Money management system #1 (Lucky 7 - trading sequence)

Submitted by User on July 16, 2009 - 17:37.

Submitted by Dachel Miqueli

Ok guys it's been a while since I don't post anything here, that doesn't mean I haven't been working on something. I have a great system to share that fit my personality perfectly so I want to post it here so you can benefit from it. This is not a system designed by me so all the credit goes to FXTraderpro. I just modify it a little to completely fit with me.

Before you read further I have to say that this is a semi-martingale system were you can have control over your losses instead of losing all your capital like any other martingale systems. The winning risk ratio is 1/2.

Here's the deal:

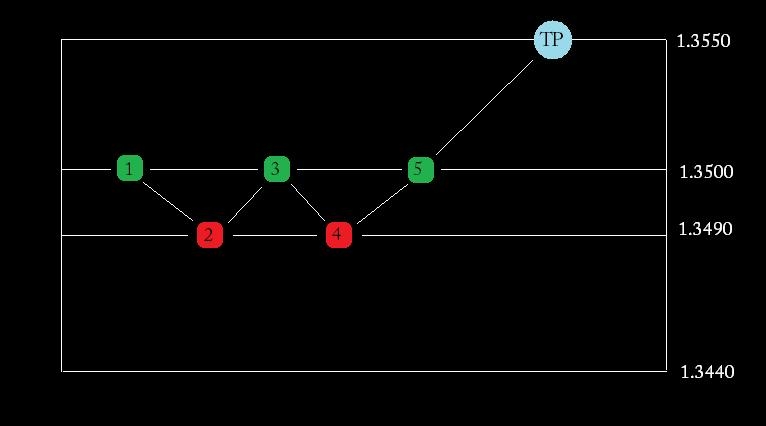

1) We open a trade based upon our Entry criteria. For example, we open a BUY on EURUSD at 1.3500. Our Stop Loss is set to 10 Pips at 1.3490 and our Take Profit is set to 50 Pips at 1.3550. This is called our INITIAL ENTRY in the Sequence.

2) If our Take Profit is hit we then wait for a new Entry Signal and begin again.

3) If our Stop Loss is hit, then our next trade would be a SELL (assuming our first trade was a Buy as above) which we would enter at Market Price as soon as our Stop Loss is triggered. This new Sell position would have the same Take Profit = 50 and Stop Loss = 10 settings as the Initial Entry. This Sequence Of Trades continues each time our Stop Loss is hit, with the resulting trade going in the opposite direction of the previous trade. The Sequence Of Trades is complete whenever a Take Profit is reached.

A Sequence Of Trades means that each time our Stop Loss is hit, the next trade would be:

* In the opposite direction

* The Stop Loss and Take Profit settings would remain the same as

our Initial Entry at TP=50 and SL=10 for all trades in the Sequence.

* The amount of lots vary as the account balance grows or decrease.

I have attached an Excel file to calculate the lots amount for the sequence based on the account balance and the % you wanna risk.

If people are interested enough I will detail my own way to entry and exit, you can use yours of course. And some tips for better timing and the best hours to hunt for an entry. I'm trading this system live for a month already and is just getting better.

Have fun and comment.

Dachel Miqueli

[email protected]

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

I am interested in how can us avoid range, i think in 40 pips range we will blow our account. sometimes we have range after open of London too

i will tats it thank you for system. If anyone has resoults please post it

Hi Dachel,

Thanks interesting MM I will try it with my strategy.

Hi Robert it work fine if u use u r idea at market time.

Is anyone still here following this thread? Is this money management system working, share some results.

Robert

thanks for sharing this money management strategy. Wonderful insight/idea. I had a question but i figured out the answer myself. Thanks a lot for this. I have been trying this reversing of trades but with a risk:reward of 1:1 and i was breaking my head on this. I am going to test this out and see if i can tweak it a bit.

Hi Dachel Miqueli give me u r mail id i want to share some more about this methode.

good system

guys personally i thing its a best method , by getting more technical and not making money is not a success , do it on probability and close profit on time. At end all need money so why we can do this .

This system may be ok for traders who do not understand forex trading or do not want to learn more about forex trading. This system may be more usefull if you play in a casino, however I agree that incorporating modified Martingale system in forex trading can be benefitial.

What is the point of these rediculous systems? If you 'trigger' is actually real, then all you have to do is go in at the optimal bet amount according to the kelly criterion. Yet you have a trigger for going on way, and are then going to ride it the opposite way? Sounds more like when you stop out that you need to get a new trigger!

please advise pair, TF and first entry point method

and what's going on if we trade more than 7 steps?

Hi want to know what are your buy / sell criteria that worked best for you and on what currency/time frames?

Hi Dachel,

I recently stumbled onto this and found the idea interesting because I've dabbled with similar concepts in the past. I currently trade the London opening breakouts mostly but this strategy would be a great compliment to my staple.

I was just wondering, have you actually been using this strategy since the summer of 2009? I'm just curious how your performance has been.

I think the user above's suggestion has some merit but in reality it's all going to depend on your own hit rate because it's possible that you might actually be hitting your targets before getting stopped out 3 times on most days -- and that alone would make your use of this technique fairly profitable.

Post new comment