'm not clear about the candle exit. Are you saying that if short:

1. You exit if the high of the last candlestick is taken out, or

2. You exit if the close of the bar is higher than the open?

Thanks

JD

Hi Eveybody,Edward, and our programmer.

Thank you all for sharing your findings with us, well done, impressive.

However I was wondering If anybody knows of an EA, or a Trademager program that can use PSAR for automatic exit as a stop-loss?

Cheers.

Hi all,

CCI is an indicator that shows overbought and oversold conditions in all the market situations. When it comes to live market it works in range bounding markets only and it does nt work in trendy markets.

Regards,

Dinesh.Pothana

Nice Team work. Wish u all the best.

Best Regards,

Rams

hi thanks for u r information can i use it on 5 min time frame

Wonderful job!

Thank you for the detailed informative report and commentaries. It was very interesting to study, and we have nice results!

Kind regards,

Edward

Careful readers will realize that Edward did not describe any entry strategy. He is just suggesting that his CCI triggered trailing stop loss can be used to exit any trade. I've backtested his exit routine on trade strategies that use CCI entries, Moving Average entries, and Bollinger Band entries. His CCI triggered stop loss can improve profits on all of these that I have tested.

Traders should learn to experiment constantly with exit strategies, and it's OK to employ several exit strategies in parallel. If you are a TradeStation user and can write programs, you should become familiar with the "Exit Efficiency" chart found in the strategy performance report.

OK, I coded this in TradeStation EasyLanguage and backtested it over 1 year of EURUSD. I tried two different CCI entry methods, one where entry is triggered when CCI crosses Overbought and Oversold. I also tried a Fast/Slow CCI crossover entry. I used Parabolic SAR as the standard exit. Then I added the CCI triggered exit described by ctlprogrammer.

I generally optimize my strategies to produce the best Van Tharp expectancy, rather than the highest net profit. That gives better prediction of real trading results. I also write my code in such a way that I can optimize input parameters separately for entering and exiting trades long or short. Therefore, I usually end up with at least 4 different sets of input parameters:

1) Long entry parameters

2) Short entry parameters

3) Long exit parameters

4) Short exit parameters

I test with a starting account balance of $5000.

All trades are limited to 50,000 units.

Commission is $2.77 for each side of the trade, $5.54 roundtrip.

Slippage is .00025

Start/End Date: 7/4/2010 - 7/6/2011

Chart Interval: 1 hour

In these tests, I found the following results:

1) CCI Overbought/Oversold entry with Parabolic SAR exit trigger:

Select Total Net Profit = $13,475

Select Profit Factor, All = 1.34

2) CCI Overbought/Oversold entry with Parabolic SAR exit trigger AND CCI triggered exit:

Select Total Net Profit = $ 15,717

Select Profit Factor, All = 1.41

3) CCI Crossover entry with Parabolic SAR exit trigger:

Select Total Net Profit = $ 9,789

Select Profit Factor, All = 1.22

4) CCI Crossover entry with Parabolic SAR exit trigger AND CCI triggered exit:

Select Total Net Profit = $11,555

Select Profit Factor, All = 1.27

My conclusion is that the exit strategy proposed by Edward increase profits about 16%.

Shown below is the EasyLanguage code for the long exit triggered by CCI.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

// Long exit. Initiate trailing stop when CCI crosses above overbought,

// using trailing stop target price of lowest low of x bars back as selling price.

// This stop price will trail upwards assuming price continues up, but it's a very tight stop.

inputs:

CCILength( 11 ),

CCIOverBought( 100 ),

SampleLength (5);

variables:

CCIValue( 0 ) ,

ExitOK ( 0 ),

LowestLo (0);

CCIValue = CCI( CCILength ) ;

LowestLo = Lowest(LOW,SampleLength);

if CCIValue crosses above CCIOverBought then begin

ExitOK=1;

end

else begin

ExitOK=0;

end;

if ExitOK=1 then

Sell ("CCI_Lx") all shares next bar at LowestLo stop;

// END OF PROGRAM

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The diligent programmer will see how to recode this strategy to handle exits from a short position.

Out of 397 trades,

242 were exited by the Parallel SAR exit trigger.

44 were exited by the CCI triggered close trailing stop.

111 were exited by buy or sell signals in the opposite direction.

No, we shouldn't close the trade immediately, that's the point of it: we want to squeeze out every possible pip from this trade, so we: start chasing place candle-by-candle by placing a stop below the last closed candle.

This is done until we get stopped out.

Regards,

Edward

Hi,

Though many of you appreciate the strategy, I am not clear about it. According to my understanding we buy/sell when a new SAR signal appears , then check for the CCI. What we have to do after CCI touches 100/-100, we should close the trade?

hi all

my opinion adx better than cci because adx gives the signal very early than cci

Great day,

Thanks Ed for the setup, i used it for 2 ays and neted 10%+

will keep using it.

r

Hi all,

I think that this can be changed a little bit. My idea is : when the CCI crosses (-100) while on an UP TREND, we should enter the market by buying. Same way, when it crosses (100) while on a DOWN TRENT, we should enter the market by selling. Try it and see!

regards

Rajan

Hi Diaa,

the method should work for all currencies and time frames.

Here is an explanation of Parabolic SAR based stops we begin with.

Best regards,

Edward

Post new comment