Trading method #1 (9 EMA Entries)

Submitted by Edward Revy on January 19, 2009 - 05:37.

Think about entries.

When your trading strategy says: enter on the cross of Stochastic lines, on the cross of MACD lines, when RSI comes from oversold/bought zone, when two moving averages cross, when divergence occur etc etc. When exactly do you enter?

Usually you would just visually double check that there is a signal from your indicator and then enter on the close of a signal bar.

Sometimes it will work, sometimes you would wish you have waited a bit more before entering.

Sometimes moving averages that produced a cross would straighten back or as I like to say "uncross", and you'll be left with a false signal and a losing trade. Same for Stochastic lines, which can cross multiple times before price actually decides to move in either direction. Things like divergence are even more difficult: at which point after you've spotted a divergence you are going to enter?

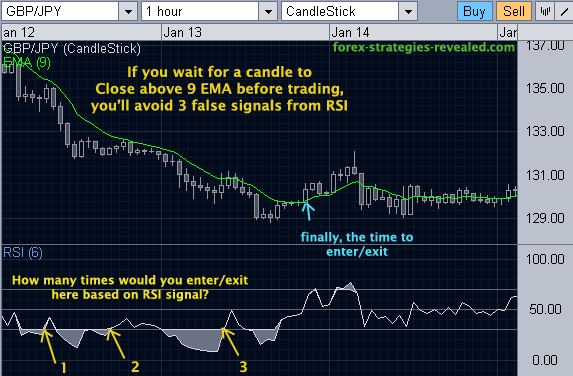

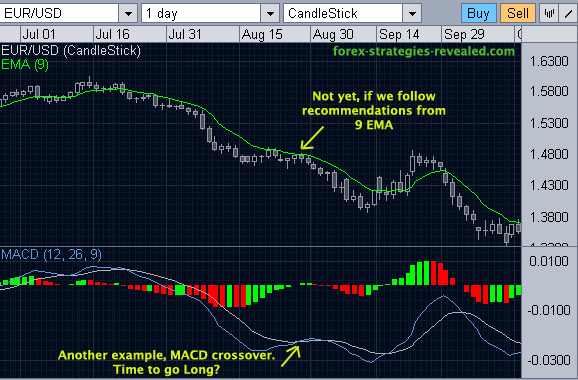

Here is my favorite and simple method. I use 9 EMA. After I get an entry signal from other indicators, I wait till a price bar Closes above 9 EMA to enter Long, or Closes below 9 EMA to enter Short. This method helps me to know when exactly I will enter, and so I have no second doubts about "acting now or waiting a bit longer".

Examples:

9 EMA Entry works on any time frame. I used to scalp on 5 min charts entering with 9 EMA, now I use it successfully for daily charts with the same good result.

Traders can use whatever Moving average they like: 5 EMA, 10 SMA etc. I like 9 EMA.

Besides entries, 9 EMA can also be used for exits, where the same principle works: once price Closes on the opposite side of 9 EMA, you exit. Note, that poking trough the Moving average without closing on the opposite side of it doesn't count, also doesn't count when price Closes right on the moving average.

Additional note: I use 9 EMA to time my entries. I do not trade 9 EMA alone, because it is vulnerable to sideways choppy prices (just have a look at the last several candles on the first screenshot with RSI - candles dance back and forth around 9 EMA as the price moves sideways).

Hope you find this method useful for your Forex trading.

Happy trading!

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Which settings do you use for the "SHI_Channel"?

This strategy is very beneficial for me,

and I only trade in the direction of the trend, in addition ... I use "SHI_Channel" indicator.

Hi Edwards,

Thank you for your excellent Strategy. It looks excellent in trending markets. But do you have any idea, how to avoid ranging markets. Please clarify. Thanks in advance.

Srinivas

Все не могу понять, как установить в терминале тот MACD, у меня только одна полоса, а на картинке две, белая и синяя, скажите как?

hello Edwards

Thanks for your strategy but I think this strategy can use in trending .Can use range market.

albert lin

thank you edward for helping us ,please explain which strategy is the best for beginner.

Tommy Lin from HongKong

Edward, thank you so very much for sharing your thoughts. I have used your methods. Mixed results. But i am very grateful. Thank you sir!!

Hi Edward. Iam new in this .Very interesting the 9 ema up to go long. Someone told me that the profesional trader espect that we enter long above 9 ema , and they go short against us.Is this true.? Thanks. willie

I am afraid we only get SMA and not EMA with MT4 as built in indicator... Correct me if I am wrong, thanx.

Any platform has EMA indicator built in, find it - then adjust the EMA setting period to 9.

Hello

I want to know where to get the formula for 9 EMA i dont seem to have it in my indicators list

Can we use ADX? Of course. How about this useful application:

http://forex-strategies-revealed.com/advanced/system-selection-technique

sir can we use adx for trading

Thank you,

I also use trend lines.

Best regards,

Edward

Post new comment