Forex trading strategy #35 (Azim X System)

Submitted by User on May 13, 2010 - 13:34.

Submitted by Azim

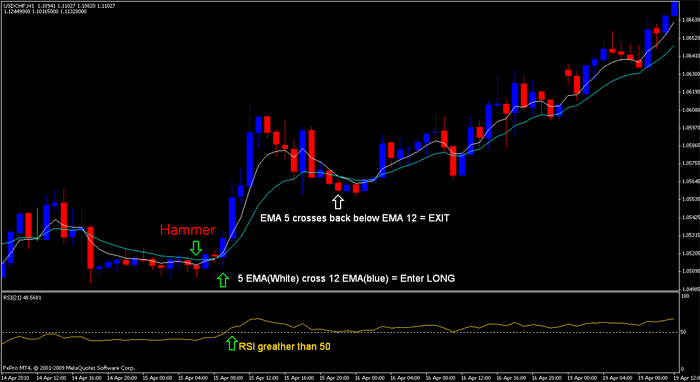

In this system, We use the following components:

1. 5-period Exponential Moving Average (EMA 5) applied to the Close.

2. 12-period Exponential Moving Average (EMA 12) applied to the Close.

3. 21-period RSI (RSI 21)

4. Bullish/Bearish Engulfing Pattern, Hammer, Inverted Hammer candlestick patterns.

TimeFrame: Any

Currency: Any

Entry Rules for LONG Trades

Two conditions must be fulfilled:

1. EMA 5 crosses EMA 12 to the upside… AND our RSI 21 > 50.

2. We’ve got confirming candlestick pattern: Either Bullish Engulfing Pattern or

Hammer.

Entry Rules for SHORT Trades

Two conditions must be fulfilled:

1. Enter short when EMA 5 crosses EMA 12 to the downside AND RSI 21 is less

than 50.

2. We’ve got confirming candlestick pattern: Either Bearish Engulfing Pattern or

Inverted Hammer.

Stop Loss:

For long trades, stop loss should be placed at the nearest support.

For short trades, stop loss should be placed at the nearest resistance.

Exit Rules for Long Trades:

Exit the trade when EMA 5 crosses back below EMA 12 Or RSI 21 < 50.

Or when price stalls at major resistance, trendline, pivot points, Fibonacci projection target.

Or when bearish engulfing patterns or inverted hammer patterns form.

Exit Rules for Short Trades:

Exit our short trade when EMA 5 crosses above EMA 12 Or RSI 21 > 50

Or when price stalls at major support, trendline, pivot points, Fibonacci projection target.

Or when bullish engulfing patterns or hammer patterns form.

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Do you have the Azim X System in a video? I am disabled and I learn easier with video tutorials. I am also very new to forex trading. Can the Azim X system be used with euro/usd ? If anyone in this forum is reading this post and is gifted with ability to create a video of this Azim x system, It would be very helpful to my learning. Of all the other forex trading strategies, this would be easier for me to learn.

Thank you all and man blessings

Hai James,

H1 and above

Hi azim, what timeframe do you use?

James

but if RSI line cross 50 at the same time as the EMAs cross is not the same thing as being above 50?

And also when it is possible to start a long move and RSI to not be over 50 but jost very close under 50.... and viceversa for short???

Look at the EUR/USD chart on 1 hour at 19 april 2011... the EMA's cross but the RSI is still under 50! How can u explain this??

yes

@Adrian: Wow this seems to be powerful. You could probably get 10 pips a few times a day.

So you enter after a close ABD

exit when the EMA3 crosses in the reverse direction?

Hello Adrian,

Whichever moving averages you are using, it doesn't matter, there is no magical number in using moving averages. The important thing is if you are very comfortable and it gives you the Positive results, that is the perfect setting for you=) because every trader has different abilities in dealing with the market.

However, with the current setting you modify, you should experiment it first maybe in 1 month time=)it's just to make sure your strategy is consistent.

Goodluck Adrian and HAPPY TRADING!

Regards,

Azim

somebody trade EUR-CHF?

Hy, I am Adrian and i like this strategy, but with some modifications.

EMA 3

EMA 12

EMA 21

RSI 14

I use 15 mins graphic.

Most of the times i saw that when EMA 3 passes under or above EMA 12 and EMA 21 in the same candlestick, gives me more confidence to enter into the trade because the most of the times the trend follows the same direction.

I am a begginer trader, and i want to ask your oppionion about my modifications.

Thank you very much for this website it helped me very much.

My pleasure;)

Azim

thanks mate best one yet and ezey

Hai Edward,

I'll be going to post a new strategy later on..But i just had some difficulties on exiting the trade, therefore hopefully all of us here can solve the problems.

Thanks Mohammad,

Well Actually i think your idea is very good,but to be honest with you i don't really know how to use awesome oscillator so do u know any web or maybe an ebook for me to learn?

Regards,

Azim

Hi AZim,

you can use smooth moving average 9( close) and 12(open) in h1 timeframe.some pairs are better than the others,totally volatile pairs.another good idea is to wait untill the price retrace and so entering in the blade for better risk to reward ratio. by the way, i think try awesome oscillator.I think it s better than RSI for filtering.

KInd regards

Mohammad

Post new comment