Money management system #4 (Scaling into a position)

Submitted by User on August 15, 2009 - 14:31.

Building positions step-by-step: A safer approach to trading

A basic difference between how a novice trader and a professional trader behave is in the choice of trade sizes, and position building. While the beginner will typically determine the trade size based on analysis and strategy alone, and commit the decided sum immediately in a single position, an experienced trader will choose to gradually build up his position, using a layered approach where each trade is justified by the success of the previous one. Especially useful in a trend following method, the gradual entry method allows us to control risk far more efficiently in online forex trading, while maximizing profits

Emotional benefits

One major benefit of the layered-entry method is the ability to reduce emotional tensions by taking small risks for each position, running many of them risk free, and building up on gains as the favored scenario is confirmed by market events. Keeping calm with ten gradual $1000 positions is a lot easier than managing one large $10000 position.

Risk free trades

By proper use of stop loss orders, we can even run some of our trades risk-free if the scenario which we had in mind is realized. We’ll discuss and illustrate this with an example soon, but by placing the stop-loss of each trade close to the entry price of the next one we can have stop-losses which are safe and secure.

Long term, or short term?

The layered-entry method is valid for both long and short term strategies, but it offers an even better risk-reward ratio if employed as part of a long term strategy. In the case of long-term trading our various positions will be less susceptible to market volatility (because they are further apart from each other), and our profits will be larger due to the amount of time necessary for a trade to reach maturity. Indeed, in order to minimize the spread cost, and to maximize profits, we can say that the layered-entry strategy is best in long-term trading.

And how do we actually apply this method?

It is easy and straightforward, and we’ll try to explain it with a brief example.

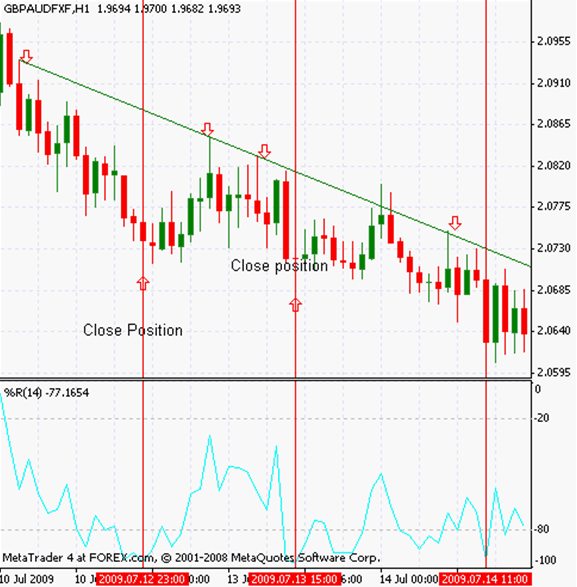

Below we see the hourly chart of the GBPAUD pair. We chose this one because it shows a clear downtrend which is easy to identify and trade. The Williams percent range indicator which we placed below the price action is good at capturing price extremes, and although it can give false signals, it is very suitable to the analysis of volatile trends and strongly directional price movements.

Our aim is to trade this trend without committing more than a fraction of our capital at one time, and building up our positions as our opinion is vindicated by the price action.

The red down-arrows show the locations where the price action touches the trend line, and signal that it is time to open short positions, on anticipation that the trend line will hold. We’ll use extreme values in the Williams oscillator, at values close to 100, or -100 for take- profit orders (indicated by the up-arrows), and our stop-losses will be placed about 20-30 points above the trend line for each trade we enter. After opening the first position at 2.091, we observe that the Williams Oscillator quickly reaches an extreme, forcing us to close our position for a good profit, and preventing us from using the layered-entry strategy. The second position we open at close to 2.085 is not followed by any extreme value on the William oscillator (as seen on the red horizontal line), and when the price reaches 2.083 a while later, we can open another short position. After that, at the point indicated by the second horizontal line from the left, we see that the Williams Oscillator reaches another extreme, indicating it is time to close both positions for a sizable profit.

We could also place the stop-loss order for the short position opened at 2.085 at break-even point while entering the second short position at 2.083, reducing our overall risk exposure by half.

Later when the price action touches the trend for the fourth time at the place indicated by the fourth down-arrow, we can enter two consecutive short positions, closing them once again when the Williams Oscillator registers an extreme value.

Needless to say, traders using the gradual entry method can trade in many different conditions using various indicators and indicator combinations, and it is good to keep in mind that the example above was especially chosen for clarity and simplicity. No single method or strategy will help us reach consistent profitability, but there are some tried and tested methods and rules, such as the carry trade, the layered-entry strategy discussed here, or the principles of money management, which will shorten our route, and lighten our burden considerably. To compare forex brokers while seeking the best offers, and to try different strategies while searching for those best suited to our character, and thereafter to combine them, is the most efficient and prudent way for those who seek to attain success and credibility in trading while suffering from minimal headaches and losses.

Credits to: http://www.forextraders.com

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hi Dino,

this strategy isn't mine, it was submitted by forextraders.com, probably they were in a hurry to put it together, or didn't pay enough attention to details, I don't know.

Thank you for bringing it up.

I agree with you, that the first few arrows on the screen shot are set incorrectly, unless, of course, the trend line existed earlier (which is not evident from the chart).

Here is my version with arrows the way they should be set:

Best regards,

Edward

Hi Edward,

in this article you say when red down arrows show price action touches trend line See paragraph below chart. how do know where the trend line is as future price action has not occurred.trend line would be a different slope. this would invalidate signal.

could you kindly clarify

Cheers DINO

dinosaw882(at)iinet.net.au

Post new comment