Advanced system #16 (30 min ATR breakout)

Submitted by Edward Revy on October 25, 2010 - 15:09.

Time frame: 30 min

Currency pair: any.

Indicators:

ATR 14

EMA 14 set on ATR 14.

i-FractalsEx: period 3, max bars (500 or any other number - it doesn't matter here).

Download: i-FractalsEx.ex4

Steps to set EMA14 over ATR 14 properly:

a. put ATR on the charts as usual.

b. from the Navigator window (on your left) drag Moving Average on ATR and in the settings make sure to put:

- period: 14

- MA method: Exponential

- Apply to: Previous Indicator's Data

Trading plan:

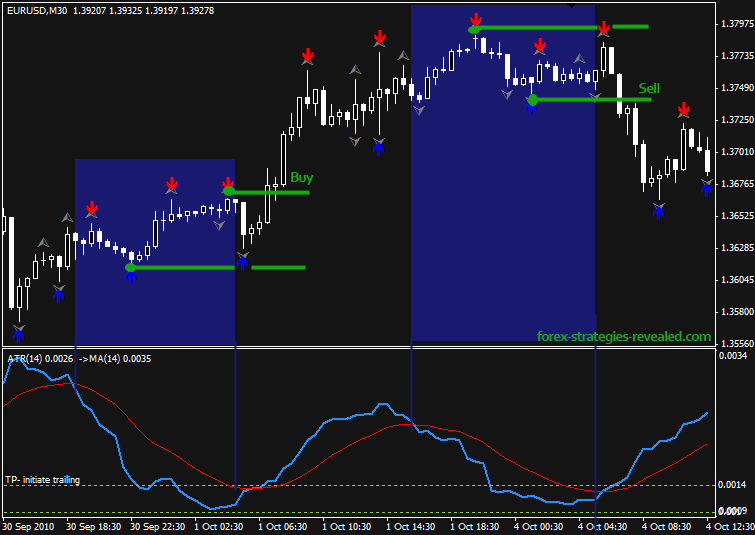

The idea:

To take a trade when the market prepares to accelerate.

This happens in a distinctive cycle where slow conditions by the end of the day (end of the New York session, through the Asian session) are changed by a fresh morning session (right after 00:00 EST).

ATR will help us to anticipate and prepare for that exact moment where the market is about to accelerate, while we'll focus on preparing a breakout range to catch the move.

The rules:

When ATR is reading above 14 EMA - the market is active - that's where we want to be trading.

When ATR is resting below 14 EMA - there isn't much activity going on - that's where we don't need trade.

Use Fractals to set a breakout range.

Set a pending order above and below the range when ATR approached the 14 EMA from below and is about to cross (approximate timing here).

Preparing for the first trade:

- Find the last occurrence where ATR went below 14 EMA.

- use colored fractals from iForexEx indicator to create a breakout range. Use only those colored fractals that fall withing the period where ATR is below 14 EMA.

- if there are several same color fractals found, use the most distant ones - those that will create a wider range.

- when ATR approaches the 14 EMA from below and is about to cross (it's always an approximate timing, rather an anticipation, but you'll learn to identify it quickly after a few days), set pending orders above and below the range. One of them will be triggered on the breakout.

- SL - the opposite side of the range.

- min TP target = the width of the range, after that you can:

a. keep a position as long as ATR is rising and its above 14 EMA.

b. close when ATR goes below 14 EMA.

c. if you took partial TP or have a second order in place, you can keep them running for the rest of the day, even when ATR goes below 14 EMA until ATR falls to 0.0014, after that initiate a trailing stop and let it close with a stop.

That's the strategy. Hope you like it.

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Thanks bro.. itz really very helpful + profitable + possitive indicator,, it is giving good result,, may ALLAH (GOD) BLESS U and ALL ALWAYS AMEEN :)

really impressive forex web site i learnt from here lot of stuffs.

Nice, will be testing this out on demo,

have changed settings slightly..

using smoothed 20, instead of ema 14..

if the move is significant am using the 34 smoothed as a trailing stop...

thanks...

Another system that doesn't work, if you look over the short term you may find winning streaks but after checking over a longer period it shows this simply doesn't work.

beautifull. thank you!

how the coding for this indicator as a filter when EA can begin. . how coding if the cross?

thanks..

[email protected]

ATR period 14 is a default period for ATR indicator.

Otherwise, what do you think it is when you place ATR on your charts? It's 14 period ATR.

Thomas

i am not able to get the 14 level on ATR indicators i have manage to get Ma and ATR on same window but cant get the 14 level line

plz plz any one can mail me his or her TPL will be really thankful that person

email id :- [email protected]

I can`t understad why nobody until now react and give Template to this people they are searching for. If somebody want this Template ( with EMA on ATR ), email to me: [email protected]

Hi Edward ,

Can you please explain to me how you averlap the Ema on the Atr ? I have mt4 platform however it doeasn't permit me or I just don't know , the ema goes directl to the price action , even by dragging the ema to Atr I have the same result , Thanks for letting me know,

Regards

Gerard

can any one upload Template for this i try every thing but faild to combine ATR with EMA

Hi,

I'm really impressed with the strategy. This is something that gives you confidence in trading. thanks and regards

Anybody has an ATR indicator with level alert (i.e. it alerts when ATR reaches 0.0014)??

Thanks!

Hi

which pairs do you recommend for this method?

@Mike

You can use a nice indicator called "Trend Magic" from TudorGirl, to set trailing stop loss. It's available from forums http://www.forexfactory.com and/or hhttp://www.forex-TSD.com, cant remember which one. OR, use Google and search for this MT4 indicator (Google is your friend :)

Post new comment