Scalping system #10 (Capture M30 direction - xx.00 xx.30 strategy)

Submitted by User on February 24, 2009 - 08:44.

Submitted by shakin23 from Poland

We want to predict movement for the new M30 candle. In order to do that we are taking the first M5 candle (xx.00 and xx.30). Then add 2pips offset to low and high: these are our entries for buy and sell. Sl is an opposite trade. Tp is moving sl accordingly to highs and lows on M1 or tick window. When our sl is hit twice on the same candle we are waiting for another one. If the next one fails twice we stop trading for present day and start again tomorrow. I'm using ibfx mt4.

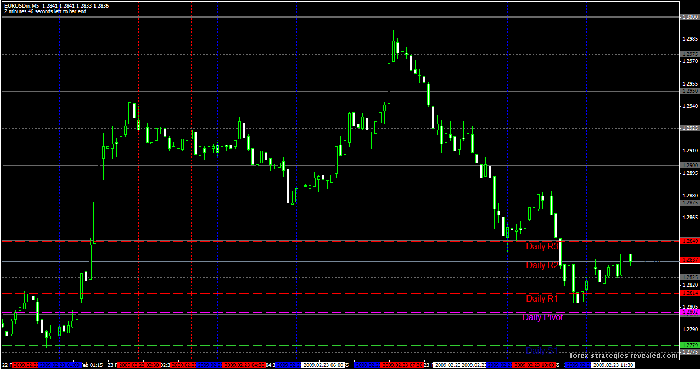

On the picture are marked entries: red - sell, blue - buy and white produced buy and sell.

I came up on this idea long time ago but just recently bring it back to the school board. Good Luck and keep up the good work.

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

how many pips you make with this systenm on 1 week?

regards steve

hallo forex trader,

I may shop only zb around 8.00 and 8.30?

Or also around 8.15 uhr?

regards steve

Once you trade it for a couple of weeks, it becomes evident that a few filters here and there wouldn't hurt. I started with the rules as suggested, but my trading quickly transformed into a new kind of strategy as brought in Moving averages (20 SMA) and Stochastic (5, 3, 3) to catch trends.

Is it critical that moniter the xx.30 and xx.00 time frames? I've been studying this strategy and don't seem to find it works any/better worse for the above times than it does for any random 5 minute candle. The only problem I have run into is the fact that when I lose by hitting my SL it more than wipes out my successful 5 pip scalps. Anyone else running into these problems? Thanks in advance.

-TR

The orders are run till executed.

You should take 2pips offset to low and high: which means +2 pips to the Highest high to place a Buy order, and -2 pips from the Lowest Low to place a Sell order.

Thomas

Hi!

Lets say you place two (sell and buy) pendingorders at xx.35.

If the two sell and buy pendingorders are not executed during the 25 minutes before the xx.00 candle appears, should I then delete the pendingorders, or let them run until executed??

And You say buy 2 pips above and sell 2 pips below. I guess you mean 2 pips above the buyprice and 2 pips below the sell price?

Thanx!

I think the author/inventor of the strategy has a great idea in mind, but somehow he failed to explain the strategy to a normal user.

I think Edward needs to make sure, that the strategy is self explanatory with clear screenshots and exit/entry strategies.

Khurram

You didn't mention that you take the five minute candle of xx.00 and xx.30, with it all steps are correct.

You'd need to test it well in order to identify the best winning pairs.

Try EURUSD, USDCHF, USDJPY and EURGBP fist.

Regarding the hours, look to trade during London and New York trading sessions.

Regards,

Edward

Hi, I want to confirm I get this stategy right.

1) I wait for any xx.00 or xx.30 candle closes.

2) Rapidly I identify high and low, put an entry order 2 pips above high to buy and 2 pips less of the low to sell.

3) Once an entry order is activated the first stop would be at the low (-2) if I bought, and at the high (+2) if I sold.

4) From there I start to trail the stop on the 1 min chart (or tick) putting my stop at new higher lows if I buy and at new lower highs if I sold.

If this is correct I would like to know if there is an hour of the day that is good to trade this strategy, for example on the EUR/USD.

Thank you very much

Hi Megadeth,

Opposite trade becomes a stop loss.

Yes, such trailing stop tool can be used.

If on 30 min candle the stop is hit twice: means that we entered a sell order, but were stopped out, then entered short, and were stopped out again; This means our trading is over for this 30 min candle, need to wait for the next one.

Regards,

Edward

Hi,

This sounds like a good strategy and I would like to try it. I would like to clarify a couple of things before I can move further.

First, what is the stop loss price for any trade? Let me give an example: Lets say, after the first 5 min bar, the buy price calculates to 1.2110 and the sell price at 1.2100. What would be the stop loss prices for the buy and the sell order?

Secondly, what do you mean by trailing the stop loss on minute bars or tick data? It is the same as a "trailing stop" order? Interactive Brokers offers a simulated trailing stop order that adjusts on each tick. Can that be used?

Third, what do you mean by if the stop loss is hit twice in any candle? Do you mean a 30min bar or a 1 min bar. How can the stop loss be hit twice in any bar? Do you enter the trade twice in the same bar?

Thanks for this interesting strategy.

Megadeth

Try this system on the pronetfx www.pronetfx.com mt4 platform

They have tight spreads from 0.2 pips and trailing stop capability from 1.5 pips

Guaranteed no requotes.

I agree with Helen . Nice method but trading it is too tedious and

stressful. 1 min. bars move too fast for me. I use Oanda and

they STILL do not offer trailing stops. Moving SL's on 1 min.

bars ?! Wow .

If someone can streamline this a bit , let's hear from you

Scott

like you mention no indicators was the starting point then i realized that xx.30 M5 candles were pretty reliable, with offset, so i took them as a signal candles, but the direction wasn't changing quickly enough so i added xx.00 candles which works well i guess. M30 idea because i find it in some way a border of scalping (i know it sounds funny cause there are no limits in forex:)). M1 bars for sl is for you to finish for example a losing day with less loss, but like i said the do not always work when tp comes to play.

shakin2 I like the idea of NO INDICATORS which often contradict each other

and lag too much. I AM curious about WHAT drew YOUR attention to the

30 min. bar/candle , specifically those M30 's that END on xx.00 or xx.30

min. bar/candle , as your starting point before continuing with the 5 min.

and then the 1 min. bars ?

Phil

Post new comment