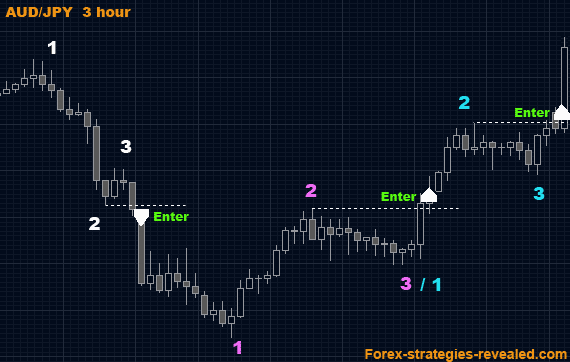

Forex trading strategy #4 (Simple 1-2-3 swings)

Submitted by Edward Revy on February 28, 2007 - 15:30.

And here we are again talking about the strategy that withstood the test of time. This Forex trading method is based on the same study of defining support and resistance levels and trading upon the fact of their violation.

A trading setup requires only an open chart and no restrictions for the currency or timing preferences.

Entry rules: Once the price makes it through the “pivot Line” - dotted white line on the figure below (drawn using the latest price peak) - and closes above (for uptrend) or below (for downtrend) the line buy/sell accordingly.

Exit rules: not set. However, exit can be found using Fibonacci method; or traders can measure the distance between point 2 and point 3 and project it on the chart for exit.

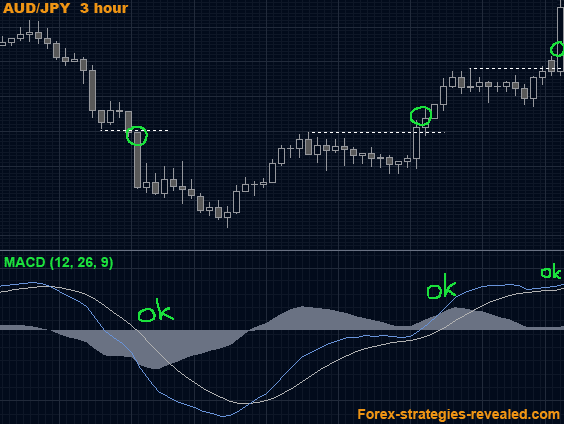

Additions: as an additional tool traders can use MACD (12, 26, 9). The rules for entry then will be next - let’s take a SELL order:

When MACD lines cross downwards, you look for 1-2-3 set-up to form. When the price starts “attacking” the “pivot Line” you check that MACD is still in SELL mode (two lines are heading down). Once the price closes below the “pivot Line” – place Sell order.

Same chart: MACD (12, 26, 9) is added.

Advantages: gives 100% profitable entries.

Exits update: Exit strategy page 4

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

This is an extremely powerful strtaegy. Try using it on 4 hour charts. It also eliminates alot of bad trades. Also, RSI can be used for confirmation.

When i started trading the 1-2-3, i chanced upon some patterns, like double top, bottom, Flags, Pennants.........With a little patience, trading can be profitable.

The 123 trading system is awesome,i placed 4 trades on the euro and 1 trade on the cable and i won 4 out of the 5 trades loosing the one on gbp/usd.This system is fantastic....but there is something i did in all my trades, (though im afraid its not right) and that is not waiting for the formation of the 2nd swing low ( point 3) before pulling the trigger at point 2, but despite that fact, i won 4 out of my 5trades...pls fellow traders, dont use my approach cos it may not work for u...Adedoyin Adebowale Raphael from NIGERIA

Edward thank you for a way out of the working class,great entry and exit points.only fools will discard this gem and go look for something else.its as easy as 1 2 3 lol Regards Pieter from south africa.

Sorry... I haven't found anything profitable about it, except for 7 minutes of talking about how good it would be if we traded this and that. He doesn't explain how to achieve that :(

Hi all, Hey People i have found very frofitable strategy (http://www.youtube.com/watch?v=oVGE4dxxypo) it is about 95 % profitable system (A B C D) I have fantastic resoults

live it alone in advance strategies there is trent traing and read it (friendly advice)

Point 3 can be determined only after it has "materialized" on the chart - it's a visual confirmation that a top or a bottom has been created.

An indicator called "Fractals" can help finding point 3 too.

Kind regards,

Edward

how can we determine the point 3 in this strategy?

Thank you,

regarding the above screenshots:

We can't expect all trades to be as perfect at the second picture, where price immediately shoots for the 1.618 FE level.

Rather many trades will look like the first picture example (with "why" on it). There the first wave ended before reaching the targeted 1.618 FE level, but that doesn't means that the trade is over, because the second or third wave can reach the goal.

Kind regards,

Edward

can anyone explain to me differance of these two poto

Just wanted to say that I have used this method 3 times in 3 days on the 1hr charts for AUDUSD, USDJPY & GBPUSD and I have increased my account to the tune of 67%.

Easy to use, easy to apply and very easy to understand.

Thanks Edward bit of a gem this. I am looking forward to many more successes.

Hi

I have tasted this strategy and there were such situation. For exlample: I have found 1 2 3 points then I used FE (fibonachi). And Fobonachi shoewed to me levels. Some times price shakes to 1.618 level and some times price stops near the 2 point (of course after crossing our resestance line along the point 2) and goes back.

Please tell us more details about exit.

I will Show It In image. Thanks.

use zig zag from scripts instead of fractals

edward you are very good thanks for everithing. This site is most popular and this site is very inportant for everyone. you have friend in georgia, Tbilisi. if you will come in my country you will be my guest. this strategy is really amazing incredible. this is most good way in forex to my mind.

Hi j,

the minimum profit target = distance between point 2 and 3.

After that, TP for least 1/2 of the position after the third bearish (in a downtrend) / bullish (in an uptrend) candlestick.

The rest is up to you - you can use (9 EMA method for exits or set a trailing stop, or use any other technique, for example, those we have here: exit methods).

Best regards,

Edward

Post new comment