Scalping system #14 (EURUSD scalping with Bollinger Bands)

Submitted by User on April 15, 2010 - 16:05.

Submitted by Hessel

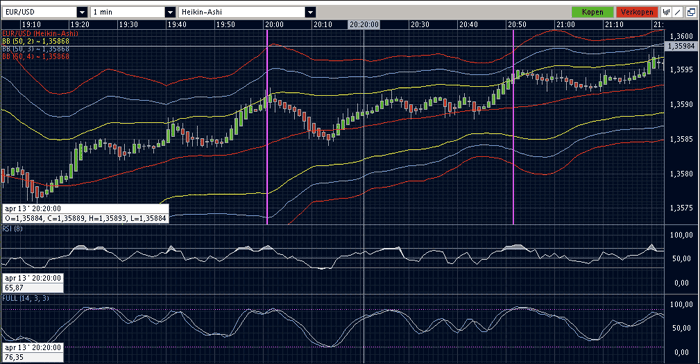

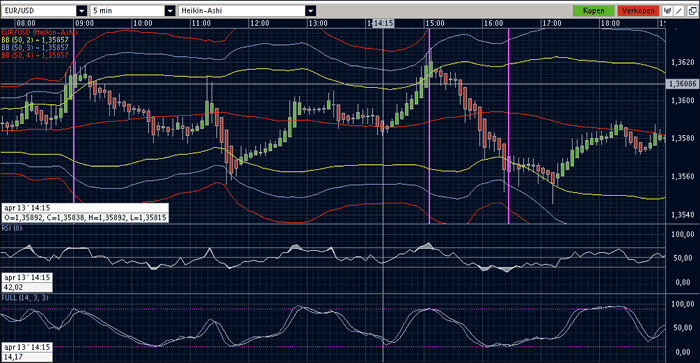

Currency: EUR/USD

Time Frame: 5M, 1M

Before I explain my simple scalping system, I have to thank Chelo who posted ''Scalping system #7''. I love the simplicity of the system, and it seems to work pretty well! However, I was not fully satisfied about the entry-rules and the stop loss. Prices can move up and up and up between BB 50-2 and BB 50-3.

So I thought about tuning the system up a little bit, making the entries more reliable.

To do this, I added RSI 8 (lines on 30 & 70) and Full Stochastics 14,3,3 (lines on 20 & 80)

We now use the following indicators:

Bollinger Bands period 50 deviation 2 (yellow)

Bollinger Bands period 50 deviation 3 (blue)

Bollinger Bands period 50 deviation 4 (red)

RSI 8 (horizontal lines on 30 & 70)

Full Stochastics 14,3,3 (horizontal lines on 20 & 80)

The entry rule stays the same, when price crosses at least half way to the upper blue bollinger band, we sell. Price will retrace to the middle red line (MA50). This is where we take profit! Taking profit a little bit earlier could be wise, because it is not 100% guaranteed that the retracement will move all the way to the MA50. But, ONLY sell when RSI is above 70 and the Full Stochastics (almost) hit the 80 line.

Opposite story for a long entry!

I don't use stop losses with this system, because (especially on 5M time frame) entries are nearly almost a success. When prices go the wrong way, I just double my bet! I take profit when price nearly reaches the MA50 during a retracement. Having patient is very important when using this scalping system!

All credits to Chelo! Happy trading!

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

I think this strategy is great is just you all need to put stop loss on every trade. Market is very unpredictable. It can go against you very quickly and lose all your gains for the day. My only suggestion is to stop your losses as quickly as you take your profits and move on and wait for another opportunity.

hi im john

i've tried this system, and you can win the 80-90% of trades gaining 3-7 pip each one but if you wrong just one of them, you'll lose the entire gain of the day.

how to avoid those high lose?

thanks

hey i've tried this system

and i think when the candels become more big than 6-7 pips is better to don't entry because it will stay in that way for more time

Hessel scalping stratege is very nice.

Follow this strategy as it is described here and you are guaranteed to lose a lot of money. Only idiots do things like trade without stops and then double their bets when prices move against them. Stay away from this sucker strategy.

Hi Hessel,

Do you have any tips regarding the best time to use this very awesome system? Thanks for this post. It really helps me a lot to recover back from a very huge loss.

Noob Trader :)

very good system :)

how can i enter the market, if price with touch uper first yellow, then we should open sell positive with top red line. ?

My advice is when market opens look for a up or downtrend if there is no trend do not enter, wait for it to trend then when it's done and starts ranging then start trading with this strategy. I t will reduce bad trades.

Andres

In my opinion i would suggest when it's ranging with very small candles(basically they stay in the same place), i would not enter the trade even if all the conditions are met, because sometimes it skyrockets and you would lose pips. So it's better to wait.

I agree with above user. If you wait for the reversal candle color to close first it will dramatically decrease your draw downs.

Hi, I'm Wee.C, just came across here and trying this strategy for past 2 days. Working just fine but I do found out i trapped during market trending. Is that any way to determine whether the coming market is trending?

regards,

Wee.C

Heiken ashi candles work well when the market is trending but not so much when the market is ranging.

And another thing: it would be wise to check if the price action has not breakout from R1 or S1 pivot points when we are about to trade. I guess some losses -even few- done with this system are those where the price overshots the bollinger bands but also breakouts from the pivot points.

Altogether it should be a great EA. I'll code it into my stack :P

Make sure to wait for the reversal candle before entering the position. Stoploss just above last candle's high. You can do that each bar or each tick: if doing it each tick enter the position as soon as the price drops from the last candle's close.

I would actually close 75% of the position with a fixed pip profit or just after the reversal candle closes. Leave the rest with a trailing stop or just leave it to see if it reverses to the moving average.

I am including this into my own EA right now :-)

Post new comment