#10 Mounzer Forex Stress Free system

Submitted by User on January 17, 2010 - 16:01.

Forex System by Mohamad Mounzer

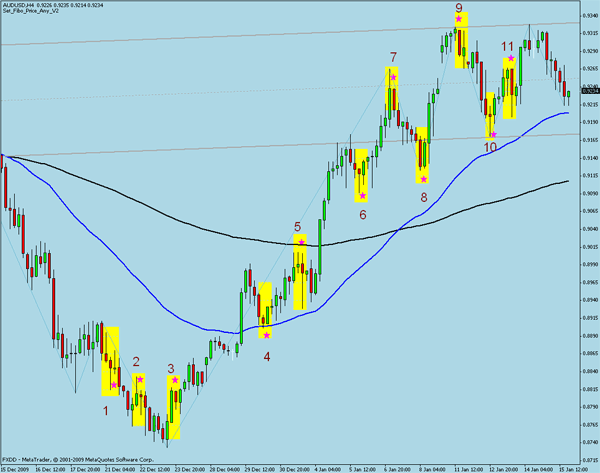

Timeframe: Four hours chart

Indicators: EMA(55), EMA(200), Zigzag, Equidistant channel indicator, MSH and MSL indicator

Pairs: Priority to audusd, usdcad, nzdusd, usdjpy and eurusd then the rest..

Note 1: You can use manual channel construction or any indicator satisfies, and we have to use the last equidistant channel available on the chart(ONLY)to keep stress resulting from the traffic lines away.

Note 2: MSH(Market structure high), MSL(Market structure low).

Note 3: entry must be in double lot.

EXPLANATION:

Zigzag indicator shows the resistance and support levels clearly with no need for any horizontal lines drawing and thats better for eyes clairvoyance.

Equidistant channels shows the recent behavior for the price and its borders plays an important role in supporing and resisting.

EMA(55) and EMA(200) plays usually an important role in supporting and resisting on four hours chart.

MSH and MSL are trend reverse patterns where MSH appears during an uptrend when the price candle or bar makes two higher highs(a,b) before making a lower high(c) due to a lack in bullish momentum and MSL appears during a downtrend when price candle or bar makes two lower lows(a,b) before making a higher low(c) due to a lack in bearish momentum.

The system idea pith is that we will wait for a MSL or MSH pattern near these support-resistance levels to enter the market with an entry order (Sellstop or Buystop)

If entry orders (buystop or sellstop) are not triggered and a new low or high appeared this will invalidate them, so delete.

Trades will be entered also if MSH and MSL were not near a support or resistance level but in caution where no support-resistance barrier is in our way and only if the patterns are included in at least 4 candles or bars formation.

Buystop order = high of c+5 pips

Sellstop order = low of c-5 pips

The entry must be in double lots where the stop is below b by 10 pips and target1=stop and target2=stop*2 where stop is moved to breakeven when target1 hit (Use trailing stop).

1: MSL is near zigzag peak but order is invalidated as the last low(b) is broken.

2: Invalid pattern as we have MSH according to 2 candles only.

3: Same as 2.

4: Valid MSL on EMA(55).

5: Invalid MSH as EMA(55) is a barrier infront our trade.

6: Valid MSL although we are not near a support area because of a presence of 4 candles and as we have no barrier infront of our trade.

7: Valid MSH for same reasons as 6.

8: Valid MSL for same reasons as 7 and 6.

9: Valid MSH for same reasons as 8,7 and 6.

10: Valid MSL for it is at the lower border of an equidistant channel.

11: Invalid MSH for we have a support barrier infront our trade which is the lower border of the equidistant channel.

12: Valid MSH as it is at resistance level.

Mohamad Mounzer,

South Lebanon, Markaba

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Very good

I disagree that it's stress free. I read it and I got stressed.

Try other pairs.... volatile market could affect some of the pairs....

Mohamad,

I tried this method in demo for 2-3 weeks, lost overall 20%...

I am not sure If I am following rules correctly?

For How long have you been using this method?

Do you think it would work in the long run?

Thx.

-Tom

I will not numerate all the hances on the chart

It depends on how much U would like to risk as a stop loss in each trade

For me when finding that 1 or 2 is a long candle I ignore the trade and look for another pair

take this chart for GBPUSD

I marked two opportunities (Yellow shaded) only but it contains more

Look at this channel

The pair made a low at a

then a high at b

then a low at c

I wait it at d

d was somewhere above ema55

it began to form an uptrend till it reached d above the ema55

The pair respected the upper side of the channel

I shall wait for a higher high numbered 1 folowed by a lower high numbered 2 and make a sellstop order below the lower high numbered 2 by 5 pips and the stoploss above the top numbered 1 by 5 pips

But also as ema55 plays an important role in supporting and resisting I need for 2 to close below it

glance at the chart

the candle numbered 1 is at the upper side of the channel

the candle numbered 2 is a lower high and closed below ema55

It is a chance for a sellstop order

candle 2 low is 1.3705

I put a sellstop order at 1.3705-5= 1.3700

candle 1 high is 1.3788

I put stop loss at 1.3788+5+spread as it is a bid chart

taking profits differs from one to another

U may for example wait for an MSL or a fibonacci number or anything else

Hi, Mohamad! Please explane: where i've to set order. Could U please attach picture?

Thx.

NO.. I donot mean that..

MSH is : high then higher high then lower high

3 candles form a MSH

and so for the MSL

But i need at least four candles in order to avoid consolidations, so for the pattern to be more effective it must be formed after a clear wave, and 4 candles=16 hours includes at least 2 markets action.. thats all..

Mohamad Mounzer

Hi,

Thanks for sharing your strategy. Could you please comment on the point: "only if the patterns are included in at least 4 candles or bars formation". Does this mean you need to have 3 bars closing with higher highs followed be 1 bar closing with a lower high (MSH) before you have a valid setup? Do the bars also have to make higher lows and a lower low for the last bar? Thanks.

Thank you so much Mohamad.

I'll give your strategy a try and let you know how it goes...

Thanks again,

Kenny

Hi Mohamad,

Thanks for your explanation of MSH and MSL.

Thank you for your wonderful strategy and a great support for traders,

The last image came out blurred...

If you happen to have a better one, it would be great to have it posted.

Best regards,

Edward

Hi Kenny

U have not to watch the charts all time...

This is a 4 hours chart strategy

U have to make one look on the charts every 4 hours as a new candle opens every 4 hours

Just do that...

Watch the time ur 4 hours candle opens...

It differs from a software to another..

I advice U to choose Buystop and Sellstop orders when market is ranging or choppy, but when market is trending U have to choose the orders that goes with the trend and ignore the others as they are only corrective.

For the strategy :

Watch MSL(market structure low) and MSH(market structure high), and read more about them.

MSL and MSH are the basic of this strategy and when they are formed enter the market with buystop or sellstop

Such MSH and MSL is more considerable and effective when they are formed at a resistance or support level such that a previos top or bottom, fibonacci level,trendline,important moving average period like EMA(55) EMA(200) SMA(80) SMA(120) SMA(300)...

BUt the most important is that U cannot put all that on ur chart U will make it very crowded and annoying and U may not find a place for trade..

Just choose some from them..

I choosed in my strategy the : previous tops and bottoms by using ZIGZAG, 2 moving averages ,equidistant channel..

below some MSH and MSL photos,,

Hi Mohamad,

Can you help me? I am a total newbie to forex - I've had a few unsuccessful trades based basically on gut feeling and lost a couple of hundred dollars. I don't want to waste any more and am looking for a decent strategy. I have invested another $500 in my live account and will not be investing any more. This is my last try... I have been looking around for a decent strategy and came across this site. I like the look of your strategy. Can you explain the system to me more basically, step by step, to set it up? One question, do I need to watch prices all the time to 'switch on' my trades or can this be set up to switch on automatically? I don't have a lot of time to watch the prices as I work full-time and have a busy life.

Your help really would be appreciated!

Many thanks,

Kenny

U can use RSI and Stoch also U can use Fibonacci pivots and any thing else..

But we have to keep our eyes clear and piercing...

The simple is it,, the more relaxing,

and adding more indicators will filter more but also will make u miss more..

Mohamad Mounzer

its awsum.... an added indicator (i wud use stoc & rsi combination ) would make it almost fool-proof..

thnx fo the lovely strategy..

regards,

khaira.

Post new comment