Forex trading strategy #11 (Arsalan's ADX+EMAs cross system)

Submitted by User on August 24, 2008 - 15:50.

Hello everyone my name is Arsalan and before i proceed i want to thank Edward Revy and all the other people who have shared their amazing trading systems over here.

I have learnt many trading systems at this website which i use in my trading and they work very well for me. I have been using a strategy which gives me consistent profit so i would like to share that strategy with everyone over here.

The strategy is as follows:

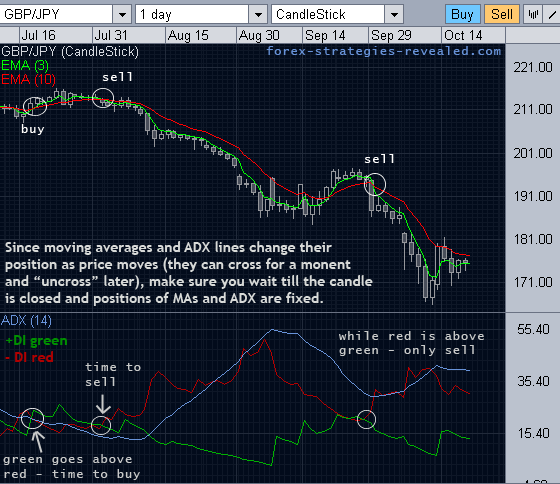

Time frame: Daily.

Indicators: 3 DAYS EXPONENTIAL MOVING AVERAGE.

10 DAYS EXPONENTIAL MOVING AVERAGE.

ADX (14)WITH +DI AND -DI.

BUY SETUP : +DI MUST BE ABOVE -DI .

BUY WHEN 3 DAYS EMA CROSSES 10 DAYS EMA FROM DOWNSIDE TO UPSIDE.

SELL SETUP: -DI MUST BE ABOVE +DI

SELL WHEN 3 DAYS EMA CROSSES 10 DAYS EMA FROM UPSIDE TO DOWNSIDE.

I use this strategy for trading stocks but i hope it will work for forex also because the systems mentioned here for forex trading works well for stock trading that's why i thought my system will work for forex as well. Please paper trade this strategy before you trade with real money.

Once again i want to thank you and please pardon me if i have made any mistake in this article.

Bye

Happy trading

Happy profitable trading to you as well!

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hi arsalan.. i would like to ask. How do we setup the adx indictor.

The levels we set it to 20 and 40

But for the color part. There is a lightseagreen, yellow green and wheat?.. How do we know which is +DI and -ve DI?

How do we set it to be the same like yours?

The indicator was taken from http://forex-indicators.net/adx

Download link: http://forex-indicators.net/files/indicators/mt4/ADX.mq4

Please help.

Thank you

Thank you very much for this wonderful trading setup. I was wondering just how long are we suppose to ignore ADX when it's falling. You said when ADX is falling from a high buy point it's useless that we should ignore it and wait for another trade setup, so my question is how long do i have to ignore it? What if it falls and suddenly starts rising again, should it still be ignored?

At what levels are these swings important. Thanks.

thnx arslan..........really helpfull for me

Hi all,

I got the best results for

EMA 60 and 90 and ADX 60. I also noticed, changes of DI+/Di- period do not impact strategy performance so much.

Christoph.

how to download this file ....wer is the option

The best entry with this strategy is ADX must be =>25 when the Moving average crosses.the above is not right.

ADX =>25 and -D above +D and FastMA cross above SlowMA for BUY

ADX =>25 and +D above -D and FastMA cross below SlowMA for SELL

This will also filter out Side-Ways market

Hey man, you should be aware of the fact that the ADX is a little bit slow for the Intraday Chart, so you should accelerate the ADX by calculating it with 9 periods instead of 11. You should be aware of the fact that if you had a decretive ADX there is not a probably trend going on. You should only trade with a crescent ADX that is oscillating in the middle of the DI- and the DI+. You should filter up this Moving averages crossings by using these configuration of the Directional Movement.

Regards, Enrico

I use EMA 5 and 20, try it

I am Mallikarjuna K,I congratulates to your good stratagie.It is very five.

It's either a sure-fire late entry or a number of faster false entries...

What about late entry? i see in my chart the EMAs already crossing far behind.

Arsalan suggested Daily TF.

With higher time frame - fewer false signals.

any time frame also can?

I believe this strategy may work better in forex than stock! I tested such strategies combining DMI and MA using Ninja trader, and it works very well in forex, especially the strong trending pairs, such as EUR/USD. The disadvantage of it is it will send out many false signals when in whipsaw or not in a strong trend. Because forex and future has better trend than stocks, so I guess this strategy may works better in forex/future than stock market. Thanks.

What strategy do you prefer on a daily chart, this one or the Stoch + EMA crossing one?

Thanks for the tips/info.

Dave

Post new comment