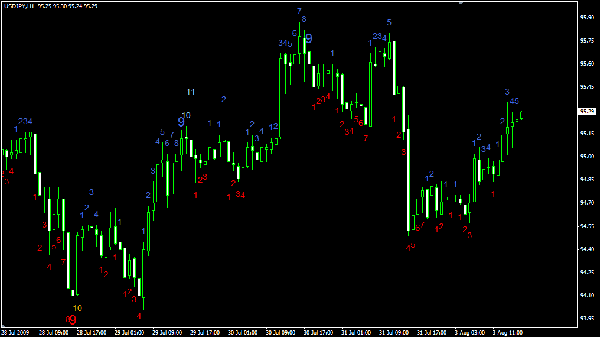

#8 TD Sequential by Tom DeMark

Submitted by Edward Revy on August 3, 2009 - 12:31.

Here goes another study by Tom DeMark.

I've pulled this system from my archives on Alex's request.

...And since we have a custom MT4 indicator already available, we have a new method to test and trade upon.

Quote about TD Sequential method:

"Currencies have long been praised for their capacity

to trend, but in today’s market, an objective

countertrend technique might be a forex trader’s

most valuable asset. TD Sequential is designed to

identify trend exhaustion points and keep you one

step ahead of the trend-following crowd."

MT4 custom indicators:

TD_Sequential.mq4

TD_Sequential_v2.mq4

TS sequential rules:

TD_Sequential_Impressive_Signals_From_Demark.pdf

TD_SEQUENTIAL.pdf

Happy trading!

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Can someone explain this in simple terms?

Layman terms..

So we buy/sell after '9' appears ? Or '13' ? When do I sell or buy??

Ron Williams an expert on TD as he studied with Tom DeMark has a webinar on TD sequential indicator and how it works on Fxstreet.com on 7 May 2012 at 15.00 GMT.

TD_Sequential.mq4 does not apply price flip, it's utterly useless.

And the second one is written by a monkey, so yeah, thanks for nothing.

HI..

I am totally new to forex and technical analysis... I chanced upon Demark's indicators. Can someone help me understand this, from basics?

My email id is [email protected]

DailyDeMark here... I want to make a comment that was made by Marie on the previous page. You absolutely must not trade the Setup 9 count based purely on the "perfection" setup. There is a 3rd requirement not discussed by anyone here: That requirement is that the current TD Setup must break through the TDST line that was established by the previous TD Setup in the opposite direction.

I.E.

XYZ records a TD Sell Setup. The lowest low of that Setup period is $50/share - that puts the TDST price line at $50/share. Current price is $60 share. XYZ moves into consolidation mode and then shows weakness. A sell off occurs and a TD Buy Setup occurs. When the 9 bar closes, price is at $55 share. The new TD Setup (a Buy Setup) did not have sufficient momentum to break through to the downside of the TDST line at $50.

DeMark suggests that this is the only time you trade a Setup 9 count. He would suggest that there will be a reversal to the upside.

Remember, the TD Sequential is not only a price analyzer but a real-time momentum indicator. That is why you cannot trade a 9 count only. A TD Setup demands a high degree of momentum,an amount of momentum that rarely is followed by an immediate reversal. If you look at the NASDAQ ETF QQQQ since late May, there have been three completed setups. All of them were immediately followed by a very brief period of consolidation or weakness... followed immediately by another Setup. You would have lost money each time.

One more note... do not trade against the Sequential trend that is a factor of five above your trading time frame. If you are trading daily bars, check the trend on Weekly bars. If you are trading 15 minute bars, check the hourly bars for the trend. Do not trade against the trend. Common sense.

For more commentary, explanation, and analysis, please read my blog:

http://dailydemark.wordpress.com/

Great stuff!

Thanks a lot for the links!

Best regards,

Edward

edward here's a free video where Tom Demark himself explains the td sequential TD combo, shows its effectiveness and explains how to use it, its a great watch

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aOp__L_lAqTM

edward here's a supplement to td sequential/combo which makes the signals even more powerful

http://dailydemark.wordpress.com/td-entry-signals/

really nice... thanks..

Pulled out yet another variation of the indicator and simplified description:

MAB_TD_Sequential.mq4

I have the book on daytrading options by the DeMarks. The authors indicate that the sequential setups can be traded by themselves as long as the qualifier related to the 6th bar is met. Otherwise, you use the countdown method. They say the methods can be used in any time frame (even 1 minute), but should be done so within the context of a trend in a longer time frame. There is also a risk that the bar labelled "9" may not be the last in the sequence. I think a test is required to determine the ratio of profitable trades, in different time frames.

Marie

and let me add, that if trendlines and this indicator from tom demark seems to be interesting, I would love to see the other indicators from Tom demark added here, like tom demark moving average and tom demark range projecting - both of which helping to project future,

In all, i read that there are 17 indicators from Tom Demark.

Wow...

Even I have not been able to fully understand the rules based on those 2 pdf files.

As per my understanding, once 9 consecutive bars have formed a trade setup, then a countdown starts and we take trade after the perfected 13th bar, right??

So, we have to wait for both the correct setup to form followed by a 13 wave coundown before actually initiating a trade based on this indicator?

Can you please throw light on this?

Thank You

Vaibhav

Could you post the simplified rules for taking a trade? Please !

I haven't actually had a chance to put this one to the test. It's been sitting in my archives and if not for a request from a trader recently, I'm not sure when I would have actually returned to it again.

Post new comment