Forex trading strategy #5 (5x5 Simple system)

Submitted by Edward Revy on February 28, 2007 - 15:46.

Just look what this trading strategy has to say. It's a simple yet quite promising Forex trading method. Trading strategies like this can only be discovered through a long and determined observation of the price behavior.

To start:

Currency: ANY

Time frame: 1 day

Indicators: 5 SMA, RSI 5

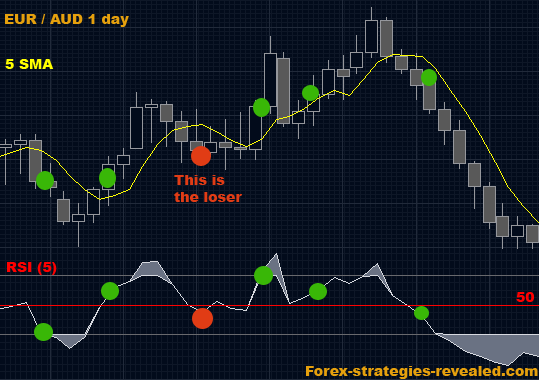

Entry rules: Buy when the price crosses over 5 SMA and makes + 10 pips up, the RSI must be over 50. Sell when the price crosses below the 5 SMA and makes +10 pips down, the RSI must be less than 50.

Exit rules: not set.

It is a very very simple system, yet with quite impressive results.

Always remember to take actions/enter the trade only after the signaling candle is closed.

This Strategy or trading idea can be used to create more advanced trading version.

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Just take RSI off the chart. Play only the SMA as described, with some little changes:

1.- When day candle close above/below SMA and break previous candle in the same direction, enter trade.

2.- If a rising/falling candle hit once SMA against his trend, be ready for a trend change placing a buy/sell stop at the break of that candle.

3.- If a candle (or candles) in his trend does not touch 5 SMA, reverse de trade IF another candle touch it in opposite direction.

Thats all.

Biscuit.

Thank you Edward for posting this simple strategy!

I have read all posts several times and I may have missed the answers to the following questions:

Scenario1:

When price has crossed the 5 SMA and that candle becomes the Signal Candle at days end upon close, and the 5 RSI has not crossed the 50% in the same direction, we wait for the next daily candle to close. If the 5 RSI has then crossed the 50% we have the entry requirements met.

Question 1:

Do we use the original signal candle to determine our Entry and Stoploss or do we use the new/last candle that gave us the RSI cross to determine our Entry and Stoploss? (High+10 Long or Low-10 Short) OR

Question 2:

If the new candle after the Signal Candle has made a Lower Low than the Signal Candle minus 10, do we use that candl's low minus 10 for an Entrance?

Scenario 2:

Suppose I took a Buy Trade, and have taken profit on that trade, then the price travels below the 5 SMA but does not close below the 5 SMA (leaves a wick through it) and once again closes above the 5 SMA with the 5 RSI still above ths 5 SMA

Question 1:

Do I have another Entry? Or

Question 2:

Do I have to have a close below the 5 SMA followed by a close above the 5 SMA for a re-Entry Long?

Thank you for all you have done!

Fxarcher

Hi Brendan,

it's Simple MA.

Hi Edward,

Can I ask if the SMA in this strategy is the 'Smoothed MA', 'Simple MA' or 'Slow MA'?

Thanks Brendan

Hello.

Looks a simple system.

Today I tried the system in demo mode on 4Hr chart and ended up losing 5 trades on 5 different pairs. Candle obeyed 5 SMA, RSI lined up in the right direction but price did not obey anything!! Anyone can give some insights on this?

Dr. Rajgopal. V

Hi guys was wondering how everyone is getting along with this strategy?

Ive been trading it on my demo account for a month(eur/usd & dax 30) so far i have a 48% win ratio & my accounts up 10%

Has anyone tried entering on the open of the candle (after the signal candle) instead of waiting 6 pips after the candle high/low?

Ive also found that its better to place buy limit & sell limit orders if your targeted entry is close to a pp, r1, s1 etc on a 1hr chart (e.g if ur going short & ur planned entry price is close to s1, wait for price to go beyond s1 then place a sell limit order 2 pips below s1)

Using this method ive been able to pyramid positions & scale out capturing profits!

Marcus!!

That could be an option.

Cheerrs

you can also trade at 15 min tf for a few pips along the day

greets

where do we take profit?

See exit strategies:

http://forex-strategies-revealed.com/money-management-systems

yes, but even we start a trade how can we manage the exits??

Hi Max,

if you have done an extensive backtesting, then you can spend less time on demo, but you still need to do the demo trading for 1-2 months.

There are plenty of opportunities in the market, and they won't go anywhere. I'd say, by the end of the year you'll earn even more money if you invest a bit more time into the research and testing, than if you start trading earlier without proper preparation.

Regards,

Edward

Hi Edward,

a general question. If you backtested a strategy successfully, not with an EA but by hand on paper, for the data of the last few years and you make consistent winnings out of it. Is it adviseable to trade this new strategy first on a demo account? Or is the risk of extreme deviation between the backtest-results and livetrading-results so small that you could start directly trading with real money?

Best regards,

Max

Yes, we do.

We wait for all signals to line up.

If SMA + 10 pips requirement is met earlier than RSI requirement, then we wait for RSI to give us a signal, and then we can open a trade.

Regards,

Edward

hi Edward ,

thanks for this simple strategy , if a candle closed above 5sma but the rsi is still below 50 , the next candle moved 10 pips and rsi still below 50,do we enter the trade whenever the rsi cross level 50 >>?

Post new comment