Advanced system #4 (Early bird Breakout System)

Submitted by Edward Revy on May 27, 2007 - 03:54.

Another advanced morning strategy tightened to the timing factor and only two currency pairs.

Trading setup:

Time frame: 1 hour.

Currency pair: preferred but not limited to EUR/USD and GBP/USD.

This Forex breakout system uses no indicators.

Trading rules:

The system is called "early bird" because it requires a trader being ready to trade Forex as early as 5:00 am EST.

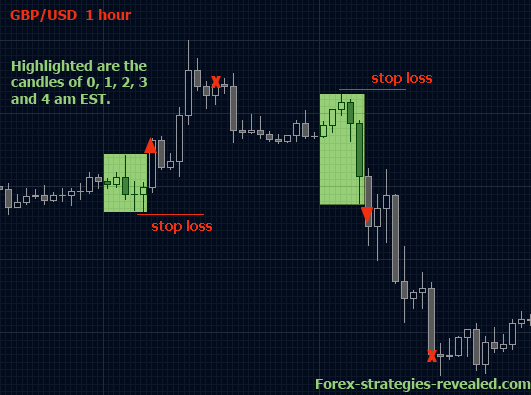

Find the Highest High and the Lowest Low for the candles from 00:00 EST to 4:59 am EST. (We should have 5 candles for each hour: 0, 1, 2, 3 and 4).

At 5:00 am EST set 2 entry orders: buy order - above the highest high +5 pips, sell order - below the lowest low and -5 pips.

Set initial profit target to +90 pips for EUR/USD and +140 pips for GBP/USD - both targets are way too high if to consider that daily range average for EUR/USD is only 110-120 pips and daily range average for GBP/USD is 180-200 pips.

If those targets get hit - very good! However, our profits will be determined mainly by the time factor instead of a fixed amount of pips.

So, we close all open positions at 12:59 EST (1:00 pm EST) and cancel all remaining orders. The next trading opportunity - only next day at 5:00 am EST.

Setting Stop Loss orders:

Stop loss for Buy order should be placed below the found earlier lowest low -3 pips, for Sell order - above the highest high +3 pips. If a stop loss is hit most likely traders will see an opposite position open. Stop loss should never be moved.

To your trading success!

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hi Edward

As I was newbie for past one week am reading all those strategies here, can u refer the low risk strategies for new comer till to become familier.

Best regards

Sam

India.

Hi Edward

Is Early bird best?

Last month I trade with Early bird, but almost reach to stop loss.

please advice me your opinion and help me?

How can I contact?

Best regards

Bachka

Hi Edward. Extremely grateful for your time in outlining this strategy. I for one know of courses charging £1000's for way less. I'm experimenting with differing hours, TP and SL. Will comment back here. Cheers

Hutch

Hi,

Nice to see your strategy.we are from India.i have little confusion regarding our time ist.you are doing in est.even though you have given explanation in starting please tell me what time i should see the 0,1,2,3,4 hours bar in indian time.more over your time calculation does not match the market opening time. so please explain what time i should follow that strategy.please tell me in Indian time.thank you,good day

why does thia thread show first post first and most recent post very last? Can I see the latests posts first in stead of having to go to the last page to see the latest posts?

This strategy might need a review in terms of shifting hours of the breakout range. So, if you like this breakout idea in general, just try working with other hours, if not, then simply consider other strategies. There is simply no point of losing money if the strategy can't deliver results on demo. May be in the future we can return to it again, because the main breakout idea is very viable.

Best regards,

Edward

I tested this strategy between 2011/04/01 to 2011/04/30.

This made some profit sometimes, but stop loss occurred almost always.

My demo accounts remained almost half.

In my opinion, the whipsaw is so strong recently.

Even when trend was strong, the price hit the stop loss.

Edward, Do you have any idea to overcome this situation?

Thanks in advance.

Derupi

This strategy is useless and even very dangerous. I don't know how well it worked back in 2007, but to use this strategy on market today seems a suicide, especially on GBP/USD pair. This only could be useful, if price generally moves in one direction - i.e. is in very strong trend state (which happens seldom and could not be predicted). Instead, in 8 hours (from 5:00 AM to 13:00 PM) price may reach daily maximum/minimum and totally retrace back. If you are watching GBP/USD pair daily movement, in most cases it draws a big 'S' around a daily average (for example: daily maximum - daily minimum - again close to daily maximum or breakout - dayly average or even daily minimum). So, this strategy, only will work with long candles (candles, not positions) and will loose almost every short one. Besides, Asian session often has strong influence on GBP/USD pair - breaking even strong supports or resistances and raising/dropping price even 100-150 pips and more. So, when placing an order, those support/resistance levels must be taken into consideration. For breakout strategy one must place order above/belove those clear support/resistance levels, not above/belove 5 hour price maximum/minimums, because price often tends to break those false levels only 5-10 pips and then totally retrace, leaving a stupid trader in deepest frustration.

So, be very careful with this one.

Regards,

Makumba Makumbre

Hello Felician,

as soon as the first order is triggered (either Buy or Sell), the other one should be is canceled. This way we don't have two opposite positions running.

If you trade on a platform that allows placing OCO orders (One Cancels Other), which MT4 doesn't support, then it's done automatically.

Best regards,

Edward

Hello Edward,

Edward, thank you for your contribution. It is very valuable really.

My question is. If we put the buy and sell order at the same time for the same pair of currency, what we gain on sell we loose it on buy. Then the difference is almost zero, how do you get then profit?

Thank you again for your contribution

Felician

How often does a volatile market take out both stops, leaving you with a loss?

Hi Jyde,

It'll weather range-bound markets pretty well, there won't be much profits though. When Buy is triggered a Sell should be closed and vice verse.

News time - we don't need to worry, unless its a U.S. Non-Farm Payroll, interest rate or unemployment rate - just keep away and simply watch the market.

Other instruments - yes, it's up to you to pick the pairs. Sometimes you'll see that on one day the setups on some pairs are better (e.g. looking more reassuring & safer, e.g. with distinctive Support/Resistance zones, clear trend lines, or are supported by some indicator signals etc.) than on other pairs.

Best regards,

Edward

Hi Edward,

May i know if this your system works well with range-bound trading, because i feel there is possibility that both Buy and Sell SL and could be trigger thus leads to perhaps losses, if not heavy one.

Secondly, do we need to be wary of an impending news during the New york open?

Finally, does it work well with other instruments like EURJPY, EURGBP, EURCHF and USDJPY.

Your valuable response would be much appreciated.

JYDE.

good

Hi Ryan,

We always set 2 orders: Buy and Sell. Whichever one is triggered will be left, the other one - canceled.

EST zone = GMT-5

Singapore time zone is GMT+8

so, it's +13 hours difference.

5am EST would be 6pm in Singapore.

Best regards,

Edward

Post new comment