Scalping system #6 (EMA Bands)

Submitted by User on July 19, 2007 - 18:54.

This scalping system was sent by Frank Tenerife (Spain).

Thank you Frank! You contribution is greatly appreciated!

Here is the system:

"This is an efficient system of scalping that works in 1 minute up to 1 day all periods and all Currency pairs

Ema 3

Ema 5

Ema 7

Ema 9

Ema 11

Ema 13

Color yellow

Read entire post >>>

Well, systematic approach is when you do what system says. Discretionary is when you make decisions on your own. I am mixing both. I am not always open positions when system says so, and I sometimes open positions when system says not yet.

well, long term for me anything longer than few seconds/ minutes:)I am scalping and sometimes day trading.

For break outs you gotta use candlesticks along with ema's. Candlesticks say you the market are moving. EMA's confirm it.

Hours for example. This strategy shows clearly where the trend is going, candlesticks show you where support/ resistance levels. You make your plan according to the information. It is not 100% of course:) but it increases probabilities greatly.

Use previous swing high or low.

which should be the stop in 1 hour charts (eurusd)

Thanks

Joan

Hi please, can you (last user) educated us on ur discretionary approach, hw u combine it wit break outs and what u mean by the long term method ? thx n advance. leo

Yes, the system is really good. it works, but I see that the best way it works is by combining it with discretionary approach. I am consistently making money with this system. The best it works with break outs. Truly good for quick scalp. But works well with longer term approach as well. Someone did a very good job. Thank you Edward and Mr. from Tennerif!

this system is good but ther is a problem that i have seen on a number of occasions when the signal is ther to get in but by the time that has happend it starts reversing or resulting with us either getting in half way through the trend or to late the first set of ema,s are brilliant i use them in my own method but the second set of ema,s dont do the system any favoures. lj

The best time to trade euro/gbp is during the london and US market sessions however knowing how to successfully execute and apply your trading strategy/method is what matters the most.

hello every one

i am mido

plz i wannt to know the best time to trade eur/gbp

Thank you Edward!

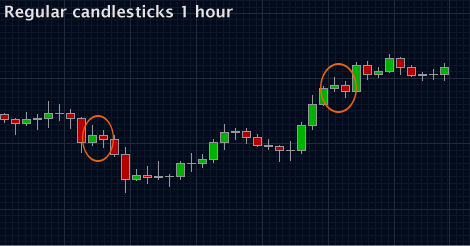

I was watching both candlesticks and I think regular ones are better for scalping. If guys want to hold position heikin-ashi might be better, they are smoothing guys' nerves:)

After trying 5 minutes chats and now trading with 1 minute, 1 minute for scalping works way better with this strategy. I have heard that some guys trade with 5 seconds chats.

That is simple.

Compare two charts with the same price data:

and

Heiking-ashi candles help to see trends better and thus are able to keep traders longer in the trends.

It is also easy to use trailing stops with heikin-ashi candlesticks. One simply need to set a stop below previous heikin-ashi candle (for uptrend), above (for downtrend).

Regards,

Edward

By the way, what is the difference between regular candlesticks and heikin-ashi candlesticks?

I have never used heikin-ashi, but I guess there is no difference. I have used regular candlesticks and understand their behavior you can probably do the same with heikin ashi. I think candlesticks generally, when you really can read them is the best of additional filters and of course pay attention to support/resistance levels. Do do not long/short according to this strategy if you are around them and trend is going to hit support/ resistance.

Moreover, if the trend was up/down, you made your pips, it retreated then as Edward says when candlestick closes above EMA 3, I still would not go long/short. I am waiting for the trend to show it is still strong and to go beyond previous peak and candlesticks must be showing strong movement, no hesitations here. Generally, practice will help and thinking along the way too. The strategy is really good, but like all tools it require someone to use it properly.

Trade only break outs and trends. No trading in consolidating market.

Thank you everyone for wonderful comments and ideas!

Hi Cornell,

Nothing more to add so far.

...But wait, on the second thought, as I'm editing my own answer now, I think I can add one more entry rule to it.

The rules is about additional entry opportunities.

It goes as follows:

When a trend is steady:

For uptrend it is true when yellow EMAs are above green EMAs, and green EMAs are above 55 red EMA.

Reverse for downtrend.

So, when a trend is steady and running, notice when price starts to retrace. So, if we are in an uptrend, notice when price finds a top and starts to slide down.

Attempt entries withing next 3 retracement bars:

Buy into the breakout above the high of the first retracement bar.

If no such opportunity arise and price moves lower, reset entry to buy the breakout above the second bar. Same for the third, but no further.

Once in a trade, set stop to the low of the most recent bar.

Take profit when price levels up with the top.

Important note: consider entering on a breakout only if there is enough pips to cover the spread plus earn profits on the way up to the top. If there isn't enough pips, skip that candle, wait for a lower one.

The higher the time frame traded with this system, the lesser are probabilities to encounter insufficiency of pips.

Below I took a fragment of the same screenshot from the original post.

Case 1 had a buy order triggered upon breaking above the second retracement bar.

Case 2 had the first candle being ignored, because the were not enough pips to profit from - the top was too close. (Again should that be a daily chart, there would be enough pips to collect, but here it is not the case). The highs of the next three candles haven't been breached, so there will be no further breakout trading for this particular retracement.

That's the method to try and test.

Regards,

Edward

Hello Edward,

Do you use any additional indicators with this system? If yes, what are the guidelines.

Regards,

Cornell

How about heikin-ashi candlesticks as additional filter and confirmation for this strategy?

Post new comment