Forex trading strategy #6 (Double Stochastic)

Submitted by Edward Revy on February 28, 2007 - 14:36.

By doubling on Stochastic analysis we are doubling on trading accuracy... However, one should remember that with each new Forex tool added complexity can appear; and a very complex approach is not always good.

Strategy Requirements:

Currency pairs: ANY

Time frame chart: 1 hour, 1 day

Indicators: Full Stochastic (21, 9, 9) and Full Stochastic (9, 3, 3).

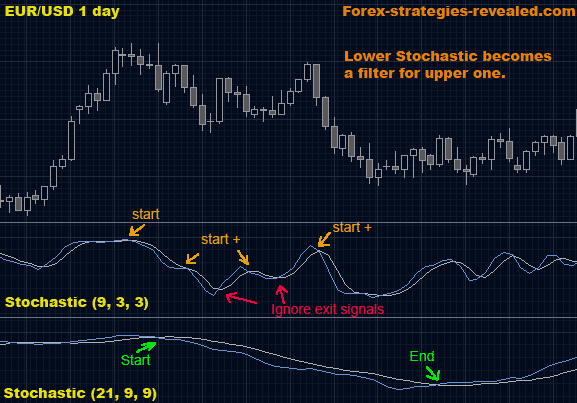

Entry rules: When the Stochastic (21, 9, 9) lines’ crossover appears – enter (or wait for the current price bar to close and then enter). It will be the major trend.

Look at Stochastic (9, 3, 3) to anticipate swings inside the main trend and re-enter+ the market again – additional entries. Also ignore the short-term moves Stochastic (9, 3, 3) that signal for exit – do not exit early until Stochastic (21, 9, 9) gives a clear signal to do so.

Exit rules: at the next cross of major Stochastic (21, 9, 9) lines.

Advantages: using two Stochastic indicators helps to see the major trend and the swings inside it. This gives more accurate entry ruless and gives a good exit rules.

Disadvantages: needs constant monitoring, and again we are dealing with a lagging indicator.

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Edward, your stochastic parameters are not consistent when market changes direction. Which signal would you recommend to marry with stochastic to detect market direction instant.

Thanks

Thanks a lot Edward, my sheet is 100% green because of you

combine the above strategy with bollinger band breakouts & RSI for a better result.

prasanna

Mumbai,India

This strategy working ok but how to ignore Stochastic (21,9,9) fake crossover? Most of the time Stochastic cross 20 then Stochastic (9,3,3) give me BUY signal but Stochastic (21,9,9) stay between 20 and 50 and price go down continuously.

first of all I want to say this site is great.I learned alot and keeping doit.

i look foward to understand well the market and keeping money.

best to all

ilan from israel.

I've been using this strategy for a few months now, and all I have to say is the strategy is simple and amazing. However, it definitely isn't a strategy where you can "set-it-and-forget-it." It requires constant monitoring. My goal is earning 3% each day/night using this strategy. I have been earning more than this each day. However, I don't really get much sleep during the week because I trade during overnight using this strategy and while I am at my full-time job. If you are dedicated and serious enough and wanting to succeed, I recommend this strategy. I figure I will catch up on sleep over the weekend.

Another great indicator to use along with this is Bollinger Bands. I pay more attention to the Stoch(9,3,3). However, when this indicator goes above 80 or below 20 and remains inside these ranges, that is when I turn to the Stoch(21,9,9). Stoch(21,9,9) gives a clear indication on what is happening in these ranges.

Good luck to all and don't be greedy. Follow your own strategy without deviating and you will win.

hello thanks 4 ds site

pls i trade with marketiva,they re not a metatrader platform...how do i configure the stoch.to 21 9 9 and 9 3 3 thanks a lot. Mike.nigeria

pls i need more explanation on double stochastic,if possible videos, can i use 34, 5, 5 and 5, 3, 3. Thanks in advance

Hi Wolf,

In my opinion:

1. Right.

2. Hourly is ok too.

3. You can add any MAs you like, for example 10 and 20 EMA.

Antony

Post new comment