Money management system #2 (Getting free trades)

Submitted by Edward Revy on July 16, 2009 - 18:47.

What are free trades?

One of the best things in currency trading is that your can trade/achieve free trading. Free trades are positions with stops set at breakeven + the cost of spread. This is achieved by rolling up your stop to a breakeven point as soon as conditions permit.

Rolling up stops is somewhere an art: you have to leave them loose enough in order to escape regular market fluctuations, yet make them tight enough in order to protect your gains.

How is it made?

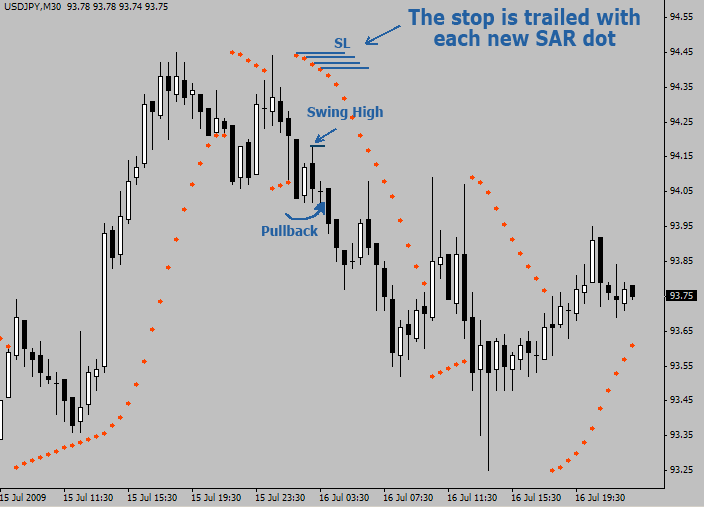

One of the easiest ways to trade with a trailing stop is probably by using the Parabolic SAR indicator.

The trailing stop strategy

After the entry, the stop loss is adjusted patiently with each new SAR dot up until the moment we reach a breakeven point OR we get a valid swing high/low.

Parabolic SAR indicator allows to avoid bringing our trailing stop too close too soon after the entry. However, once we have a first pullback and a new valid Swing High/Low (which suggests that a resistance/support level has just been found), we can immediately bring our Stop Loss few pips above the Swing and no longer rely on the indicator.

From the point we are trading at breakeven, we can fully enjoy a free trade and decide on the next stop adjustment strategy, this time to lock in some profits. One of the methods to use is to move your stop below/above each new candle ONLY after the market moves in your favor.

Here is the video that illustrated this point:

No matter what indicator/method you choose for stop trailing purposes, the goal is to achieve a breakeven point as soon and as safe as possible.

Talking about safety: I knew traders, who liked bringing stops to breakeven + 5 pips as soon as their trades were showing 10-15 pips profit. Their motto was: "why wait?"

With that approach all winning trades had only two scenarios: be stopped at +5 pips profit (it happened 90% of the time on a winning entry) or develop into a beautiful trade with good amount of pips (happened not so often).

Please note: in order to successfully use this alternative method, your entries should never be taken near or exactly at reversal levels (because such entries often develop into a negative trade first before turning into a winner - not the best option in this case) instead you should look to enter with a trend on a move that's already in progress.

Either way both scenarios had one thing in common - free trades.

The whole point about getting free trades is: there's nothing like knowing that "you can't lose a trade this time". Taking free trades is a great way to aid your money management and have a peaceful mind while trading Forex.

Happy and profitable trading!

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

This was my initial strategy, but it didn't work out so well for me for me as you still lost for trades that didn't make it to the break even point. Worse, having correctly identified a reversal, I got stopped out of a trade that proceed earn 150 pips for those in it over the next few hours. This happened just yesterday. Not to mention that several trades made profits of 50-100 pips and then reversed themselves to 0.

No doubt its a very good video, especially for a novice. However, the initial entry point is very important in order to trail stop. I also find the possibility of increasing profit by adding a trade of an equal amount, once the first trade reaches the breakeven point.

A I Comrade

Great video!!! I am surprised I don't see any comments about it, even though that strategy is one of the best to protect yourself from losing your account, and that what professional traders use. This is a really a great strategy to protect your capital. The strategy in this video, I apply it to the one-hour chart combined with an other strategy of a trend line strategy. It works a great!!!! But of course with proper money management "LEVERAGE" which is very important and at the END without DISCIPLINE, the whole strategy is a waste.

Happy trading

H Akbour

Post new comment