Advanced system #15 (THE SWING 15 min TECH)

Submitted by User on April 11, 2010 - 09:37.

Submitted by Olivier

Traded pair: EUR/USD, GBP/USD, EUR/JPY, GBP/JPY

Time frame: 15 Min

Trading hours: 6.45 am to 5 pm, PARIS time, GMT+1

1 – WHEN TO OPEN A POSITION?

The first work of your trading day will be to draw on each graph and for each pair: resistances, supports and trends lines. First from 4H time frame, then on 1H time frame, and finally on 15 min time frame.

*You have to choose one colour of lines for each timeframe, as you will understand how strong your support, resistance or trend line is when you will be watching on 15 min.

*A trend line will connect minimum 3 points

*This marking takes only 15 minutes, and at 7 am, you will have 4 graphs EUR/USD, GBP/USD, EUR/JPY and GBP/JPY in 15 min time frame.

Now we are ready to trade and we just have to wait for the signal on our screen!

When a 15 min candlestick closes above or under a trend line, support or resistance, we have a signal to go long or short. WE CAN OPEN A POSITION!

Ok great! But how much should I risk or expect on this trade?? Let’s look the following

2 – WHAT WILL BE THE SIZE OF THE POSITION?

This is the most important part of this trading technique!

Most of the traders think of how many pips they want to win per trade, per month or per year.

But we will think of how much percentage of our capital we want to win per trade, per month or per year.

A- You should define the maximum percentage of your capital you are ready to risk to open a position. It could be 2, 3, 4,…., 10 %. For example – me, at this moment my maximum risk is 6%. So now you divide this by 2 ( 3% in my case) and you will have your standard risk, let’s call it K1. and K2 will be K2=K1*2

B- When you have an entry signal, you have to evaluate your stop 30, 40, 50, …. 100 pips. In general a stop should be above or under the last low or high (depends if you are long or short). Always include the spread in the setting of your stop.

C- For example, if you estimate your stop at 40 pips(spread included, which means that your stop will be at 37 pips if the spread of your broker is 3 pips), and your K1 is 3% , so it means that 40 pips should be equal to 3% of your capital.

D- Why K1 and K2? If you consider each pair separately, after each winning trade, you will trade K2 % of your capital and after each lost trade you will trade with K1 % of your capital

Let’s take an example of this to make it more clear:

Your capital is 10 000 eur and you set your risk K1 at 3%, it means that your standard risk is 3% of 10 000 eur : 300 eur and your K2 will 6% so 600 eur,

Now you have a signal on EUR/USD and your previous trade on this pair was a looser, so your risk for this trade will be K1= 3% of your capital, 300 eur

You estimate your STOP at 30 pips and the EUR/USD =1, 36 so you will have to open a position of 136K (account in EUR) and you know that you cannot lose more than 300 eur on this trade.

Now you wonder how much will be your profit? Let’s see this in the third part:

3 – WHAT IS MY PROFIT TARGET?

As much as you can!

A- you will set a profit target at the same distance as your stop. Don’t forget to include the spread

B- You will sell the half of your position at this profit target, and set a new stop for the second half at your entry point (breakheaven)

C- You will move this stop manually under or above each low or high, following the trend.

4-TIPS

This technique is very subjective in the sense that, for different traders, support, resistance and trend lines will not be seen at the same place.

Sometimes a signal should not be taken:

- After you set your stop, you see that the profit target is above a strong resistance on a 4H TF or 1H TF, so in this case you should not open a position as your chances that the prices break this resistance are low.

- You should not enter a signal on ‘news’ as the volatility will be too high

- Don’t trade before 7 am or after 5 pm PARIS TIME

- Don’t trade on low volatility days

SO THAT’S IT! If you have any questions about it, please, feel free to ask me.

GOOD TRADES!

OLIVIER

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Olivier..

How to Select entry point & exit point in this method ??

and how to select sell or buy trade through tradeline??

Hello,

Results are perfect,

I am now trading this method, with some improvement, that i found are the best. My goal was to simplify my method, as much as i could.

I trade mainly from my Iphone with OANDA, here is the new setting

Traded pair: EUR/JPY (one pair , is enough to earn in forex)

Time frame: 15 Min

Trading hours: 9 am to 7 pm, PARIS time, GMT+1

The rest of the method, is the same than before.

ROI you can expect , will depend on your risk, but let say, that it is twice your risk (risk =5%, ROI expected /month : 10%)

Write all your trades, follow your results, respect strict rules, review each trade every week, set reasonnable goals, and you will earn money with forex.

Olivier

Hi Olivier, hows the results of your trading with this method so far?

Rgds,

Robert

Any new tips for us Oliver as I consider trading this? Thank you for good instruction. Steve

This is the most difficult in this technique, to see the rights trendlines, support and resistance.

The way you see graphics is very personnal, different personns will see the same graphic their own way.

For me there are some rules that i respect in my trading plan:

-On monday morning i dont trade if there is a gap not fill in( this morning 7am GMT+1, gap not fill in on GBP/USD and GBP/JPY, so i will not trade toady this two pairs). And the followings days, i will trade only in the direction to cover this gap

-I trade only trenline breakout, if the breakout is in the opposite direction of the trend

-I open only one position for each pair and i wait for the end of the trade to take another signal(for now i m still short EUR/USD, i will not take others signal till i my position is closed)

-Usually i draw my trendlines, support and resistance at 6.45AM GMT+1 and i take the first signal from 7 AM, and i m done for the entire day. I do not take more than 2 positions per day per pair. The first braekout in the morning is the most important.

-I do not take a signal on big news

So by following this few rules, you can get good results with this technic!

GOOD TRADES

OLIVIER

-

Good job, Olivier, on jumping on the Greece concerns sell-off rally! Happy that you managed to secure a winner after a loser! Tomorrow will be an interesting day since the IMF and EMU will be meeting in Athens and if the concerns don't get a good solution we can see downtrend continue, so it's great to be in your situation: having a winner in the pocket and just sitting back and seeing the fireworks.

I've been also using the same but entry in 30 min charts. the problem i face sometimes with the strategy is somedays i'll have lots and lots of trendlines all over my chart (all of them which connects 3 ir more swing highs/lows) which confuses me whether to enter or not. And many days i misses good moves because of this.

Thanks everybody for you interests in this technique !

Henry, once you have your drawings from the morning, you just wait for the signal.

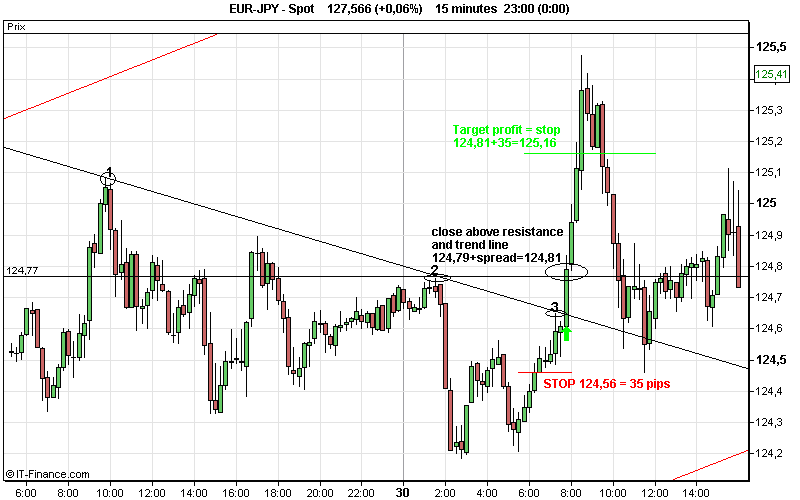

Look at this graph:

Careful! The last bar close under the support , BUT this support is not anymore valid because of the bar just before which came under the support but close above. THIS IS NOT A TRUE BREAKOUT! To enter a position the close of the bar should be the lowest under the support.

Here is an example of a trade I took on 15 April (I am still on it) on EUR/USD

It is 6 45 am (Paris time), just woke up, and my first work is to draw trend line.

On EUR/USD, nothing on 4H, so I go to 1H and draw this first trend line in red.

Then I go to my 15 min Chart and draw another trend line in black this time.

So I decide that today, I will enter a position in EUR USD if a bar close under the red trend line. It will to risky to sell if a bar close under the black trend line because we are too close from the strongest red trend line, and the chances to have a rebound on it are high.

Let’s see what happened next!

So here we have a signal to sell. My previous trade on EUR/USD was a looser. So I will trade K1% of my capital on this trade. (1,5% of my capital for me at this moment)

I want my stop to be just above the previous high, so it will be 1,3651 , 40 pips. So my Take profit 1 will be +40 pips at 1,3571. At this price I will rebuy the half of my position, and set a new stop for the remaining position at my entry price, 1,3611.

So this trade went well, half of my position was sold at 1,3571, and I set a new stop at 1,3611.

Every time I make a new high, I move my stop just above.

It is 3 40 pm, 16 April (Paris time), and this is my position on EUR/USD, my stop is set to 1,3571 and I already secured 40 pips with 1,5% OF MY CAPITAL.

hi still awaiting your kind response..i dont seem to be getting it right

Solid foundations to a strategy! There is no need for n+1 indicators, it's all about resistance, support and trends!

Great job!

Good work Oliver,keep it up!

Do we continue redrawing the trendlines as the trade progresses or is it just a one off affair. by this i mean after inputing the initial drawings it serves for the entire day's trading.

Also i would appreciate you throw more light as regards the stop loss and take profit issue.

Thanks

Henry.

I think if your capital is less than 20 000 eur , your standard risk should be

K1=1,5% capital.

I am totally agree with you, you must feel free when trading your system. If the risk is too high you will start to stress and you will not apply 100% rules of your system.

So my advice is: when you start to doubt, to stress, to hesitate... so DECREASE YOUR RISK until you feel confident. This is the secret to control your emotions.

For example start trading with 5% risk and decrase it till you re ok, it can be 0,5% of your capital or even less. But to succeed in forex, you need to trust yourself. Once you get enough trust increase your risk percentage.

By applying this way of trading, you will succeed 100%.

GOOD TRADES!

Olivier

This trading is good. I advice the K1*3 which is smaller than 3% of total capital. When you set it to 9% , you will doubt your owns system.

1) Creat your trading 2) trust your trading system 3) Follow your trading system (Strickly).

Good Trading

Cool story bro!

Супер

***

(rus.) Superb

Post new comment