Forex trading strategy #9 (Trend line tunnel)

Submitted by Edward Revy on February 28, 2007 - 15:25.

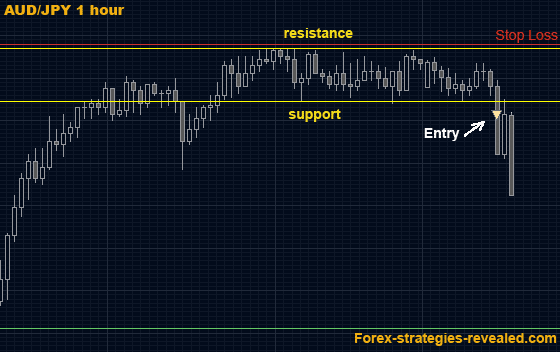

Creating a support/resistance tunnel on the price congestion and trading on the break of this tunnel is a milestone of Forex trading discoveries.

This trading system/approach needs no indicators and can be applied to any currency and traded in any time frame where coiling in a tight range is spotted.

Entry rules: Find consolidation on the chart and draw two horizontal trend lines – support and resistance. Once the price breaks trough one of the trend lines and a current price bar closes outside the tunnel – buy/sell in the direction of the breakout. (If price pierces the trend line, but did not close outside the tunnel, cancel the previous trend line and draw another one according to the new conditions).

Note: also very often happens that once the price makes it through support or resistance it rocks down/up very quickly and so, more aggressive entry can also be adopted – without waiting for the current price bar to close.

Exit rules: not set, however, it is believed, that the price after breaking the tunnel will travel the distance equal to the width of that tunnel.

Advantages: very simple and extremely effective. It can provide 100% profitable entries if short profits are taken - usually with the close of the first candle right after the entry.

Disadvantages: very accurate and well thought entry point should be picked. Orders placed very close to the tunnel can be triggered by sudden whipsaw early before real breakthrough occur.

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

very good

The Problem is: Not Veryday when Asian Session is consolidation, generally if have a big news or sometimes without big news, the price will fly up/down very quickly, so how you can determines this day will consolidation or trending, besides we look the previous day have a big news or not. Thanks.

Regards;

Manus168

Thank you Albert,

Nice work!

These are great guidelines to follow.

Expanding the topic of Inside bar, let me add further guidelines:

Among variety of Forex bar patterns, "Inside bar" and "Engulfing bar" patterns deserve a good look.

Inside bar is a bar that has its high, low and close values fitting withing the previous price bar.

This pattern can be seen and traded across all time frames, however, hourly charts, 4 hour, daily and weekly are preferred.

Trading the Inside bar pattern:

The presence of inside bar pattern tells traders about a relative price agreement between buyers and sellers. This is also the time when new trading orders are stacking up ready to be released.

The smaller the inside bar candle, the more explosive force it accumulates.

Traders should look for the break out of the inside bar price range to either side and trade in the direction of that breakout. Pending orders are often used to capture price explosion.

Engulfing bar is a type of bar that fully covers/engulfs its preceding bar.

Engulfing bar pattern is also seen across all time frames.

Although there is no strong preference towards any of the time frames in this case, the higher go you, the more reliable the pattern becomes.

Engulfing bar will often be seen after a ranging/pausing time period. Its presence suggests an attempt to start a new trend and shows the dominance of either buyers or sellers - the initiators of the engulfing bar.

Trading the Engulfing bar pattern:

Wait for the engulfing candle to close, at which point look take a trade in the direction of the engulfing bar, but try to catch the move on its retracement whenever possible.

Best regards,

Edward

Hi Edward,

thank you very much for this great site. I would like add to this method and trading in general the following:

1. Look for inside bars.

The breakout is almost meaningless or too risky, if you bought an inside bar. The Market tend to trade outside but closes finally very often inside the Range. Ergo: Wait for the close!

2. Look for more breakoutpoints near the same level on higher timeframes.

If the breakout level is near on other "Hot-Spots" (Fibo., Pivot, Hi.Lo., Supp.-Res.) then the point should be more reliable. And very Important too: Take these points also as resistance for your target, if it has to reach more than that level.

2.1. Look for accelerators on the desired way. These may be the Points, i´ve mentioned in 2.

You can rate these points on a scale from 1-3, where 1. is very strong, but profitable too and could give a great acceleraton to reach the next point.

Try to make statistics an do your OWN math for your market. Only then you are able to say how the market reacts in the case of this method (pullbackrate, size, strenght etc.). With your OWN data you can feed your self-assurance.

3. Look for the best circumstances.

Try to figure out:

- the best time to trade (activity)

- the best risk/reward level

(the more you are trying to get out of the market, the less the size of your position should be)

+ Create a "good feeling" money- and riskmanagement

4. Strategy is the last, that makes you profitable.

Good feeling MM and RM and a stable personality is the only key.

The strategy should be so easy that you could tell "everybody" to trade for you.

In other words: Don`t trade on strategies you and everybody else don`t understand!

5. Good feeling

I wrote it above. You can never know before, which is the best MM, trading-method etc. But you are able to say what feels good. And when something is feeling good you are more able to reharse it and stick to your neccesary tradingplan.

PS: Only the wise traders know the real value of the k.i.s.s principle.

PPS: I try to reflect with my own words something very important that somone wrote in his book:

Trading will be so easy for you as it seemed to you at the first time -

after a lot of despair, deprivation, stress, grief, anxiety...

PPS: This post stands for all the strategies that are confirming: "Occam's razor" (look at wiki if you don`t know how occam was)

Best regards

Albert

Once you've spotted a channel, notice, how many times the channel borders had been tested. They should be tested at least twice - this is a good sign that a breakout is underway.

Then you can use to your advantage the knowledge of trading divergences.

Stochastic, RSI or MACD would do a good job. (you can learn about divergence trading here: http://forex-strategies-revealed.com/trading-system-divergence

Your goal would be to spot a clear divergence setup while price still trades inside the channel. Based on this knowledge, you'll be able to anticipate a direction of a breakout (it is especially good if divergence signals agree with the main trend), as well as plan earlier entries on the first retracements.

Regards,

Edward

Hi Edward.

Great place.

Could you give me some tips for prevents false breakouts? Tks

Hi Jason,

If price tunnel is formed within the two Pivot levels, it keeps the tunnel valid and makes the breakout even stronger.

It is always beneficial to know where Pivots on the chart are; and, as you said, it would be absolutely logical to wait till price breaks pivot support/resistance line if the last one happen to be close to boundaries of an established price tunnel.

How pivot points can improve our trading with tunnel breakout method?

Primarily, Pivots help to identify initial profit targets once price broke out of the tunnel. You simply set your profit target 4-5 pips earlier (to make sure it gets reached) than the closes pivot level and have your breakout trades win day after day.

Also, during early trading hours traders may filter out breakouts they want to trade:

before even London session open (and during London session as well), price tunnels which formed above the daily Pivot point would shift biases to taking Long trades only, while tunnels formed below the Pivot point level would advice reacting only to breakouts with an opportunity to trade Short.

Regards,

Edward

Hi Edward,

So what role do pivot points play in this strategy? If the observed tunnel is the same range as a pivot point tunnel, does it make it invalid? Also if the breakout is near a pivot point, is it advisable to wait until a candle breaks the pivot point as well?

I have been trying a similar strategy to this but setting my range to the asian market time frame (7pm - 4am EST) then setting a buy/sell limit 10 pips beyond the range of that time. It has been a fairly successful strategy but pivot points sometime burns me.

thanks,

Jason

Hi uzo,

Spotting channel formations and drawing channel lines is mostly done visually, which means when you look at charts you simply see a price pattern in a form of a channel.

However, there is a rule that can help traders to identify a newly formed channel pattern. It goes as follows:

If the price makes new highs or new lows as the time goes, the market is in a steady trend. Once price STOPS making new lows (when in a down trend) or new highs (when in an uptrend) traders have got a first signal that a possible channel formation is under way =>

A failure for price to make a new high or low in a trending market means buyers' or sellers' power is getting weaker. This alerts an opposite force - (if buyers, for example, were pushing price forward successfully and than on a new attempt failed to send price for a new top, sellers immediately get the "message" and use the opportunity to pull price down.

Now, let's take an uptrend as our reference:

So, once buyers failed to make a new high - a price swing high that exceeds previous swing high - then we have a first alert in place and start watching sellers reaction as they pull price down.

If sellers succede in making a new swing low - a low that will be lower than a previous swing low on the price chart - then we will have a trend reversal and a beginning of a new downtrend. However, in case of sellers' failure, the price will be stuck in no trend situation, e.g. no new high was made, no successful low was made - we've got a valid tunnel formation, which price now will try to break out of.

Regards,

Edward

pls i want to know what is the best strategy to use in trading.my email address is degod03[at]yahoo.com

Thierry

i was there a setting for the ADX i should set it for.

thanks, mike f

eddy,

my problem is to know at what point to draw the tunel. what are the parameters to use

thank

uzo

Thank you Thierry for the great comment and the insight on your trading strategy!

I've taken notes for myself as well.

Happy and profitable trading!

Edward

Hi Ed,

I use tunnel break out/down for a while now. The most effective is when you have a very small and short tunnel like 3 to 5 very small candles minimum with very short or no shadow (less than 20pips long in total), the price when it breaks, goes very far like a champagne bottle lead when open.EUR/USD 1H is really good with that. It works in the direction of the RSI returning from over bought/sold. Stochastic and RSI should be in the same mode (I mean both over or below the same extreme line) Break down when RSI is coming from overbought and Break out when RSI comes from oversold. The stop loss should be 5 to 10 pips above/below the longuest candle in the setup... Because this is a setup with small candles, the risk is small arround 30Pips. usual target 80pips... More effective if it is made in the direction of major trend...

The tunnel could be a Chanel I mean not always perfectly horizontal.

TO BE AVOID IF ADX IS BELOW 30. ADX above 30, we have more than 90% accuracy generating with 1 or 2 stup a day generating 120pips a day in average

For example.

1- In a downtrend, after a pullback rally, Stoch is in overbought and RSI is coming from overbought... the tunnel formed you place a Sell Stop at 5pips below the lowest candle. you are in the market when the price breakdown. Place a stop 5pips above the tallest candle. Stoch must follow if not, get out and take the few pips as commission free.

2-Do contrario in uptrend with a sell off pullback, stoch and RSI in oversold.

Good luck... and thank to Ed for the great achievement so far... this site is unique.

Thierry

Hi Edward,

With all these you are given to us, your wish and your desires would always be accomplished to your taste. Thank you!

FAIEZ

Post new comment