Forex Trading Strategy #56 (DWL3 system, AKA DT2)

Submitted by User on March 10, 2021 - 13:08.

Submitted by James Leone

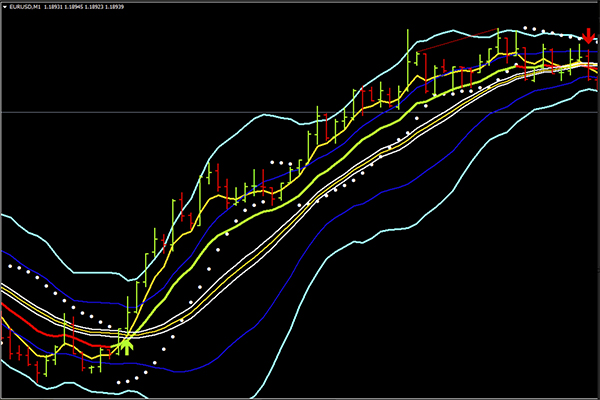

Indicators:

PSAR (0.02,0.2,0.02 Colour White size 2)

Bollinger Bands, 21 period 2 Std Dev (Mid line set to invisible) Upper and lower Aqua

Bollinger Bands, 21 period 1 Std Dev (Mid line set to invisible) Upper and lower Blue

Bollinger Bands, 21 period 0.1 Std Dev Mid Line Green (Up)/Red (Down) Upper and lower White

EMA 8, Yellow or Gold

EMA 13, Green Uptrend and Red Downtrend)

MACD 12 26 9 (MACD colour coded)

Timescale:

Any time frame, any faster moving major markets on lower time frames. Any on Higher time frames.

Entry X 2

There are 2 types of entry signal. 1 with PSAR outside outer bands, 2 with PSAR inside the bands (anywhere inside).

1. PSAR flips from above/below to opposite and is outside the outer Band (above upper for SELL, below Lower for BUY). This is our heads-up message. Then we observe the 2 EMAs, must cross (8 above 13 for buy and 8 below 13, for sell). Price MUST be above (BUY) or below (SELL) the centre DWL/DBL bands. Confirmed entry with emergency stop at the relevant PSAR.

2. PSAR flips from above/below to opposite and is inside the Band (above PRICE for SELL, below PRICE for BUY). This is our heads-up message. Again, we observe the 2 EMAs, must cross and be in the right mode (red/red SELL and green/green BUY) Price MUST be above (BUY) or below (SELL) the centre DWL/DBL bands, AND inside the BUY or SELL channel. Confirmed entry with emergency stop at the relevant PSAR.

Exit Rules and Management:

All trades carry the initial stop at PSAR rule but we can actively stop the trade upon several conditions.

1. Target of 2:1(between PSAR and entry) ratio locked in or hit too quickly to move limit.

2. PSAR flips back to opposite side

3. EMAs change colour/cross

4. Divergence suggests lock in very tight

5. Price closes opposite side of DWL/DBL centre bands

6. Combinations of the above

This strategy has been back tested by professionals and traded live by many (very profitably) for months at time of writing. There will be losses! Remember your other RULES.

ADDITIONAL

1) Consider adding a MACD

2) Check for divergence

3) Check higher time frame

4) Check High value EMAs

STOP

Place the stop on the PSAR

TARGET

Initial target of 2 x stop

TRADE MANAGEMENT

Lock in 1 pip below an EMA line closest to the price on a flat section

As soon as you have locked in a profit delete your limit

TRADE EXIT

Exit on change of colour of EMA line OR hitting locked in stop. Analysis using Fib levels and big round numbers may also be used to exit a trade.

Post new comment