Forex trading strategy #8-a (My Line In The Sand)

Submitted by User on September 26, 2010 - 14:09.

Every one says keep it simple and the trend is your friend. This is as simple as it comes and it utilizes daily trends in the Forex.

Currency pairs: ANY

Time frame chart: Daily

Indicator: SMA (I use a 30 SMA on most my charts but the idea is to choose a SMA that gives you the best looking trends.)

Entry / Exit rules:

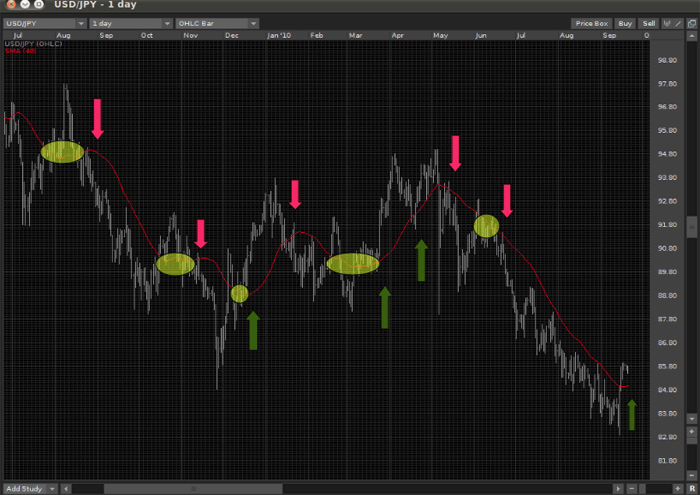

Crossing the SMA in either direction, in other words you reverse your position when ever the price crosses the SMA

Money Management:

2% of your account per trade

1 open trade per pair with a stoploss of 1/2 % of your account (even though the idea is to reverse your trade every time the price crosses the SMA, there will be times that you’re not going to be there in front of your computer and in those cases you will need a stoploss to ensure your account only takes a small loss.)

Advantages: This is a trend following system and the Forex does trend.

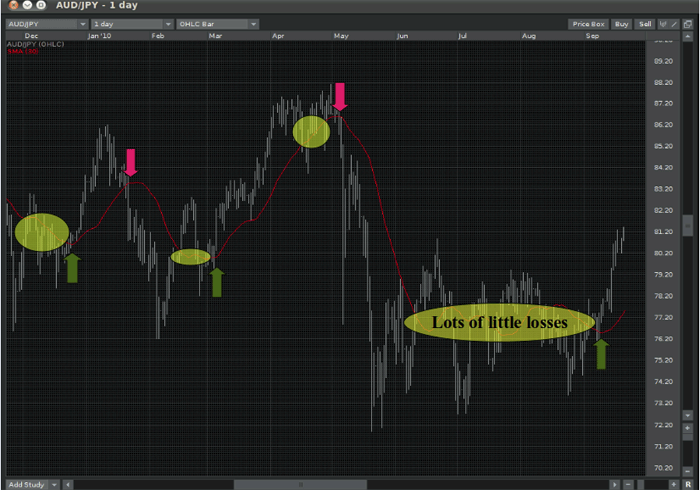

Disadvantages: In periods when the market is not trending there will be a lot of little losses. (For me, this is price I pay in order to catch a big trend.)

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

cool

TANX BRO

I have just back testet this strategy for EUR USD from Jan. 2006 - now which is 16 Mai 2011

I have made the following rules .. for entering a long position ...

Enter a long trade if price Candle closes above the 30 SMA .. put a buy stop above the High + spread + 10 pips and a stoop loss - spread - 10 pip bellow the low of the candle or maybe a near term support if its close to the entry only..Now we exit the position if we see that a candle closes back on the opposite site of the 30 SMA and move our stop loss then again 10 pips + spread bellow the low of that candle (the same rules apply for a short position just vice versa)

The Results are based on an 2% Risk entry per trade..on a 10k account so if my stopp loss gets hit i will lose 200 USD.

Here are the Results..

2006 + 262 USD

2007 + 1462 USD

2008 + 4250 USD

2009 + 1572 USD

2010 + 4382 USD

2011 + 230 So far till now

Note that the strategy is getting better i think its because of volatility ..And in 2008 we had a great year because of the crisis and the huge drop of risk currencies against save heavens..All in all the more trendier the Pair the more profit it will make ...

As i remember there was 2 times when there was a draw down in a month of 600 USD ...

Ok i was wondering if anybody can code this strategy .. it would be interesting to see if the strategy would get attached to all trending currency pairs with the same risk or less would we might get a return of more than 100% a year or would it become dangerous because when the euro dollar is choppy all the other are choppy as well maybe we need to make good thoughts on money management and i think the best way to do so is if we do this test with an EA..

So Please if anybody can code please let me know or even if somebody is ready to work together in a team to back-test strategy's i will be more than happy to do so ...

You can contact me under [email protected]

I have once read a book from Jamie Seattle "Sentiment in the Fx Market" . I think he had also great results but with an other MA i will try to find out and will maybe post the results ..

Sincerely

Winny

simle and really cool

winny

Do you open a trade on candle close or just when price goes beyond SMA?

Post new comment