Forex trading strategy #26 (EMA cross + Stochastic)

Submitted by User on December 21, 2009 - 11:39.

Submitted by Arsalan, our valued contributor.

Hi friends

I have been following this system for quite some time now, and believe me, have never had a losing day.

The system is very simple and though I cannot guarantee massive profits, you will get consistent returns.

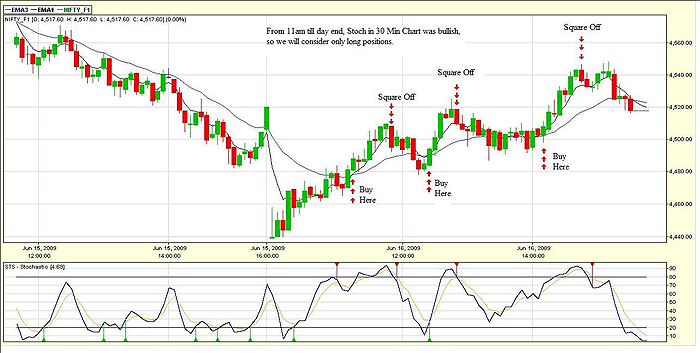

It utilizes Dual time-frame Momentum and EMA Crossovers on a 5 Minute Chart and is best suited to trade Nifty Futures,

though any stock can be traded with this system over any time frame.

Coming to the actual system now, the following is required for a long position to be initiated:

Entry Strategy

1. In the 30 Minute Chart, the Stochastic should be bullish.

(That is, the fast stochastic line should have crossed over the slow line. It does not matter how long ago the crossover took place, it should just be above the slow line and should be going upwards).

2. In the 5 Minute Chart, the Stochastic should be bullish as well.

(Fast stochastic line should have crossed over the slow line and should be moving upwards. It should not be in overbought condition yet, that is, it should not have crossed 80 yet).

3. The 5 Period EMA crossed over the 13 Period EMA from below and moves upwards.

When all three conditions are met, we buy, placing stoploss at the low of the last bar or the bar to the left of the last bar, whichever is lower.

Stochastic Setting is 8,3,4 for this system.

Exit Strategy

1. When fast Stochastic reverses from it's upward move, curves downwards and crosses the slow line from above, sell half of the units.

2. If the next bar goes below the low of the previous bar, exit completely, otherwise keep a tight trailing stoploss and enjoy the continuing bull market

-----------------------------------------------------------------------------

The second point of the exit strategy might seem confusing, but it is there as in a trending market, the stochastic might reverse while the market is still going up, so we do not exit completely on stochastic reversal as we do not want to miss out on the rally. But if the next bar goes below the previous bar (where we have exited half), it is confirmed that there might be a reversal, though short term, but we exit with the profits we have.

I tend to avoid taking positions if the crossover is near an important support or resistance level.

For going short, the exact opposite of the above rules is used.

Thats it! I have been following this and making around 50 points everyday.

-------------------------------------------------------------------------

Overall profit of around 50-55 points after removing brokerage and slippage.

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Hey guys, try RSI with the Stoch in 30 min chart. Go long when RSI and Stoch both moving upward in 30 min chart and go short when RSI and Stoch moving down. Enter a trade only when both moving same direction. Backtest it and you will get the result.

Rgds

Rajib

you should try, it must work for daily Stocks as well.

Can anybody tell me about a system that can be use in daily time frame in stocks.

Rgds

Rajib

This is a great strategy and it works consistently.

I am using this strategy, works great

is there anyone still using this strategy ?

great job edward and arsalan. May the pips be with you

How many trades per day do you get on the average? How is W/L ratio?

The system uses 5 EMA, 13 EMA and Stochastic (8,3,4).

Regards,

Edward

may i ask, whats the indicator and setting for this system? i dont seem to understand..thanks

Try this link:

MACD divergence.

Thomas

Hello there, does anyone has any good idea about trading divergence? I'm new and want to just know more about it.

Hello everybody,

Long time not been at this site...

I cannot agree that this is too simplistic for real trading. Newbies are after a lot of indicators and very messy charts, good traders try to avoid indicators as much as they can and keep things simple.

Arsalan has described a very good setup here. But trading it from M5 & M30 is a waste of resource :) Choose H4 & daily and you win without watching the stupid screen all day long. And I would prefer 14,3,3 settings for Stoch but this is a matter of taste, of course.

Cheers!

Indrek

This is a very simplistic approach that is good for newbies who make their first demo trades and just want to get the first understanding about the forex market. But it is absolutely unsuitable for trading with real money.

Hi friends,

This system is very reliable as i mentioned in the strategy but the only drawback is that it sometimes gives false signals in range bound market so please use it carefully.For more info on using appropriate system refer to my system selection technique in advanced strategy section.

Happy Trading,

Regards,

Arsalan.

Post new comment