Advanced system #6 (Picking Tops and Bottoms)

Submitted by Edward Revy on July 15, 2007 - 07:29.

Were you told not to hunt for tops and bottoms when trading..?

Why not break the rules when you can tell with an astonishing precision where the next top or bottom will be?

Here is one very nice and accurate trading system that could make your Forex trading entirely about hitting the right spots.

Trading setup:

Time frames: 5, 15, 30 minutes, 1 hour, 3 hour and 1 day – just one chart at the time will be used.

In case you do not have the exact time frames, simply substitute them with the closest ones. For example, 15 min can be changed to 10 min, 3 hour can be changed to 4 hour etc.

20 EMA and 40 EMA on all time frames

ADX 14 for all time frames.

Currency pairs: any.

The idea behind this Forex method is that ADX helps to measure the strength of the trend while 20 EMA acts as a flexible support-resistance line.

Trading rules:

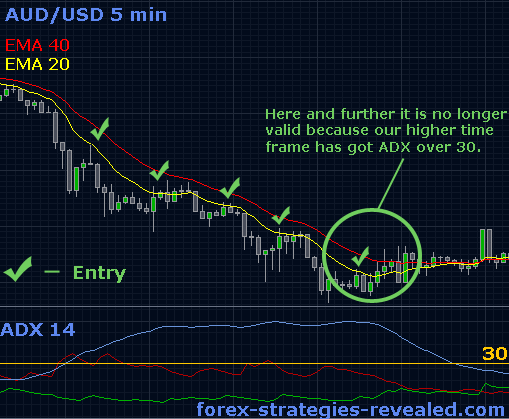

Our first goal is to find the chart with ADX being over 30 mark, which will indicate a strong trend. We start with a daily chart and continue the search moving downwards (3 hour, 1 hour, 30 min, 15 min, 5 min) until we find the chart with ADX being currently over 30.

Note: In case several time frames meet requirements for ADX, we opt for the highest time frame. That's why we start with the highest frame first.

Having chosen the time frame, we are ready to trade the first bounce off of the 20 EMA. We set a limit order close to 20 EMA accordingly: in a downtrend we expect the price to touch 20 EMA from below, then reverse and move down, in an uptrend – from above, reverse and move up.

Always make sure that at the moment of entry you are using the highest time frame with ADX currently over 30. Only then you can expect the price to obey 20 EMA.

That's it.

Initial Stop loss order is placed above (when short) / below (long) the 40 EMA.

Important note: once in the trade stay with the time frame used for entry.

Risks: looking at the charts traders will find that at times the price reverses exactly at 20 EMA, but sometimes it moves even further before making a u-turn. Always be ready to leave some room for the price to make this turn, that's why we suggest using 40 EMA for stops.

Exit rules:

Option 1: Use Bollinger Band with settings (18, 2) for all time frames. Set a profit target at the outside band. Move your profit target as the Band expands or narrows.

Option 2: For traders familiar with Fibonacci tool, profit target can be set to 1.618 expansion level. AB Swing for Fibonacci should be found from the earlier price moves and the actual point of entry should be considered as point C or a retracement.

Option 3: Once the price clearly moves in your favor move the stop below/above (Long/Short trading) the previous price bar. Adjust the stop with each new price bar. Trade until stopped.

Also exit always if ADX goes below 30 on the time frame which was used for entry.

That’s it. Test it and see that it works remarkably well.

P.S. Accuracy of this strategy is quite difficult to backtest/visualize using historical data. If you decide to do so, make sure you do it right and know what time frame should have been chosen for trading at any given time. The easiest way to analyze current strategy performance is by running it in real time.

Happy trading!

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hi,

Is there a trading platform that can give an alert when price touches the 20ema?

Regards

Sunny Star

Following this strategy.... I've found a candle touching 20 EMA from below with ADX (14) over 30 line but it's like approaching towards 30 level.... Should I enter at such level as the ADX might touch 30 or go below it in next candle.... Trend is downwards though in both larger and smaller time frames except at smallest time frame.... How should I act to such case.

Sohel (Newbie)

Hi Edward

I am a newbie and trying to figure out how to use this strategy. How do i physically set it up on the trading station? So far i have gone into Marketscope and 'add indicator' then clicked on EMA and changed it to 20....don't really know what i am doing or why, would you mind very much explaining this in detail for me so i know how to set it up to try a trade?? thanks

Natalie

Hi,

Thank you for your feedback.

Unfortunately, I don't think I'll be able to give some good advice, since I don't trade commodities.

Kind regards,

Edward

Hi Edward,

first of all thanks a lot for your precious didactical activity. I applied some of your advanced trading strategies to forex and they worked well. Thanks again. But I have a little question for you: I trade forex but my principal trading area is commodities. Well, do you think some of these strategies could work as well on, e.g., gold, crude or soybeans? Do you trade commodities as well? I use a simpler version of this advanced#6 strategy that is known as 'holy grail' strategy and has been revealed by Linda Raschke; it looks similar, except for the down-scaling time frames. Do you think this way to scan down the time frames in search of the 30 adx value and retracement to 20 ema could work in commodity futures as well? And what other strategies could fit in your opinion?

Thank you so much. I was honestly just doing the same thing but using an ETB for support and resistance, but this is much better.

ADX is the perfect indicator for confirmation while scalping trend pullbacks.

Hello ! I would like to know if anybody is making consistent profits using this strategy ?

Thank you.

Could be that some platforms don't include Saturday and Sunday data into the calculation, or may these are different types of ADX, when, again, one of them uses Mon-Fri, and another a whole week.

Also, keep in mind that different platforms can run in different time zones, so the day and hours will start with a shift, thus affecting the calculation of the daily ADX.

Hi Edw.

i just noticed tt using MT4 on diff. providers the ADX(14) on daily basis gives diff. values. check att. snaps and advise how this happens and how to know which is the correct one.

thks

brgds,Andy

Thank you, Sazu!

I'm really glad you're becoming a better swimmer in these challenging Forex waters.

Keep it up! The more you learn and practice the better you trade.

Best regards,

Edward

Hi Edward, your site is super, whitout this I`d be sunk in the sea... but now am trying to survive jajaja

I also want to thank a user called PANI, for the comment about charts on FXCM, really surprising to know as easy is put the 3 hours or any-time charts!!!

Your knowledge let us get some more in between us, more to thank you Ed!!

Sazu. Mexico

This is a nice complement to my RSI14 reversal strategy. I am a 10 pip scalper using

We screen all time frames to find the best/strongest trend.

Using one ADX on a fixed time frame is fine too, absolutely, you'll just be waiting for the opportunity to come to you on your time frame while we hunt for the opportunities across multiple time frames.

Best regards,

Edward

I cann't understand the logic behind the use of higher time frame with ADX > 30.

Why cann't we use a fixed one to work with?

Hi Udom,

You have just answered your question. When you see a divergence - it is a warning for you to watch out for reversal. I wouldn't trade against a clear divergence signal.

Thomas

Post new comment