Forex trading strategy #3 (Stochastic High-Low)

Submitted by Edward Revy on February 28, 2007 - 13:54.

Forex systems which adopt a Stochastic indicator for monitoring the price provide some very good tips about the situation on the market for traders that are willing to see it.

Currency pair: Any.

Time frame: Any.

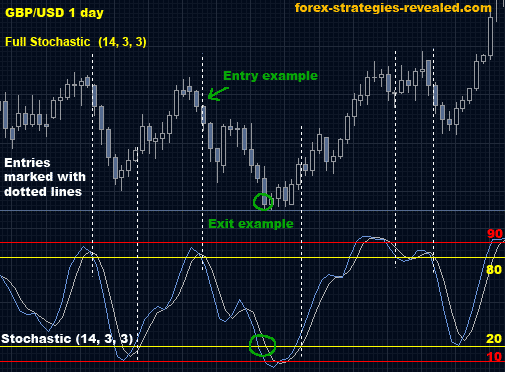

Indicator: Full Stochastic (14, 3, 3)

Entry rules: When Stochastic has crossed below 20, reached 10, and then crossed back up through 20 – set BUY order.

Entry rules: Sell when Stochastic has crossed above 80, reached 90, and then crossed back down through 80.

Exit rules: close trade when Stochastic lines rich the opposite side (80 for Buy order, 20 for Sell order).

Advantages: gives quite accurate entry/exit signals in well trending market.

Disadvantages: needs periodical monitoring. Stochastic is suggested to be used along with other indicators to eliminated entering on false signals.

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hi Edward,

what indicator you suggest to be used along to eliminated entering on false signals?

Thanks

Hi Edward,

Thanks for your comments,

You have suggested what other indercators to use with this stratagy, could you just confirm in detail how you would play this stratagy.

Thanks

In simple words, Fast Stochastic is faster and more choppy and Slow Stochastic is slower, but much smoother.

The difference is in the formulas, where Fast Stochastic uses the original formula, while Slow Stochastic additionally smooths out one of the parameters (K% line).

Since the introduction of the Slow Stochastic, many traders give preference to it over the Fast Stochastic.

Kind regards,

Edward

hi Edward thx b4 4 sharing with Us

Im Ringo,

i found on some trading platform stochastic indicator but there always 2 type fast and slow, can U tell me what the different ??

Put Stochastic on 60 min chart? Yes.

Hi,

Can you stochastic on a 60 min chart>

5,3,3 perfect for EURUSD M15, Enter only when the crossing is withing 20-80 ,

Beyond 20-80 crossing try just to exit, M5 cannot be traded with this strategy

You shouldnt use stochastics alone, when you use basic strategies use EMA OR SMA

Hi, my name is Eric

how much will you pay me for giving you the best strategy?

I mean, look around, people are working hard to make this unparalleled source of strategies, so that you can enjoy studying the best systems for free, yet you seem to be taking it for granted...

HI. my id UB_ezs(at)yahoo.com give me a best strategy.

A trend line is a tool, not an indicator; although today in MT4 you can come across custom written indicators that draw trend lines for traders.

Best regards,

Edward

What is Trend Line? Is it an indicator ?

Stoch 14, 3, 3 can be use on any chart, you can combine it with MACD indicator.

Regards,

Edward

Can I apply this to MACD chart? Or is it better on hourly chart? It should be 14,3,3

Thank you for this wonderful site :) Please keep it updated from time to time.

Post new comment