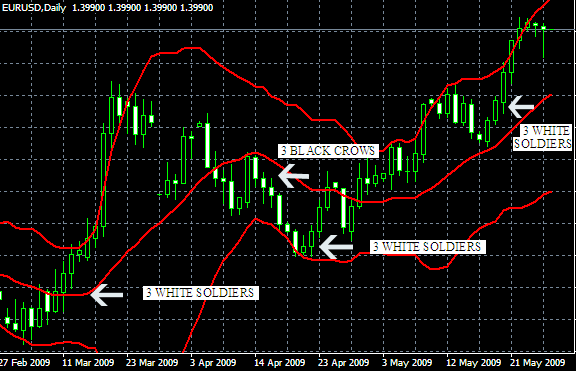

Forex trading strategy #12 (3 white soldiers / 3 black crows)

Submitted by User on May 26, 2009 - 19:32.

Submitted by trader.

Very Simple system - simply look for 1 of 2 candle formations at or near the bollinger band (in this case the default 20)

You are looking for either 3 consecutive bulish candles for a buy, 3 consecutive bearish candles for a sell - that's it!!! - 3 white soldiers / 3 black crows formations

Things to note. On the larger moves, the price WILL retrace. Best thing to do in this situation is when you see this happen (typically 1 or 2 candles in the opposing direction) simply close the trade and re-enter when the price has returned to the point where the change started. as for exit strategy - a lot of the time you can count on approx 2 - 3 times the value of the retracement (e.g. if the price retraces 10 pips, then you are looking on the re-entered trade of a TP between 20 - 30 pips!

You can use ANY 3 consecutive candles, however this works best when the price has just "bounced" off the Bollinger Bands.

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Can you please clarify? The pic is ambiguous. Are you calling the black candle bodies white and vice versa. Also, it shows the arrow pointing at a formation that doesn't follow the explaination....at least to my understanding. Thanks in advance.

Hi, please can you explain the formations in relation to the bolinger bands please? Two of the white soldiers appear to originate on or near the centre and gravitate towards the upper outer band, the other appears to originate at the lower outer band and gravitate towards the centre?

hai,

iam a newbie, thanks for strategy..

so GOOOOOOOOOD for the beginer like me!!! ;)

best regards,

3pip30usd-RM105sehari.

Simple and logical. Thanks for the information

I'd set is behind the last soldier/crow.

Best regards,

Edward

Hello,

thank you for your ideea. Please tell me where do you fix your stop loss (risk) after you enter a trade based on three white soldiers or three black crows ?

thank you,

Lucretiu

Thank you for your feedback.

For exits, try this one:

http://forex-strategies-revealed.com/money-management-systems/cci-exit

Best regards,

Edward

This looks promising on backtesting. Have been dummy trading and its consistent. Wonder what you'd found to be the best exit strategy?

Hi Manus168,

I've been returning to your question for 3 times in the past few days, but so far haven't come up with a useful idea.

For conservative entries, look to trade on the upside breakout above the 3 white solders formation, below - for 3 crowns. Other than that, I have no advice so far. Sorry about that.

For more aggressive entries with market orders, look to switch to a lower time frame, where catch a momentum with Stochastic indicator as it produces a lines cross favoring your trading direction.

Regards,

Edward

Any Confirmation indicators for this trading system like Stochastic/MACD besides Bollinger Bands ?

Sincerly;

Manus168

It doesn't matter which candle hits or breaches Bollinger bands. It also doesn't matter how significantly the bands are breached.

Entry is made on the close of the third candle, and it is a market order; or on the breakout above/below the formation.

An ideal entry opportunity is considered to be when 3 consecutive candles formed just after price had bounced off of the Bollinger bands.

Regards,

Edward

Hi, thanks very much for this sytem, it's very simple but effective. Does it matter which candle hits or breached the Bollinger, for example does it matter if the first second or third white soldier touches or breaches the bollinger? Also, after the third candle has finished as a white soldier, do we just get in with a market order or do you set an entry level order somewhere.Does it matter whether the bollinger has been breached significantly or as long as it has at least touched this is OK?

Thanks in advance

You'll see more successful occasions on daily charts, while on smaller time frames chances for a reverse after 3 consecutive white or black candles will be much higher.

ANY timeframe

Any pair!!!

I have also found that it works better if it has bounced off a bollinger band

Thanks for the strategy but you did not say which pair it is best used for and also the timeframe

http://filekeeper.org/download/shared/fibo_strategy.MDI

Post new comment