Advanced system #20 (Advanced Currency Trading System)

Submitted by User on August 2, 2012 - 14:32.

To fully understand this system, there are key assumptions that must be taken into account because that the system is generic.

Key assumptions:

Although the market is now functional 24hrs of the day, key trading hours for each session is about 7.5hrs as shown below:

- Frankfurt : 7am – 3.30pm

- London : 8am – 4.30pm

- New York: 2.30pm – 9:15pm

- Tokyo: 12:45am – 6:30am

- Note that these times are all based on UK time and are when active/live trading takes place, you can of course place trades out of these hours trading but non-forex instruments will attract a premium so i.e. higher spread.

- Lunch periods are periods of trading lethargy, therefore 1 hour is subtracted from the total active hours of each session

Instruments traded

• £/$

• €/$

• German Dax -30

• Japan (Nikkei) -225

• DJIA (Dow)

• US Crude

• Gold & Silver - I used it in the last 3 months or so for these instruments and it worked well

Indicators:

• 10 EMA

• 35 EMA

• 135 EMA

The user of the system is familiar with candlesticks patterns

TRADE SETUP:

Three EMAs are used to mimic the fan principle and in an uptrend, prices are expected to hang on to the 10 EMA and to depart far away from it in very strong trends but retrace to it at some point.

The time frame used is the 4hour chart. Horizontal support and resistance points are drawn on the daily chart and trendlines on the weekly chart. Entries and exits are made on the 30min TF Pending orders based on Fibonacci retracements for entries and a predefined level for exits can also be used. Two orders are placed; one at 61.8% level and the second at 50%.

As previously mentioned, the EMAs are chosen to get certain results which are explained below:

On the weekly chart:

10 EMA – Prices applied to last 10 trading weeks (approx. 3 months)

35 EMA – Prices applied to last 35 trading weeks (approx. 9 months)

135 EMA – Prices applied to last 135 trading weeks (approx. 34 months)

• Note how the EMAs are related by a factor of approximately 3, I know it’s not exact but trial & error shows that these settings work best for my purposes.

On the daily chart:

10 EMA – Prices applied to last 10 trading days (2 weeks or half month)

35 EMA – Prices applied to last 35 trading days (7 weeks or 2 months)

135 EMA – Prices applied to last 135 trading days (27 weeks or 7months)

• This time, the EMAs’ price actions are related by a factor of four, each should act as a very good dynamic resistance and support on the chart.

On the 4hourtime frame:

10 EMA – Prices applied to last 40hrs (effectively 5 days based on 7.5hr per trading day/session)

35 EMA – Prices applied to last 140 hours (19 days or 1 month)

135 EMA – Prices applied to last 520 hours (72 days or 4 months)

• Again the EMAs’ price actions are related by a factor of four

THE SYSTEM TRADE SET-UP

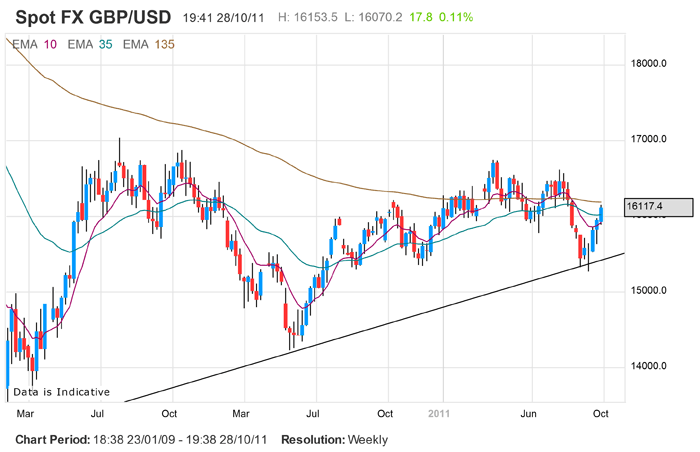

Starting with the weekly chart as shown, we draw our trend lines and also use this screen to determine what direction trade will be taken. This is the weekly chart of the £/$

The last candle shown on this chart is for the week beginning the 24th Oct (where arrow is pointing), the candle prior to the last one clearly shows that the £ is bullish so we will be looking for longs, i.e. we have identified the direction of our trades from the long term chart. If you look at this chart properly, you’ll see that you can draw an ascending triangle on this chart – a bullish pattern.

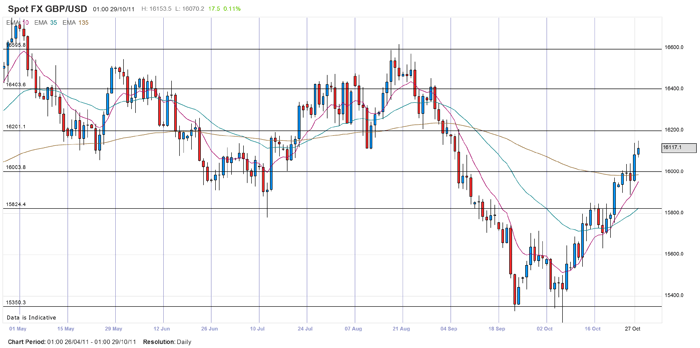

On to the daily chart now with our horizontal support and resistances drawn:

The double arrow shows that the trading days from 24 – 28 Oct, now if you had not looked at the weekly chart, you might make the decision to go short since the candle 24th was a doji, and it was followed by a spinning top. The inspection of the weekly chart makes of aware that the spinning top is potentially a pause and the rally to upside could be to continue.

For those who would prefer to trade strictly on daily charts, you’d have entered at the close of 23 0r 24 daily candles around 15950 area with about 70 pips SL and TP to 16200 (you’d be risking 70pips for 250 pips – a very good risk reward indeed)

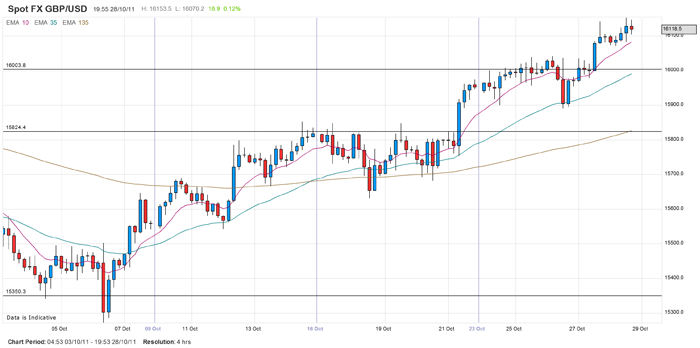

For the trader who prefers the 4H TF, you’d potentially have a better entry and therefore a better risk reward ratio:

Recall that I said previously that your EMAs act as dynamic support and resistance, you’ll see that candle that the arrow is pointing at, clearly broke and close below the 10 EMA, so we’ll expect the a little more downside move. The next candle however, sat nicely on the 35 and I’d place my long trade here. In this case I use a rule of thumb of 50 pips as my SL and same TP as before, note the better entry at 15900, giving a risk reward of 6:1 (fabulous indeed) and this is why I prefer the 4H TF entries. If you are the more conservative trader, you may choose to wait for a bullish signal before you enter.

This system can be applied to the day trading as well as follows:

• Select your preferred trading time frame

• Multiply this TF by a factor of 5 ( this is where you draw your horizontal support and resistances)

• Multiply the second TF by factor of 5 to get your long term trend.

For example if your preference is the 1hr chart, your support and resistance would be drawn on the 4hr chart since a 5 hr chart is not the norm and your trendlines will be drawn on the daily chart.

Adam provided this article to us, who also writes for www.binaryoptions.net. For more information about Forex trading or binary options, feel free to visit this site.

(Credits: Strategy designed by TemiOkuboyejo)

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Thank you for taking the time to submit your strategy.

So the basic rules of this strategy are that:

we trade in the way of the trend (weekly/ long term trend),

we trade in the 4hr chart,

our trading signals are triggered when the last candle has broken through one of the resistance/support levels

and also broken through the 10ema and has touched the 35ema.

where is the arrow?

create a DEMO trade it for a month and post it here. Good work

Hi

As you go ahead you have to try find simple strategy not something like this with so many lines and info for trading it seems you get back 20 years ago

At least, take a time to read other systems in this site

How long you allready used this trading system in live account ?

How much percentage of the profit each month ?

How much the profit factors & the drawdones from your system ?

Regards;

Manus168

too many things to do...too complex...

What part you didn't understand ? It's so clear.

I will test it soon and post what I find out.

Thank you, your strategy look's great.

i too did not understand anything. It seems he wants to drive people to his website just writing some article.

I dont understand the intention of this article here

Post new comment