Advanced strategy #10-a (Complementary to strategy with Trendlines)

Submitted by User on March 4, 2014 - 00:35.

Submitted by Andrei Florian

Ok, here we go.

Myron said (here) we draw the trendline by HH (Higher Highs) and HL (Higher Lows) for uptrend and LH (Lower Highs) and LL (Lower Lows) for downtrend. We need a minimum of 2 LH swings for downtrend and a minimum of 2 HL swings for uptrend. We need be a trend follower and ALWAYS go with the trend. These are the words of Myron when the trendline strategy was presented, not mine. So, when the third time the price intersect our line we are looking for buy if we have uptrend line and for sell if we have downtrend line.

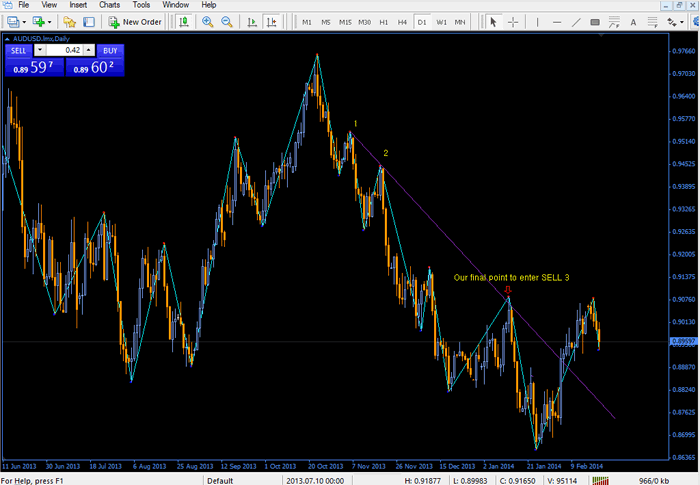

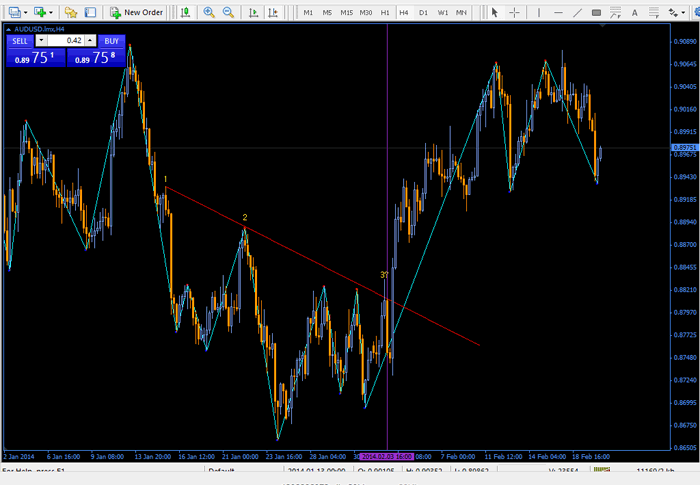

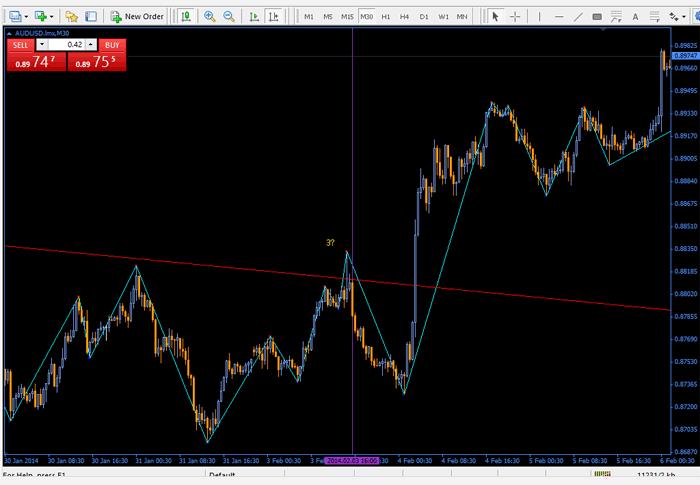

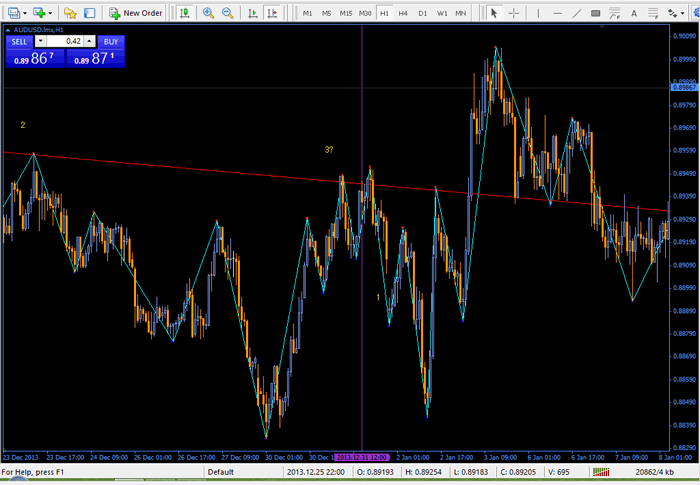

For example, on AUD/USD Daily we got a huge and clearly downtrend

After we have spotted the two first LH we draw a trendline and wait for the third test to go short. The price is touching our trend line and also is reject and trend continue to decline. Again, I remind you that until now these explications were of Myronn not mine.

Now, how do we know when the correction to the third point is over? Most of you will search for signs of weakness around the resistance point 3 and this isn't wrong but this need some extra knowledge in interpreting the weakness in single bars or few bars formations.. But what about if we go on low timeframes and look for the 123 pattern ? Yes, the 123 pattern is si simple and eficient, plus it can give us a true confirmation that the move up is over. The most efficient 123 pattern appear at the end of a move, more clearly at the top and at the bottom. In our case we 1have a top and we start looking for the confirmation on lower timeframes.

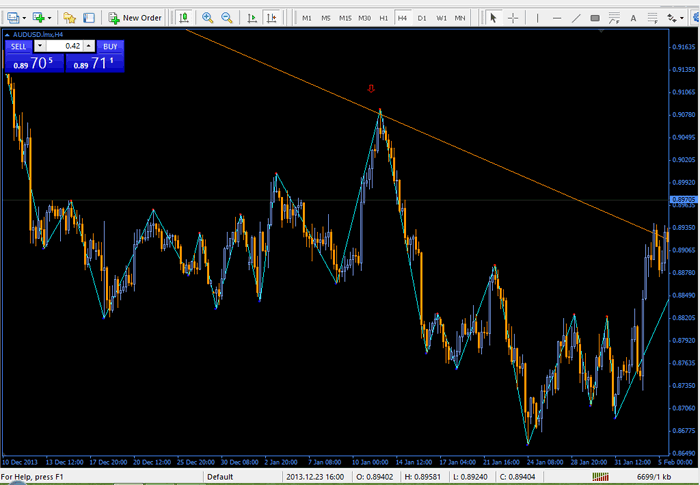

Let see what we have:

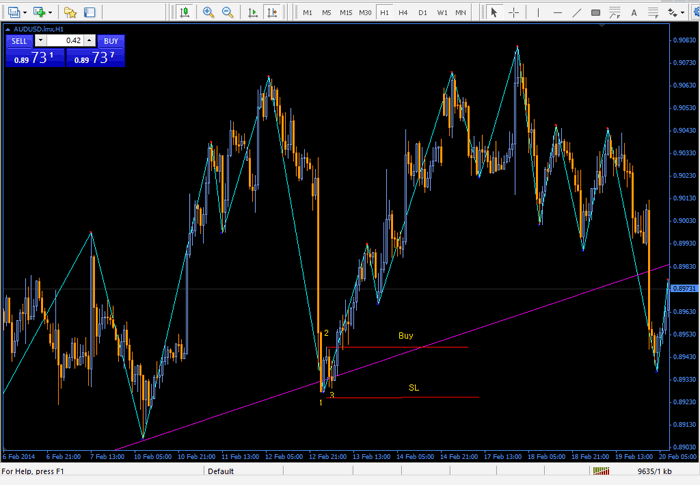

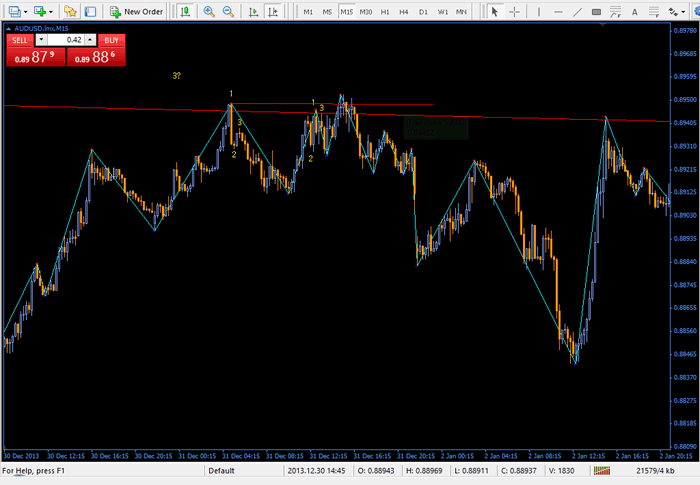

4h : we dont have 123 pattern

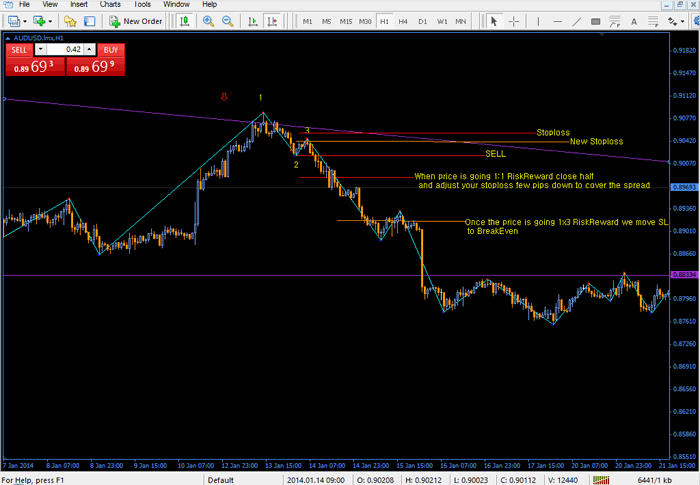

1 : we got a clearly 123 pattern that signal us the end of up move witch corelated with the Daily resistance offered by the third test of trendline this is a strong signal of sell.

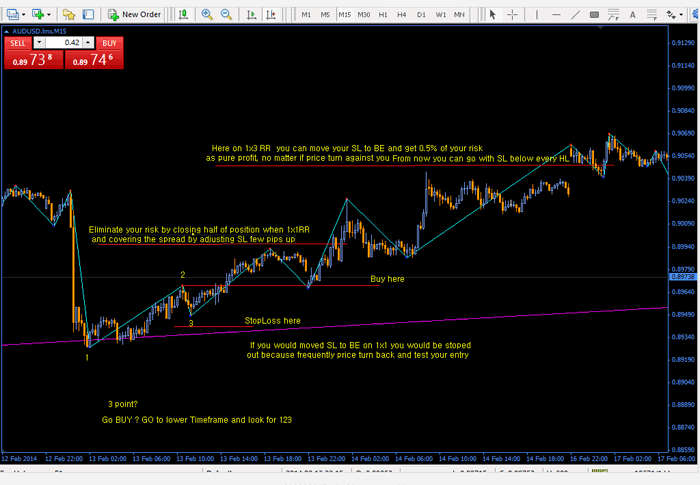

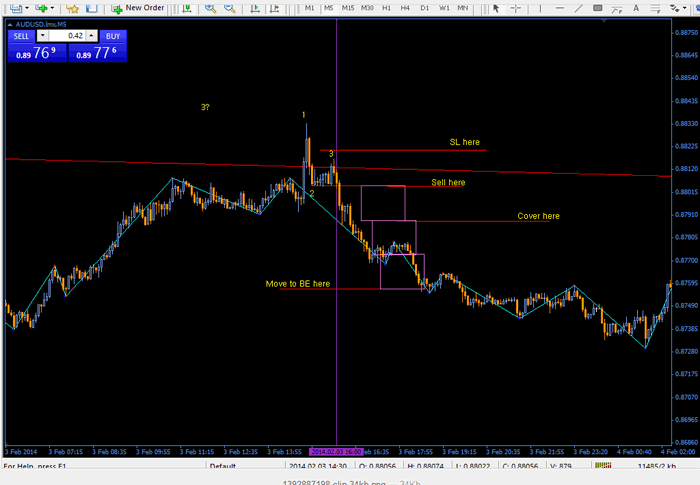

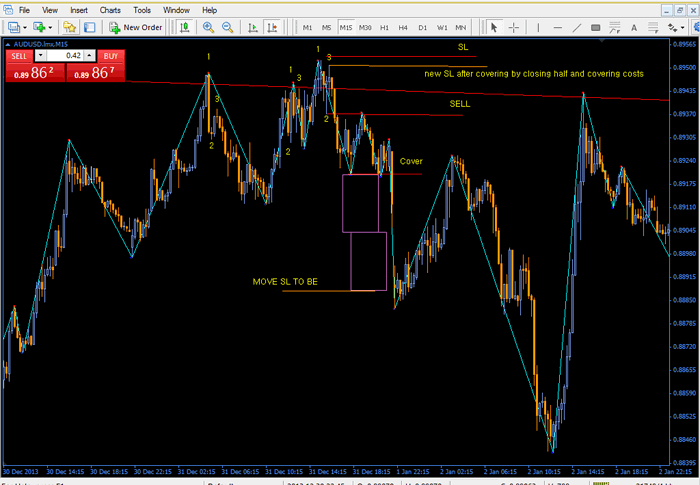

You can see also my recomended method to manage the position. Why I recommend that ? Because i don't like the fear and anxiety. What mean that ? That mean that you become feared and anxious when the price is heading down toward your TP. You don't know if the price will really hit your TP and how much he will go down you can just expect but isn't a certitude. And what I want is the peace while the price is going down. I can achieve this inner peace by eliminating completeley the risk. Because I close half of position when the price is going 1x1 my Risk and adjust the SL to cover the costs of transaction , I am completely immune to a lose. That mean if the price turn against me I will not lose any cent. Nothing. And I am completely free of emotions. That help me with my stillness and in the long term with my patience of trading. That will reduce radically my Drawdown also. Once the price is going 1x3 Risk you can finally move you last adjusted SL to Breakeven to have half of your risk as profit in case the price is turning against you. I am sure, no ! I am very sure if Myronn would applied this conservative and defensive method he would got good Drawdown. Bear in mind, a Drawdown over 20% isn't a performance if your risk is 1-2% per transaction.

But you will say probable "I don't want risk 2% per transaction and close half 1x1 and let the position run with 1% when I can let the position run with 2%". You can risk 4% and when the price is going 1x1 RiskReward you will have your position run with 2% for the rest of the move.

Bear in mind : YOU HAVEN'T A CERTITUDE that the price will touch your TP. As long as you aren't covered you are exposed to a lose. And price frequently is going 50% in the way where you are expecting to go and then turn against you. That mean you can be on the end of a move and price will create the 123 in reverse hitting your SL and run against yours expectations.

"Remember that if you practice strict money management rules, you will become the casino and in the long run, "you will always win."

This is a Golden Rule. Don't underestimate him.

I am sorry I don't have at this moment printscreens with my transactions but what I can tell you is first TRY YOURSELF on a demo account these informations for at least 2 weeks and understand if they are good or wrong. But I am sure that once you will become familiar with the peace achieved when the risk is eliminated completely the trading will become more beatiful. :)

I was tested all of these information many months with different techniques but nothing was suficcient for me until these days when I become in contact with Myronn thread and learned a simple and powerfull method to trade with the trend. I need be sincerely and admit I never traded WITH the trend because I was looking only for breakouts ,never to go with the trend. I am sorry I deleted and I haven't the myfxbook record to show you the 2 weeks aplication of this money management strategy where I've got over 100 transactions with 1% risk per transaction and only 2.4-2.5% Drawdown and zero profit. Than mean if the technique isn't good or if the price is turning against me, I can at least have zero lose.

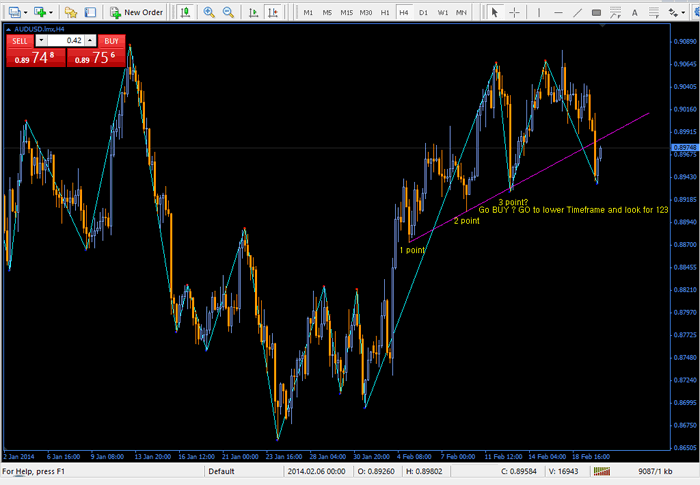

More examples of combinations of trendline and 123 pattern :

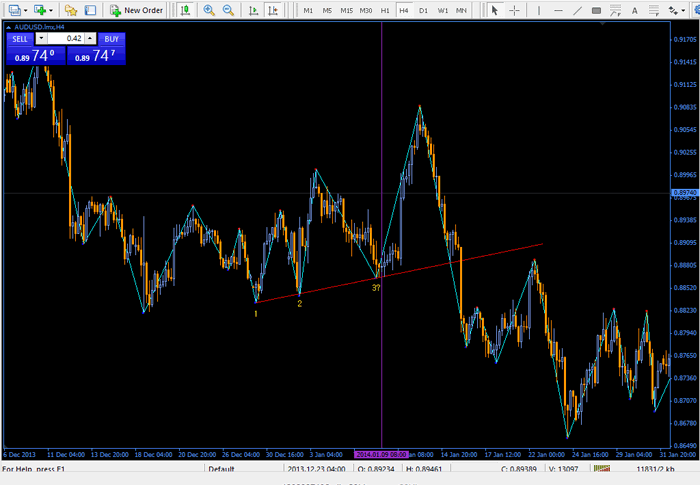

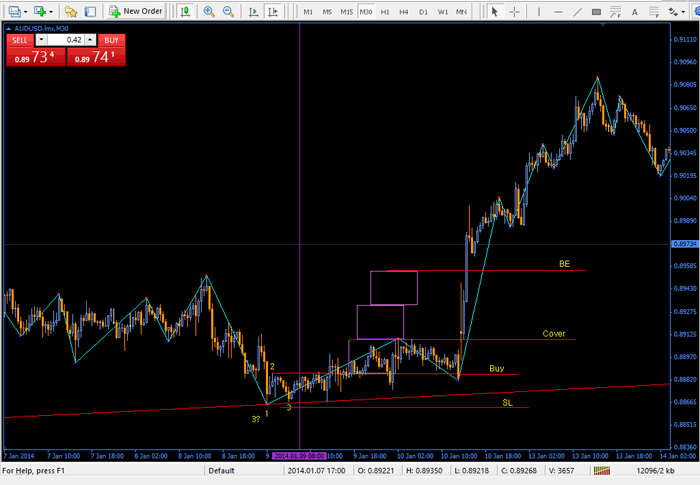

4h we got a uptrend line

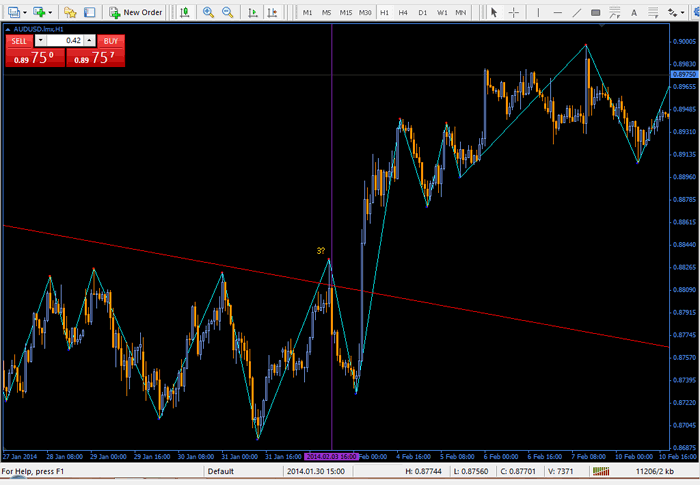

Now we are looking for 123 pattern around this third point of support to go with the trend.

Bear in mind, the indicator SwingZZ isn't all time draw the 123 pattern near the third point and you need spot him in advance but this will become easy once you get familiarized because is a mini zigzag or mini abc corection but MUST BE on the third point of intersection or fourth etc.

We can switch on lower Timeframes and look for the 123 pattern created by Swing ZZ but the more the price move from our third point the more risky our entrance become especially if we want play defensively with MoneyManagement strategy.

Here we have

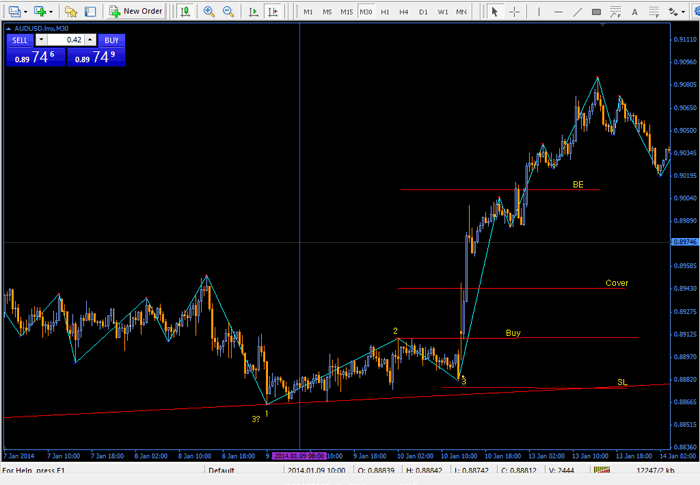

More examples :

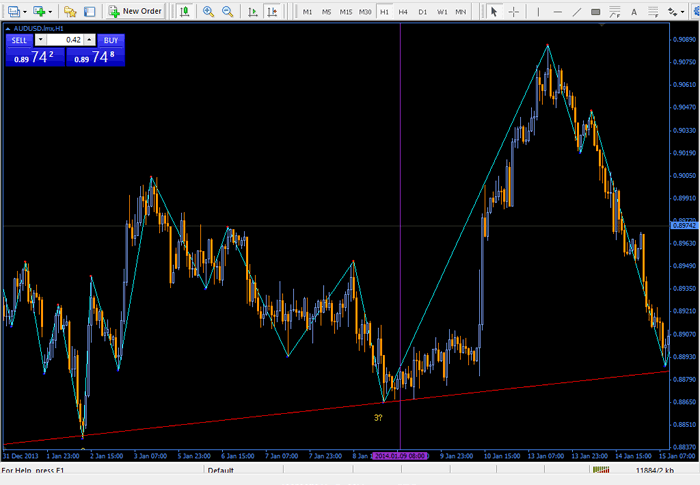

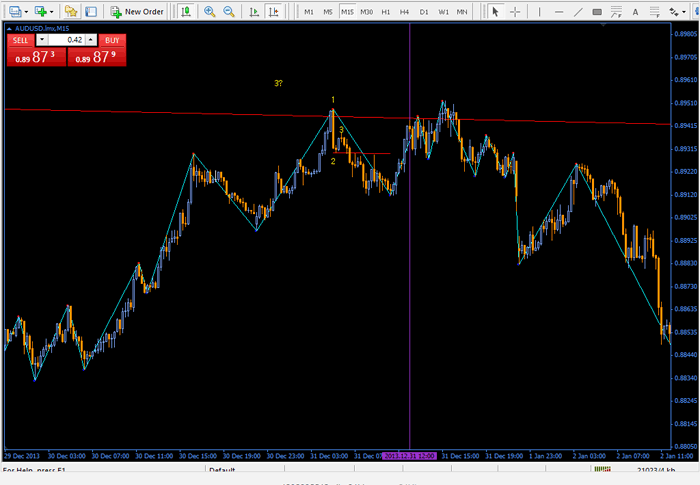

We switch to the lower tf until we got a clearly 123 pattern.

1h : we haven't the confirmation

30m: we haven't the confirmation

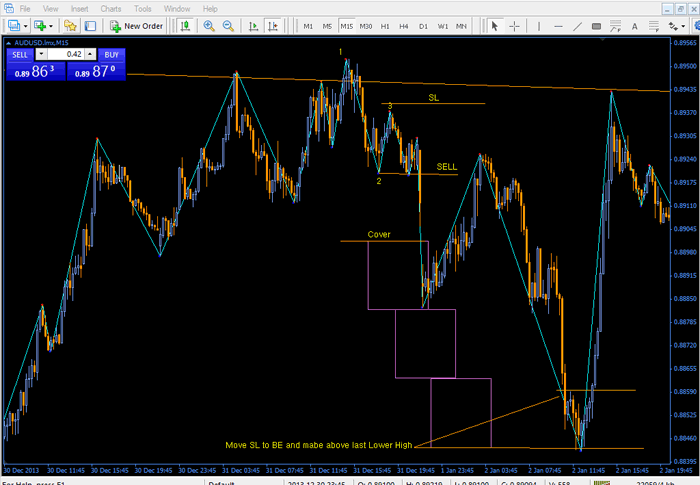

15m: We have the confirmation , I have spoted but probably you didn't.

5m : Great entry

Bear in mind, every time we have congestion the price will break with explosive force. In our case we got the 2 point at the lowest range of a congestion. A congestion can be an inside bar at higher timeframes.

It is important that to show you on this example how the price turned against you before hit your TOP on the previous low.

DON'T BE GREEDY ! Play defensively. Cover your position and sit relax, life is beautiful in stilness :).

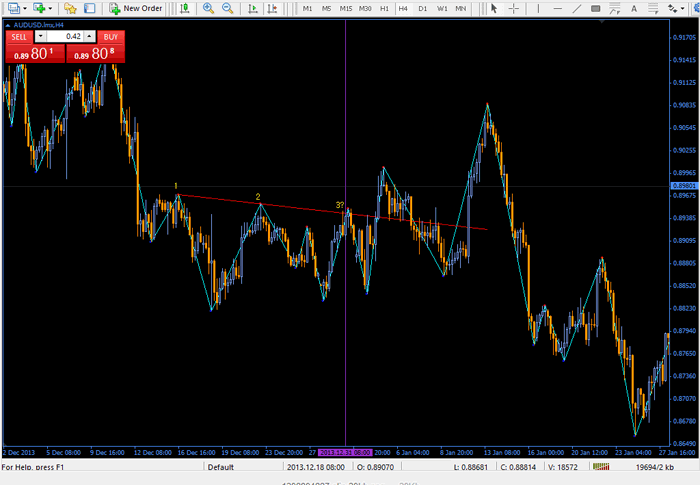

h4:

h1:

30m:

agressive entry or

delayed entry by swing created with ZZ

The next example will show you the importance of playing defensively with Money Management Strategy

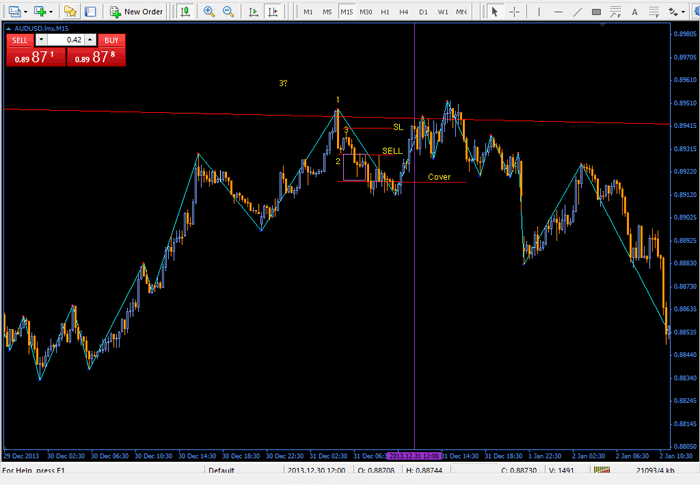

We got our trendline on two points and we have third possible point. The bar intersect the trendline creating resistance . This is the first sign that alert us the price might go down from now.

We want go with our friend, the trend, and start looking for the confirmation of reversal, more exactly the 123 pattern. Remember, any corrective move is a minor trend on a lower timeframe. A trend is over with 123 pattern that signify the begin of a conversely move, this is how Dow Theory explain.

I remind you that we are starting looking for 123 reversal pattern BEFORE the close of the bar that intersect third time the trend line. This will give us an very early entry with good reversal confirmation. As soon as we have the trend line intersected we don't have to wait the close of the candle, we zoom to the lower timeframe and start looking for reversal.

Let see what happen on lower timeframes.

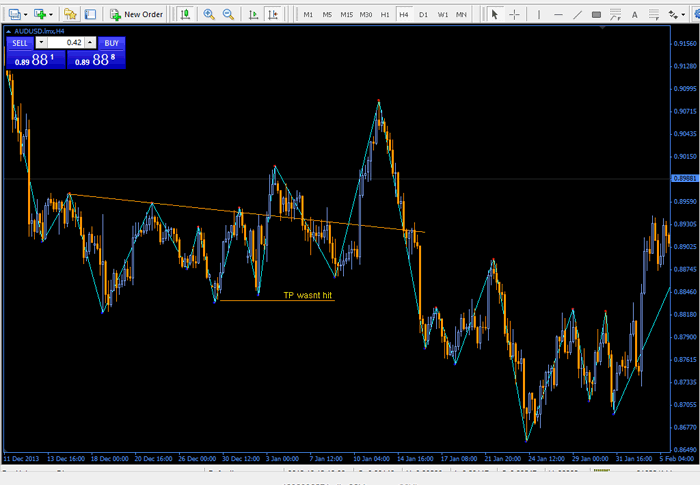

1h : no clear signs of reversal, just higher trend on its corection

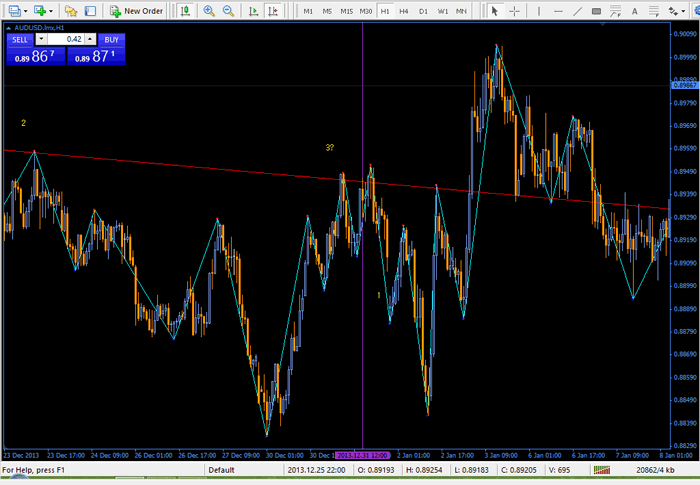

30m: I see the 123 formed but probable you didn't saw it so let consider no clear signs.

15m : oh yes, here the princess

Let see how we manage this position using our defensive Money Management strategy

As you can see after we covered our position price ran up and hit our STOPLOSS. Did we lose something ? If your answer is NO then you have understood the Money Management Strategy. Nothing win, nothing lose, just looking for the next opportunity around this third point of downtrend line.

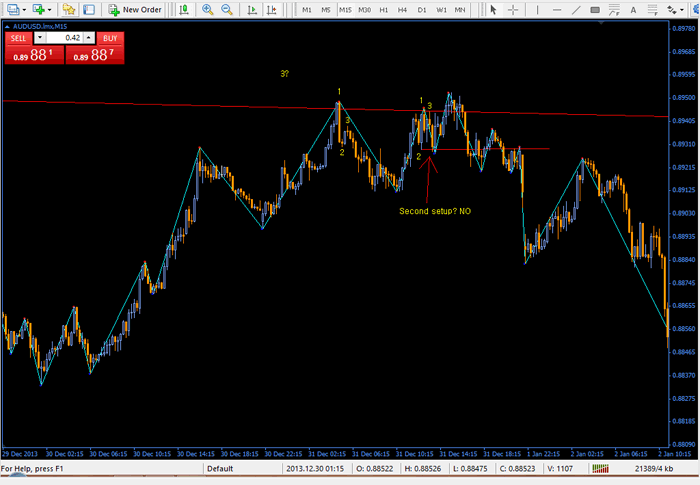

In the above printscreen is a good 123 ? I think NO, because the point 1 of a 123 pattern always must be the highest point of entire up movement, for a uptrend, and always lowest point of the down movement, for a downtrend. For those who would mistake , don't worry, it's a lose, the high reward potential will cover your lose as you will see. It's like firing with a gun at the target, you can miss 2-3 shots but finally you will hit the centre that will give you the prize.

In the screen below our price created a new high over the first point of our first 123 pattern that failed and stoped us out with no lose no win.

Now we are looking again for 123 because we are again at intersection. The game isn't over. Let see what happen.

or mabe you prefer ther 123 designed by swing zz

Wohoo, this is what we like to see, eh ? :) Bear in mind, we didnt get the price at our tp , because price failed hit our TP.

Your job is to experiment with trailing SL and 123 pattern. Sometimes they appear undesigned by zigzaz sometimes they appear designed.

. Chose the method you like and dont forget, TRY ON DEMO FIRST !

I would like receive updated with your results.

Regards

O zi buna,

Andrei Florian

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Post new comment