#1 Range-bound trading (50 SMA angle)

Submitted by Edward Revy on December 17, 2009 - 17:40.

One of the methods to detect a range-bound market is by looking at the angle of the Moving average.

If, for example, our Moving average (MA) is rising fast - the angle of the MA line on the chart will get steeper and steeper.

Already at this early stage we can make a conclusion: if the angle of the Moving average is rising – the trend is getting stronger. If the angle is dropping – the trend is getting weaker.

If the angle of the moving average is insignificant, close to flat or is flat – we know that the market has entered its sideways mode.

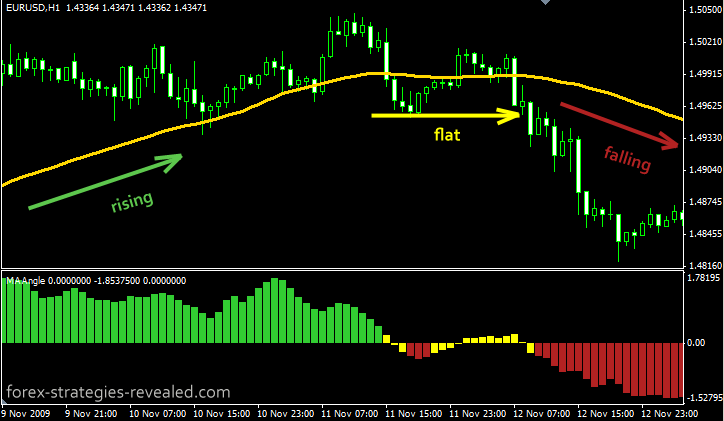

Now lets have a look at 50 SMA (regardless the time frame) and its angle on the chart.

The direction in which moving average is going is not important. the angle at which it rises or falls is what interests us.

First of all, it is a visual guidance – when the Moving average lies horizontally, we know that the trend has paused or non-existent.

But, we don’t stop on just visual evaluation. There is already a tool to help us calculate the numbers/angles for better precision and further confirmation.

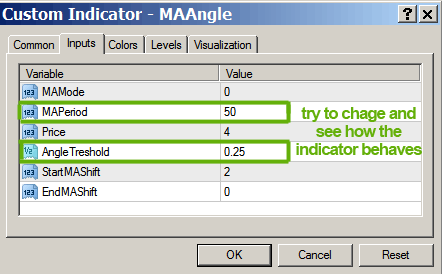

This is a custom MT4 indicator: MAAngle.mq4

It calculates the angle of the Moving average (MA) at any moment and displays it as a histogram. When MA goes completely flat – the indicator is yellow, other times it'll show whether MA is rising or falling and how fast it does so.

But that’s not all. You can change indicator settings, especially Angle Threshold to make histogram more (or less) sensitive to angle changes.

So, this will conclude our first method of detecting ranging markets.

I have many more ideas and methods to share. Stay tuned!

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

This method (50 SMA angle) is equivalent to comparing the current price to the price from 50 candles ago. If it is higher now than 50 candles ago, the SMA50 will have an upward slope; if it is the same price as 50 candles ago, the SMA50 will be flat, etc.) Can prove mathematically that they are the same thing.

Range trading is one area i'm weak at, and I'm looking to strengthen here before even considering a live account.. Thanks for the help man its really appreciated!

Indicator dosent works manus.

Regards

Raghav

Try look this one for detect the healty trends :

http://www.hectortrader.com/coursechapter1.php

Regards;

Manus168

Edward,thank you for all work of your team.You are great guys.

Hi Edward,

It's one of the best site for beginner, so far I've found. Thanks for it. I'm a beginner, doing demo trading for last one month and starting to get positive result only after using few strategies I've found here.

I wonder, whether you'll provide us with the update of Manus168's technique of ATR and standard deviation to spot ranging/trending market. Because spotting market environment is also important.

Jam

fantastic

Thanks for the info.

Hi Babatunde,

both of your questions are too general, anyway the answer can be narrowed down to the following:

a trend is either visible, or there is no trend.

If you open any chart, just zoom it out a bit and what you will see is a direction in which the market is heading (could be UP, could be DOWN, and could be SIDEWAYS). As primitive as it sounds, that the best measure of a trend.

Here, in this range bound trading section, we talk about using various indicators & tools to help us judge about presence/absence of a trend.

If you're looking to find more sophisticated range/trend indicators, try also looking among MT4 custom indicators offered on various Forex forums.

Kind regards,

Edward

Hi Edward,

can i just ask:

1) how can i spot a trending market pls?

2) how can i spot a ranging market.

Could you send a reply to me on babatunde_od()yahoo.co.uk please?

cheers.

Babatunde.

Does the ATR method from Manus still work?

If so, someone should make a combined indicator for this. :)

You won't find such things on this page, because it is a trading method = an idea to work with. Trading methods on this site don't have any specific setups or sets of rules, unlike trading strategies.

Thomas

Post new comment