Forex trading strategy #14 (Stochastic + EMAs' cross)

Submitted by User on October 10, 2008 - 06:04.

Submitted by Arsalan

------------------------------------------------------------------------------

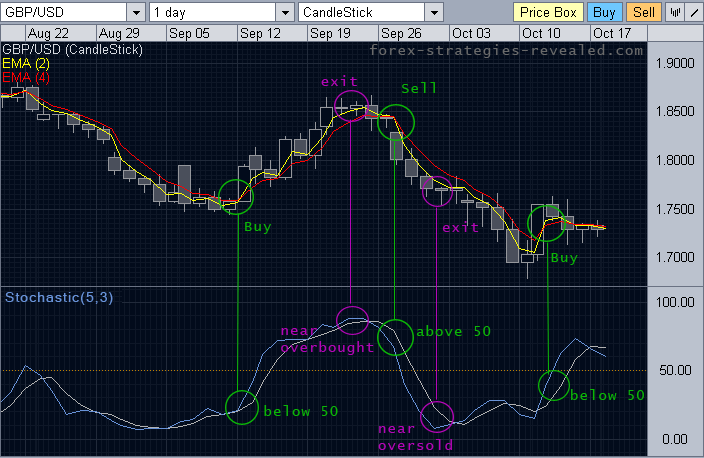

I have developed a new strategy and it is based on stochastic and exponential moving average. Although it is very simple but it is very effective for short term trading.

The strategy is as follows:

Time frame - Daily.

Indicators - Stochastic (5,3)

2 Days exponential moving average.

4 Days exponential moving average.

Buy Setup - Stochastic(5,3) should be below 50.

Buy when 2 Days EMA crosses 4 Days EMA from

downside to upside.

Short Sell Setup - Stochastic(5,3) should be above 50.

Short Sell when 2 Days EMA crosses 4 Days EMA

from upside to downside.

Stop loss - Below low of the Entry day but it should not be more than 3 % from your entry price this is my way of using stop loss but you can use stop loss as per your risk appetite but try to maintain Risk:Reward ratio of at least 1:3.That is if your target is 15 your stop loss should not be more than 5.

Target - Exit when Stochastic(5,3) reaches near overbought zone i.e near 80 if you are long.

Exit when Stochastic (5,3)reaches near oversold zone i.e. near 20 if you are short.

2 Days and 4 Days emas crossover provides early entry into the trend and stochastic helps to filter out false signals.

I have tried my best to keep this as simple as i can and i hope everyone will like this strategy.

Happy trading,

Regards,

Arsalan.

More strategies by Arsalan:

Special thanks and wish of prosperity to Arsalan

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

With regard to strategy No. 14 I think you mean to say 'Buy Setup - Stochastic (5,3) should be a b o v e 50 (not below) and

Short Sell Setup - Stochastic (5,3) should be b e l o w 50 (not above)

Please confirm

dont waste your time in forex. Its not gona make money.

great post. for the forex traders using the eur/usd ive traded this strategy with a few minor changes. im using a 6-8 ema cross and my stochasitcs are set the 5-3 that was advised. 15 min chart works great but ive even found success with the 5min charts. im loving this simple strategy.. dont get me wrong ive had some loosers but i cut my losses early as soon as i saw a turn around. happy trading..

bud fox.

Find that a lot of whipsaws in EURUSD trades using this strategy recently

If you've been stopped out to watch a trade going shortly in your favor - your stop loss is set too tight. Try moving it further, at the same time move the profit goal a bit further as well.

Thomas

HELP! I am new to FOREX trading and am trading a demo account using Metatrader. I've been entering the trades using this system only to be stopped out then watching the trade go in my favor. I am trying to figure out where to enter the trade so my stop losses can be reasonable. Any help will be appreciated.

2 EMA = Exponential moving average with period = 2.

4 EMA = Exponential moving average with period = 4.

Seems very good strategy to me, However as I am new in Forex Trading I want to know what do you mean by 2 & 4 days Moving Averages? How I put then on candle chart? Thanks

Jaddu

I'd say yes, but be ready to have more trading signals and some false signals too.

Seems like a great strategy.. But can I use it on the 15 or 30 minute timeframe?

Hi Milanthi,

You should use Stochastic Slow.

(Optionally try Stochastic, although I don't know what formula they use there.)

Kind regards,

Edward

hi..

First of all thank you so much for the strategies you have posted.

My question is in my Forex Platform I have 3 indicatord, 1: STOCHASTIC 2 Stochastic Fast 3 Stochastic Slow

out of that I have attached the display of first 2 indicatord, and which one should I use

Thank you

Milanthi

Thank you, Drew!

Happy trading!

Edward

Hi all,

Great simple strategy! I might suggest a small refinement on the entry. When the "trigger" candle closes set a stop entry just outside the end of the candle in the direction you are expecting to trade. For example, if the setup is a buy setup, set your 'stop buy' order just above the top of the "trigger" candle.

The stop entry orders only triggers when the price reaches the set price. For the above example, this means if the price doesn't continue to rise above the previous high your not in the trade. This has saved me a lot of false entries with many strategies.

On the MT4 platform the stop orders are found in the order entry screen under "pending orders".

The "trigger" being the one the meets both criteria for the MA and stochastic cross as defined in the strategy.

Best of luck!

Drew

Thanx Eddy!

Post new comment