Money management system #5 (Winning risk : reward ratio)

Submitted by Edward Revy on August 25, 2009 - 02:51.

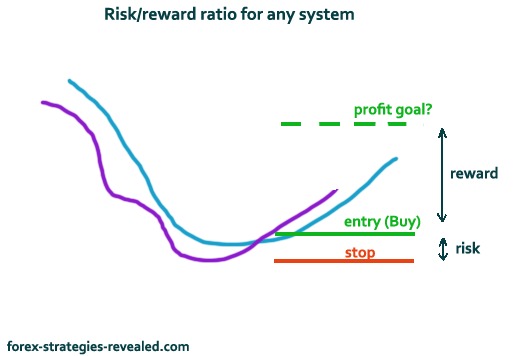

Risk/reward ratio is one the most influential parameters of any Forex system.

A good risk/reward ratio is able to make an unprofitable system profitable, while poor risk/reward ratio can turn a winning setup into a losing strategy.

What is risk/reward ratio?

Risk - simply referred to the amount of assets being put at risk. In Forex it is the distance of our Stop loss level (in pips) multiplied by the number of lots traded. E.g. a stop loss at 50 pips with 2 lots traded would give us a total risk of 100 pips.

Reward - the amount of pips we look to gain in any particular trade - in other words the distance to a Take Profit level.

Example of risk/reward ratio:

100 pips stop vs 200 pips profit goal gives us 1:2 risk/reward.

25 pips stop vs 75 pips profit gives 1:3 risk/reward ratio.

Why consider risk/reward ratio at all?

An average trading system which is able to produce at least 50% of winning signals automatically becomes profitable if its stop and profit targets are set at 1:2 risk/reward ratio or higher.

On the other hand, a trading system which is capable of delivering over 70% of winning signals can still be unprofitable in the long run if it shows poor money management with, for example, 3:1 risk/reward ratio.

Small risk - large reward: a winning formula used by professional traders

How do they do it? Let's review some practical examples:

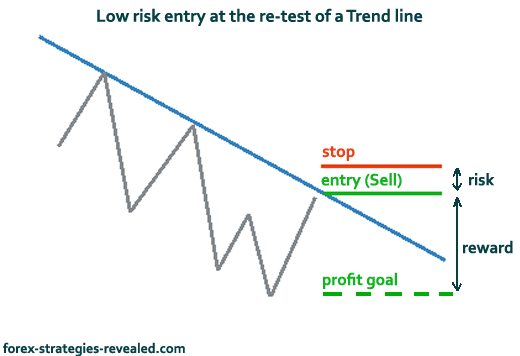

With low risk : high reward entries at the re-test of trend line, experienced trades can allow to be wrong multiple times before pulling out a winner, and still end up in profit.

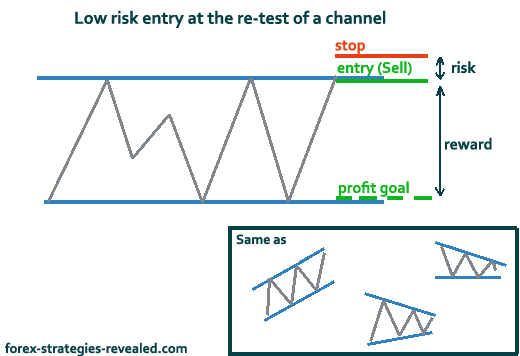

Channeling, range bound markets also offer low risk : high reward trading opportunities. Besides, it is not only about getting in/out of a trade, but also about reviewing previous trends and positioning yourself in the direction of the most likely breakout, and in this way seeking additional profits plus once again eliminating the risk of stops being hit.

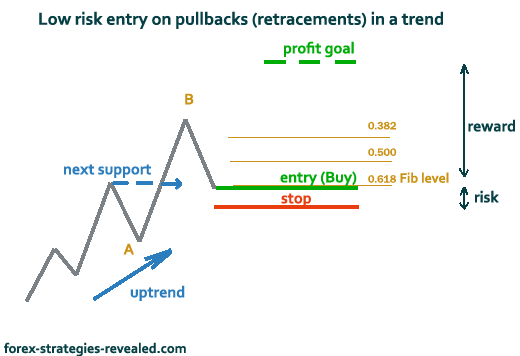

Wave traders like to ride market trends by entering on price retracement levels. These levels can be found using various studies and indicators: Fibonacci levels, support/resistance levels, trend lines, moving averages, which are treated as flexible trend lines, etc. All these studies help to see the points of retracement reversals.

When doing complex analysis of a retracement, special attention is paid to those price levels where two or more studies coincide in place and time with each other.

No matter what trading system you use, if you make sure your risk:reward ratio is set properly, you'll be trading on a profitable side, even when the number of your losing trades is greater than the number of winning trades.

Happy trading!

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

It's the best!

João Alexandre

This risk reward sounds logical on paper but in reality, it seldom works! Because tight SLs get hit quite a lot & quite often. Then they look at this and trade with very tight SL but with ridiculously high TP. All trades need proper room to breathe or you just end up spinning your wheels with tight SL being hit constantly.

almost broker is scam

when you set sl, price always hit sl before hit TP.

Hey, what if we just enter the market randomly for 20 trade using 1:3 ratio. Would that give us profit after the 20th trade?

What would be an example of a low risk entry based on a trend line break?

Hi all, great site, a pleasure to read, many thx for all the knowledge shared!

I'm currently building my own ea in MT4 and I'm implementing this Risk/Reward ideology in some way. But tweaked it with a Martingale ^^.

First of all I want to say I'm a true believer in this system. In the end it's your balance and not your pips count what matters!! Write this line on a post-it and put it somewhere visible on your screen, so you won't forget! Sounds easy but creating a dynamically risk system to implement this, is another story. But after some checking and rechecking in Excel I believe to have found something that might work...

The blue-sky scenario goes as following:

- The system lets the initial trade go with initial lotsize, SL and TP settings (Manual Risk/Reward ratio to be set). SL can also be set to follow PSAR automatically as soon as possible and if the new PSAR stoploss is actually a better one.

- With the previous trade closed and just before entering a new trade, it checks the last trade for profit/loss, starts a win/loss streak counter and adjusts settings accordingly as follows.

-> If a new Win streak starts: set lotsize*2, set SL to profit/2, leave TP to initial (Now you risk losing what you've won with previous trade)

-> If a new Loss streak starts: set losize*2, set SL to loss/2, set TP to loss/2 (Now you risk losing the same amount again, or recover the loss when TP hits)

- Just before entering a new trade, check if win/loss streak continues

-> If Win streak continues: set lotsize*2, set SL to previous SL/2, leave TP to initial (Now you risk losing what you've won with FIRST trade, if this new trade is a another win, profit will be locked)

-> If Loss streak continues: set lotsize*2, set SL to previous SL/2, set TP to totalLoss/multiplier (Now you risk losing the same amount again, or recover the total loss when TP hits)

- Just before entering a new trade, check if win/loss streak has ended

-> If Win streak ends: reset lotsize to initial, reset SL to initial, reset TP to initial, reset Win streak counter (Now you've lost your initial profit, but locked in profits after first win, this requires a Win streak of at least 2 to make profit, but lotsize increases so if jackpot hits it'll be a big one ^^ only risking first/smallest/biggest profit of the win streak

-> If Loss streak ends: reset lotsize to initial, reset SL to initial, reset TP to initial, reset Loss streak counter (Now you've recovered from a considerable loss)

So this system doesn't take alot of risk, adjusts it accordingly and leaves the door open for jackpot wins. Check it in an Excel, the theory works...

I've built it, tested it against 9 years of history in all majors, it makes a (30%profit-70%loss, max winstreak 3-max lossstreak of 11) bad trading system into a profitable one ^^. Even the combined total of the greatest loss streak (11) was far less than the combined profit of the win streak (3).

BUT! The system is NOT waterproof, it has its boundaries and prevent normal execution of the system:

- 1. Lotsize: It can't be doubled forever. So I built in a max streak parameter depending on micro, mini or normal lotsize trading (micro: 10, mini: 7, normal:4)

-> Consequences: Profits or losses will be 'locked' in sooner as the win/loss streak can't continue, the streak will be reset or I can leave it at the highest settings(didn't test that yet)

- 2. Too small SL/TP (error 131). The SL or TP will become too close to the opening price at some point. (checked against the freezelevel). So stoploss will become bigger as calculated, thus risking more, streak will be reset

-> Consequences: Again profits or losses will be locked in sooner. A small positive note to this, the system automatically adjusts to what is actually possible. But makes it very hard to use on smaller time frames. Because less pips profit, less stoploss will be set and so reaches this scenario sooner. That's why I introduced following parameter. Mininum loss to start loss streak. Minimum profit to start win streak. So this system kicks in when it's actually usable.

I'm still building and testing this EA to get it 'professional' enough to leave it to you guys. I won't see anyone using this code already in this stage. But I'll drop it here sooner or later.

Happy balanced risk trading!

Please advice if you discover better tweaks ;)

and keep sharing that 'good' knowledge, it's a win-win! And off course: Greed should be a crime!

If the chart tells you where to enter the market then it would also tell you where to get out. R/R ratio should not be set in stone.

IMHO, the risk/reward ratio is something to be calculated AFTER THE FACT; to describe how good a particular strategy WAS. Sure, you can decide how much to risk, but you do not know what your reward will be before-hand. Therefore, we must MANAGE the trade in progress with our money management system (such as the scaling into the trade method, along with moving stops to break-even, and trailing stops posted in this section).

Thank you,really good material. Thanks so much.

newboy

Hi newboy,

Yes, ATR is known to help with setting volatility relevant stops.

Check out the following page which talks about ATR and ATR based stops is greater details.

Kind regards,

Edward

Hello Edward,

I have difficulty setting my SL and many times get hit then price went back to my initial entry direction.

I learn somewhere that ATR indicator is good tool to use for SL and reward basis i.e. 1X ATR or 2X ATR etc.

Appreciate if you care to explain how to use this ATR to measure SL and TP.

Thank you very much!

newboy

Excellent explanation and example on risk/reward ratio! The graphs allow the info to sink in. Thank you very much!

Hi Mahmoud,

I respect your opinion, but what I've described should be the goal, the strategy to always keep in mind while trading.

While mentioning paper trading, I think you meant that traders won't get an ideal situations every time. That's true, but we learn from simple examples in order to have an idea and a strategy when the market sets another challenge for us.

With practice comes experience and ability to recognise and trade a larger variety of patters and setups.

Best regards,

Edward

Post new comment